In line with our expectations, the Bank of Japan decided to keep the basic framework of the existing monetary easing programme in place.After a two-day meeting at the end of July, the Bank of Japan (BoJ) has decided to maintain its existing monetary easing framework, but has announced a few minor changes to improve the sustainability of the framework.The BoJ’s latest policy decisions are largely in line with our expectations of no major changes to the policy framework due to inflation remaining well below the BoJ’s target.We expect the BoJ to maintain its current policy framework until at least the first half of 2020, when the fallout from the second consumption tax hike will be clearer.The BoJ’s decision should provide further relief to Japanese equities.Read full report here

Topics:

Dong Chen and Jacques Henry considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In line with our expectations, the Bank of Japan decided to keep the basic framework of the existing monetary easing programme in place.

After a two-day meeting at the end of July, the Bank of Japan (BoJ) has decided to maintain its existing monetary easing framework, but has announced a few minor changes to improve the sustainability of the framework.

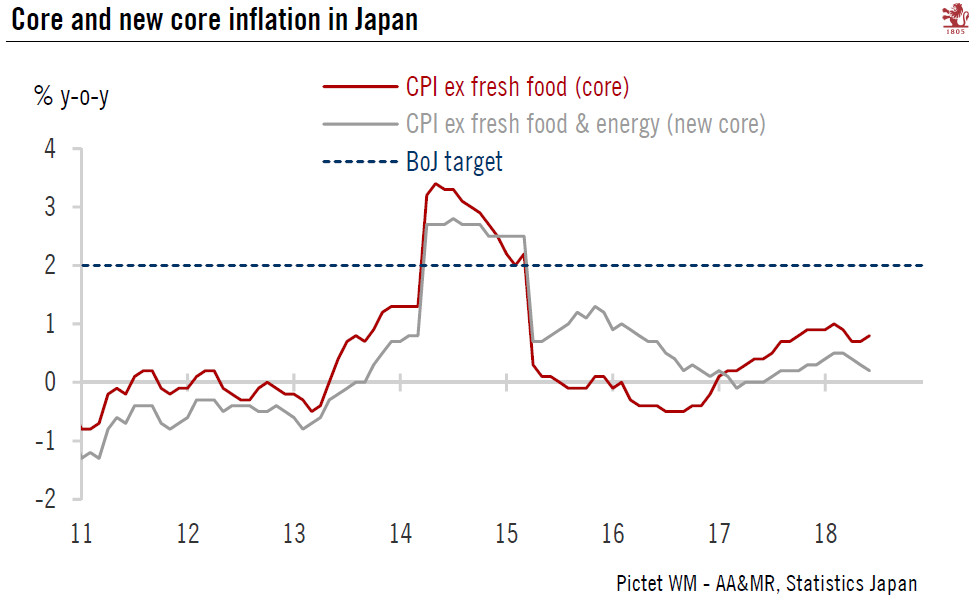

The BoJ’s latest policy decisions are largely in line with our expectations of no major changes to the policy framework due to inflation remaining well below the BoJ’s target.

We expect the BoJ to maintain its current policy framework until at least the first half of 2020, when the fallout from the second consumption tax hike will be clearer.

The BoJ’s decision should provide further relief to Japanese equities.