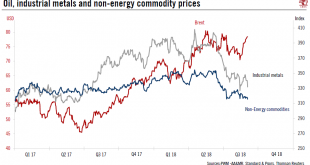

Oil prices are caught between concerns that trade disputes will dent demand, and the risk of supply shortages due to production shortfalls and capacity constraints. We think that these combined factors justify our estimated fair value for oil.In light of the OPEC + Russia decision to increase output, oil prices declined from the end-June to mid- August. This decline is not limited to oil: all commodities have been affected. Industrial metals declined by 12%, and non-energy commodities by...

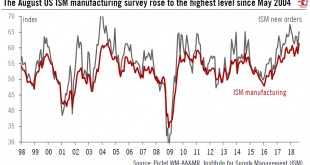

Read More »ISM business survey rises to highest level since 2004

August’s US ISM manufacturing survey rise confirms that economic momentum is strong.The flagship ISM manufacturing survey, a series released by the Institute for Supply Management, with data going back to 1948, rose to 61.3 in August, its highest level since May 2004. Details of the survey were strong, for instance ‘new orders’ rose to 65.1, from 60.2 in July. The ISM index is a diffusion index, with any reading above 50 indicating expansion in activity.These healthy data are another...

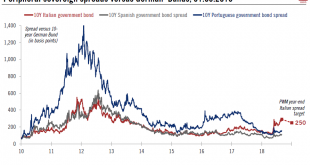

Read More »Fiscal battle looms over Italian bonds

Given the market volatility we expect around 2019 budget discussions in Italy, we remain bearish on euro peripheral bonds in general.Italy is coming back into focus as investors become increasingly nervous about 2019 budget discussions. September will be a key moment to gauge the intentions of the Italian government regarding its 2019 budget. Indeed, more details will become available when the Italian government publishes the updated Economic and Financial Document (DEF), no later than 27....

Read More »Weekly View – deal or no deal

The CIO office’s view of the week ahead.Last week, the US concluded a trade ‘deal’ with Mexico, although the extent of changes is limited, mostly targeting the car industry. While this is a step in the right direction, the picture is not clear-cut and could ultimately be a story of several deals. Meanwhile, this week we expect Trump’s confirmation regarding the potential for further tariffs on USD 200bn of Chinese imports, fuelling uncertainty around global trade. China’s economy is already...

Read More »Assuaging yield curve anxiety

Unlike some Fed policy makers, Fed economic staff have been downplaying the significance of recent yield curve flattening.The ongoing yield curve compression (the narrowing difference between short-term and long-term Treasury yields) has become a key focus for Federal Reserve (Fed) policymakers. Several Fed researchers have released notes dismissing some policymakers’ anxiety about a flattening yield curve, the latest coming from economic staff at the San Francisco Fed.Some of them,...

Read More »Peak headline inflation for the euro area?

Latest inflation report came in on the softer side of expectations, but changes in headline inflation are likely to gain importance as we move closer to policy normalisation.Although the European Central Bank’s (ECB) mandate is defined in terms of headline inflation (targeting an annual rate of “below, but close to 2%” over the medium-term), over the past few years, the central bank has been mainly focused on underlying consumer price dynamics, including core inflation. Looking forward,...

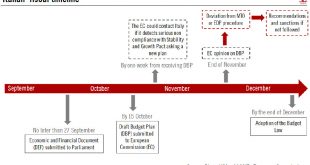

Read More »Italian 2019 draft budget: a bumpy road ahead

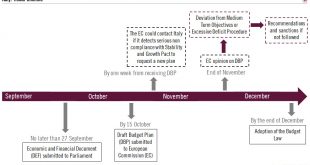

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found. September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures. In this contract, the governing...

Read More »Italian 2019 draft budget: a bumpy road ahead

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found.September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures.In this contract, the governing coalition, made up of the Five Star Movement (M5S) and the League, committed to a...

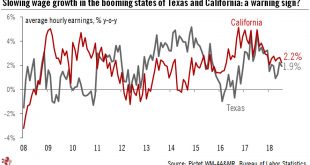

Read More »State data’s sobering message for future US wage gains

US wage growth has remained puzzlingly weak lately, possibly held back by structural factors.Perennially slow wage growth partly explains why the Federal Reserve’s monetary tightening has been so slow despite the strong US labour market and core inflation that is now at or about the Fed’s target of 2%. Hence the close market attention to wage growth, which could influence Fed policy considerably. Recent wage data has remained tame, with average hourly earnings in July growing an uninspiring...

Read More »Powell maintains his middle-of-the-road approach to tightening

Jerome Powell’s speech at Jackson Hole brought limited news, reinforcing our Fed scenario of one quarter-point rate hike per quarter.At the Jackson Hole conference last week, Fed chairman Jerome Powell once again showed his pragmatic and cautious approach to monetary tightening: US rate hikes should continue at a gradual pace, even though the US economy is in strong shape.Powell took a well-trodden path in his Jackson Hole speech, discussing once again the numerous uncertainties around the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org