European banks’ exposure to Turkey looks non-systemic and manageable overall, although a number of indirect effects could amplify the eventual losses.The rapid depreciation of the Turkish Lira is raising concerns at the European Central Bank over European banks’ exposure to Turkey, according to recent press reports. Data from the Bank of International Settlements (BIS) show that the total exposure of foreign banks to Turkish assets was USD223 bn in Q1 2018, on an ultimate risk basis (net of...

Read More »US CPI inflation still moderate

Underlying inflation in the US remains moderate in July, confirming there is still limited impact of the trade tariffs.July’s US CPI data showed that underlying inflation remains moderate despite the strong economy, the tight labour market and the higher customs duties recently put in place by the Trump administration. The headline CPI print rose 0.2% m-o-m in July, keeping the y-o-y reading at 2.9%. This y-o-y print was still mostly driven by energy prices (up 25% y-o-y), but this boost...

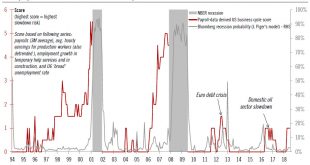

Read More »US chart of the week – Job market is open

The positive job openings data in the US is a sign that the US economy continues to weather ongoing trade tensions.The latest job openings data release for June brought another positive signal for the longevity of the US business cycle, echoing other encouraging indicators from US data releases, including the July employment report (see our Flash Note and our ‘business cycle score’ derived from monthly payroll data). These data add further support for the continued strength of the US economy...

Read More »US-China trade tensions could persist

China’s latest retaliatory measures seem fairly restrained, but the tension between the two nations could drag on for quite some time.On 3 August, the Chinese government announced a list of additional tariffs on USD 60 billion worth of US imports in retaliation to the US’s proposed tariffs on USD 200 billion of Chinese goods. When these tariffs are implemented will depend on when the US activates its tariffs. The announcement came shortly after President Trump stated that he was considering...

Read More »Weekly View – new headwinds

The CIO office’s view of the week ahead.Apple made headlines for being the first company to reach a market capitalisation of USD 1 trillion. This milestone highlights two key points about the technology sector, in particular the FAANGs (Facebook, Apple, Amazon, Netflix, Google) which dominate it. Apple and Amazon’s continued success stems from their highly diversified business, which makes them less dependent on narrow revenue sources. Meanwhile, advertising-driven Facebook and Google and...

Read More »US employment – chugging along

The July employment report confirmed that the US economy is in great shape, and still unaffected by international trade tensions.The US labour market remains in fine fettle, as the three-month average in job growth up to July was 224,000. The unemployment rate dropped to 3.9%, while the ‘broader’ unemployment rate (U6) fell to 7.5%, its lowest level since May 2001.Wage growth remained relatively tame (especially in light of the low unemployment rate), with average hourly earnings growth at...

Read More »Europe chart of the week – UK households

ONS data suggest that UK households lived beyond their means in 2017 as they became net borrowers for the first time in nearly 30 years.The latest UK sectoral accounts from the Office for National Statistics (ONS) has received considerable attention over the past few days as it shows UK households’ outgoings surpassed their income in 2017 for the first time in nearly 30 years. The ONS noted that, on average, each UK household spent or invested around GBP 900 more than it received in income...

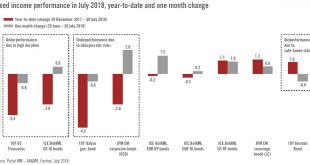

Read More »House View, August 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six- month basis we are maintaining our neutral stance on developed-market equities in general in light of increasing trade and political frictions, but we remain more upbeat on their prospects further out.We have a bullish short-term stance on Asian (ex-Japan) equities given their increasingly attractive valuations but we are paying close attention to...

Read More »Japan: Minor tweaks to the BoJ’s policy

In line with our expectations, the Bank of Japan decided to keep the basic framework of the existing monetary easing programme in place.After a two-day meeting at the end of July, the Bank of Japan (BoJ) has decided to maintain its existing monetary easing framework, but has announced a few minor changes to improve the sustainability of the framework.The BoJ’s latest policy decisions are largely in line with our expectations of no major changes to the policy framework due to inflation...

Read More »Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data. According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018 (0.346% q-o-q unrounded, 1.4% q-o-q annualised, 2.1% y-o-y), below consensus expectations (0.4%). This was the weakest growth in two years and comes after a GDP growth of 0.4% q-o-q in Q1. The carryover effect for 2018 reached 1.7 %, meaning that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org