Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six- month basis we are maintaining our neutral stance on developed-market equities in general in light of increasing trade and political frictions, but we remain more upbeat on their prospects further out.We have a bullish short-term stance on Asian (ex-Japan) equities given their increasingly attractive valuations but we are paying close attention to developments in China and remain neutral on emerging equities overall. We are also bullish on Japanese and UK equities.We have a bearish tactical stance on sovereign bonds overall, in large part due to our negative view on low-yielding euro area bonds. We believe the Italian government budget to be

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six- month basis we are maintaining our neutral stance on developed-market equities in general in light of increasing trade and political frictions, but we remain more upbeat on their prospects further out.We have a bullish short-term stance on Asian (ex-Japan) equities given their increasingly attractive valuations but we are paying close attention to developments in China and remain neutral on emerging equities overall. We are also bullish on Japanese and UK equities.We have a bearish tactical stance on sovereign bonds overall, in large part due to our negative view on low-yielding euro area bonds. We believe the Italian government budget to be

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management's latest positioning across asset classes and investment themes.

- On a tactical, rolling three-to-six- month basis we are maintaining our neutral stance on developed-market equities in general in light of increasing trade and political frictions, but we remain more upbeat on their prospects further out.

- We have a bullish short-term stance on Asian (ex-Japan) equities given their increasingly attractive valuations but we are paying close attention to developments in China and remain neutral on emerging equities overall. We are also bullish on Japanese and UK equities.

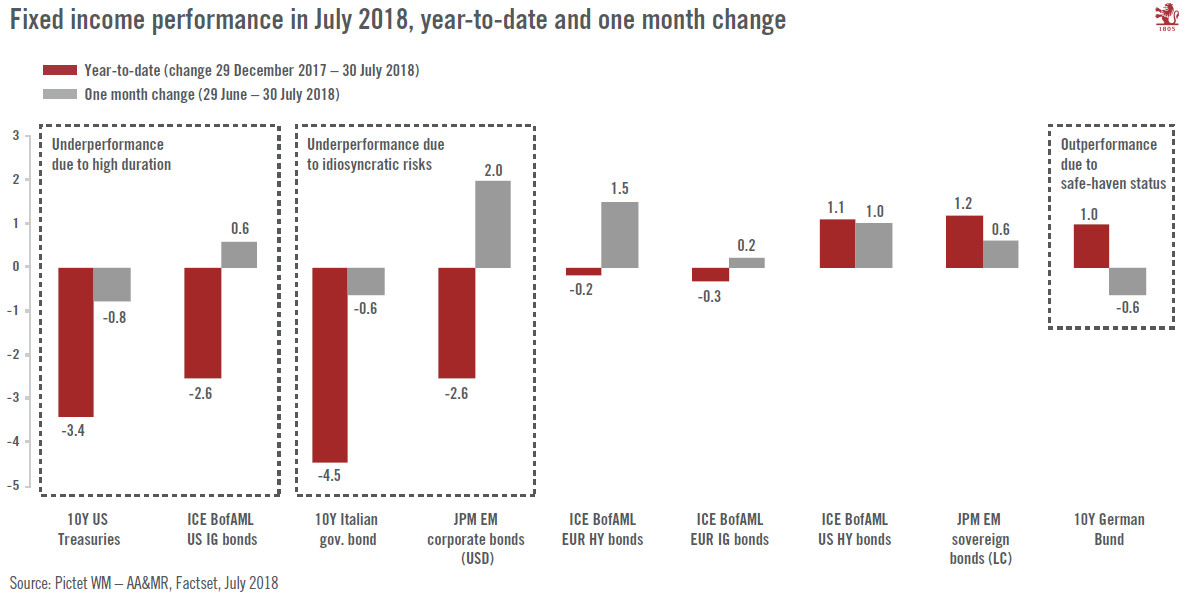

- We have a bearish tactical stance on sovereign bonds overall, in large part due to our negative view on low-yielding euro area bonds. We believe the Italian government budget to be presented in September could be a flash point.

Commodities

- In spite of the June agreement by producers to boost oil output, we expect a significant risk premium to prevail until at least the middle of next year as oil supply remains tight, resulting in prices remaining above their long-term fundamental equilibrium level. The prices of other commodities, including industrial metals, are likely to remain under pressure as long as trade tensions last.

Currencies

- Despite recent weakening of the renminbi, we believe China is unlikely to use currency devaluation as a weapon in any trade war with the US as any potential benefits would be outweighed by the damage caused by increased capital outflows.

- While we believe the US dollar remains in a long-term downtrend, trade disputes could continue to weigh on emerging market currencies in general in the short term.

Equities

- US Q2 corporate earnings have been quite strong. Although the magnitude of positive sales and net income surprises is still elevated by historical standards. Expected 2018 earnings growth for the S&P 500 has continued to rise, providing further support to equities.

- Volatility remains low, but technical analysis suggests investors are not entirely relaxed about market dynamics.

- Falling gross issuance (which often precedes a rise in the default rate), more restrictive monetary policy and trade tensions are making us bearish on high yield for the next three to six months.

- We are neutral on emerging corporate debt in US dollars and local-currency sovereign debt. Following the recent rise in yields in emerging markets, we are waiting for the clouds of trade war to lift before turning more positive.

Alternatives

- Sustained volatility and dispersion supported by global recovery and monetary policy normalization should favour long/short stock pickers and arbitrage strategies. Event Driven managers continue to benefit from buoyant M&A activity.

- Global Macro funds continue to play the reflation theme albeit with reduced levels of risk in their portfolios, while CTA funds are seeing opportunities across FX and commodities.

- Capital continues to flow into a highly competitive private equity market. More than ever, investing with managers with differentiated investment strategies, specialist sector expertise and proven track records is vital to achieve target returns.

- Despite high prices and an eighth consecutive year of growth, investors continue to pour into real estate private equity. The asset class’s solid income- enerating characteristics and the opportunities offered by urbanisation, technology and demographic trends that are redefining real estate needs are proving appealing to investors.