Underlying inflation in the US remains moderate in July, confirming there is still limited impact of the trade tariffs.July’s US CPI data showed that underlying inflation remains moderate despite the strong economy, the tight labour market and the higher customs duties recently put in place by the Trump administration. The headline CPI print rose 0.2% m-o-m in July, keeping the y-o-y reading at 2.9%. This y-o-y print was still mostly driven by energy prices (up 25% y-o-y), but this boost should start to fade as oil prices begin to stabilise. Headline CPI inflation should head towards 2.6% y-o-y by December, in our forecast.Core inflation was modest at 0.24% m-o-m, pushing the y-o-y print to 2.4%, from 2.3% in June. The reading was boosted, perhaps atypically, by airline fares which rose

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Underlying inflation in the US remains moderate in July, confirming there is still limited impact of the trade tariffs.

July’s US CPI data showed that underlying inflation remains moderate despite the strong economy, the tight labour market and the higher customs duties recently put in place by the Trump administration. The headline CPI print rose 0.2% m-o-m in July, keeping the y-o-y reading at 2.9%. This y-o-y print was still mostly driven by energy prices (up 25% y-o-y), but this boost should start to fade as oil prices begin to stabilise. Headline CPI inflation should head towards 2.6% y-o-y by December, in our forecast.

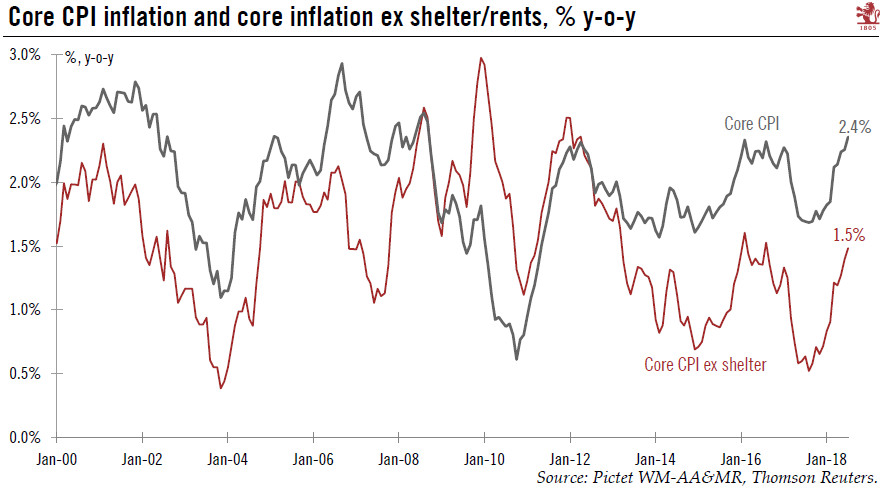

Core inflation was modest at 0.24% m-o-m, pushing the y-o-y print to 2.4%, from 2.3% in June. The reading was boosted, perhaps atypically, by airline fares which rose 2.7% m-o-m in July. A recent interesting development is the ongoing softness in medical care prices (physicians’ services prices up a modest 0.6% y-o-y) and prescription drugs (+0.9% y-o-y only). If continued, this could help keep a lid on inflation, and offset higher ‘cyclical’ inflation.

Meanwhile, there is still limited impact of the trade tariffs on inflation. However, an area to watch is car prices, as they may be affected by the recent trade tariffs on steel and aluminium. After twelve months of negative price growth, new cars’ prices rose 0.2% y-o-y in July, even though car sales dropped 4.0% m-o-m to 16.7 million (annualised) in July.

From a Federal Reserve perspective, this CPI data keeps the story of a strong economy with modest inflationary pressures unchanged, particularly as recent wage growth has remained tame. We still see the next rate hike in September, followed by another at the December meeting.