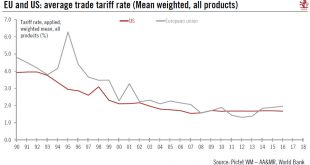

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching.US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US. Importantly, Trump agreed to put his threat of tariffs on EU cars on hold as bilateral trade talks continue, and to re-examine the tariffs recently imposed on steel and...

Read More »Message from the ECB: Enjoy summer!

Today’s Governing Council meeting did little to break the seasonal torpor. We continue to expect its first rate hike to come in September 2019. There was no change in interest rates or forward guidance at today’s ECB Governing Council meeting. The Governing Council reaffirmed that bond purchases will end in December and that key interest rates are expected to remain at their present levels “at least through the summer...

Read More »Message from the ECB: Enjoy summer!

Today’s Governing Council meeting did little to break the seasonal torpor. We continue to expect its first rate hike to come in September 2019.There was no change in interest rates or forward guidance at today’s ECB Governing Council meeting.The Governing Council reaffirmed that bond purchases will end in December and that key interest rates are expected to remain at their present levels “at least through the summer of 2019”.The ECB said it remained confident about the euro area’s economic...

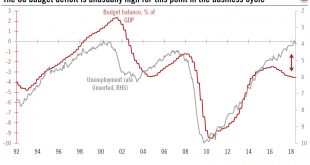

Read More »US fiscal policy update – Tax cuts 2.0

Ahead of the mid-term elections, politicians in Washington are trashing out proposals that aim to make permanent the tax cuts voted last December.The House Republicans have launched a new plan to cut taxes, mostly revolving around the idea of making recent cuts for households permanent (they are currently scheduled to lapse in 2025).This willingness by Congress to continue the tax-cutting effort, even if uncertain, could reassure a US business community that has been receiving mixed signals...

Read More »EM storm is subsiding, but clouds remain

We are waiting for trade-war clouds to become less threatening before adopting a more positive stance on EM debt.In a Flash Note in May, we argued that the rise in yields of emerging market (EM) debt could offer compelling opportunities for investors who had the patience to ride out the storm. EM credit spreads and yields have indeed recently being shown some signs of stabilising after a period of rising yields. The faltering rise in US Treasuries yields, some effective EM rate hikes and the...

Read More »The Fed’s ‘auto pilot’ response to Trump’s displeasure

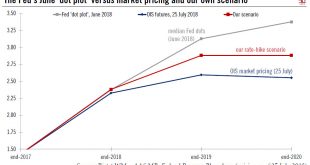

At next week’s meeting, the Fed may well debate recent criticism of it by President Trump, but we continue to see the central bank tightening rates each quarter.The Federal Reserve’s next regular, two-day policy meeting will take place on 31 July-1 August. The Fed is very unlikely to raise rates and the post-meeting statement should contain limited news since Chairman Jerome Powell gave a good overview of his latest thinking before Congress only last week. Although uneventful in appearance,...

Read More »Euro Area Lending Dynamics in Good Shape

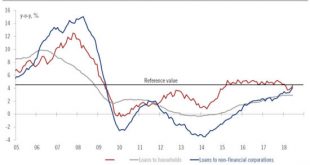

Rising bank credit flows confirm that domestic fundamentals remain solid across most of the euro area. The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in...

Read More »Euro area lending dynamics in good shape

Rising bank credit flows confirm that domestic fundamentals remain solid across most of the euro area.The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May. Corporate-sector lending increased 4.1% year-over-year in June, its...

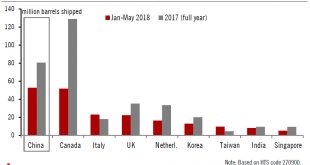

Read More »In midst of trade frictions, China imports more US oil than ever

While US trade deficit with China has reached a record high, so have US exports of crude oil to the Middle Kingdom.China has overtaken Canada as the dominant destination for US crude oil this year, potentially becoming an important bargaining chip in the trade dispute between the two countries.Exports of crude oil to China rose from 0 in 2015 (when such exports were still banned) to 80.7 million barrels in 2017. In the first five months of 2018, oil exports to China rose 85% to 52.8 million...

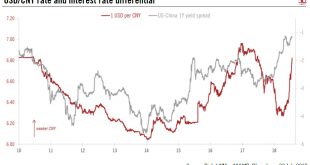

Read More »Another hot summer for the renminbi

China’s policy stimulus could continue to weigh on the renminbi in the near term, but fading support for the dollar and PBoC may limit downside risks for the Chinese currency.Since mid-June, the renminbi has come under severe downward pressure. The China Foreign Exchange Trade System (CFETS) renminbi index has lost roughly 4.7%, while the renminbi has dropped roughly 5.8% against the US dollar. As we are moving nearer to the psychological threshold of CNY7.00 per USD, concerns that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org