Growing by about 10% over the past year, a regime shift in IT spending is supporting the US economy.Q2 GDP growth data (which showed GDP growing by 4.1% quarter-on-quarter and 2.8% year-on-year) was another indication of the strong shape the US economy is in.Particularly solid support for growth in recent quarters, and again in Q2, has come from business investment. We have long highlighted our belief that robust investment growth would be a major contributor to US GDP growth, which we...

Read More »Half way into Q2 18 earnings reporting season

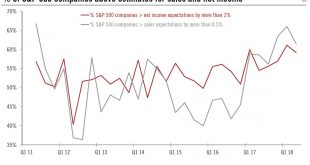

US corporate earnings remain strong, even though some high-flying names announce negative surprises.By 30 July, 267 S&P 500 companies had reported earnings for Q2 18. Despite Facebook’s profit warning, the Q2 reporting season in the US was good, with around 60% of S&P 500 companies significantly beating top-line and bottom-line expectations.Positive surprises in the US were higher in Q1 (66% for sales and 61% for net income), the first quarterly results to reflect Trump’s tax cuts of...

Read More »Revising our euro area 2018 GDP growth forecast down

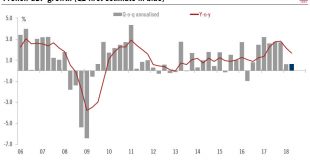

The cut to our growth forecast reflects slippage in euro area data.According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018. We now expect euro area real GDP to grow by 2.0% on average this year...

Read More »US 10-year Treasury yield: no return to 4% anytime soon

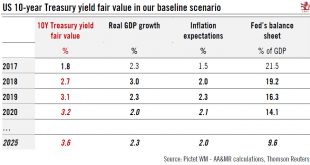

The 10-year Treasury yield is unlikely to reach pre-crisis levels in the current cycle. Our baseline scenario envisages its fair value being capped at 3.2% in the next two years.The 10-year US Treasury yield is probably the most watched bond yield globally, seeming to encapsulate everything from the noise coming from financial markets and politicians to the health of the world economy, not to mention monetary policy. Trying to forecast the likely behaviour of such a global indicator is...

Read More »Weekly View – Let’s talk

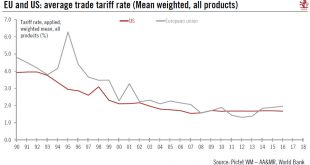

The CIO office’s view of the week ahead.Last week brought some unexpected news in trade relations, with President Trump putting the threat of tariffs on EU car imports on hold and promising to re-examine those recently imposed on European steel and aluminium imports. At first look, it seems like wise heads are beginning to prevail in Washington. And with US companies becoming more vociferous in their concerns about tariffs, Trump himself needed to show his “art of the deal” was bearing...

Read More »French Q2 GDP growth marks time

A number of one-off factors hurt growth dynamics, but there are many reasons to think that expansion will pick up in the rest of this year. France is the first country in the euro area to publish Q2 GDP figures. The economy expanded by 0.2% q-o-q in Q2, the same pace as the previous quarter and below consensus expectations of 0.3%. The key source of disappointment was private consumption, which was hit by one-off...

Read More »Ceasefire in US/EU tariff dispute

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching. US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US. Importantly, Trump agreed to put his threat of tariffs on EU cars on hold as bilateral trade...

Read More »Ceasefire in US/EU tariff dispute

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching. US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US. Importantly, Trump agreed to put his threat of tariffs on EU cars on hold as bilateral trade...

Read More »Solid momentum in a US economy so far unaffected by trade tensions

Second-quarter growth points to a US economy in fine stead, driven by investment spending. Revisions show the savings rate is healthier than thought.US GDP grew 4.1% in the second quarter q-o-q (seasonally adjusted annualised reading, or SAAR), according to the first estimate, up from a revised 2.2% in Q1-2018 (2.0% previously). This is the strongest q-o-q reading since Q3 2014. But there was no particular ‘wow’ effect since the market had expected 4.2%. The y-o-y print, a more accurate and...

Read More »French Q2 GDP growth marks time

A number of one-off factors hurt growth dynamics, but there are many reasons to think that expansion will pick up in the rest of this year.France is the first country in the euro area to publish Q2 GDP figures. The economy expanded by 0.2% q-o-q in Q2, the same pace as the previous quarter and below consensus expectations of 0.3%.The key source of disappointment was private consumption, which was hit by one-off factors such as unseasonal weather and transport strikes. More positively,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org