Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings.The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less unfavourable to the franc.The upward pressure on the...

Read More »Getting ready for tiering

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves. Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020....

Read More »Signs of global rebound are appearing

Recent data suggest the downturn in the world economy is bottoming out after a prolonged period of deterioration. We expect the world economy to expand by 3.3% this year.At its Spring Meeting, the International Monetary Fund (IMF) revised downward its 2019 global growth forecast from 3.5% to 3.3% (the same as our own forecast). The IMF left its estimate for 2020 growth unchanged at 3.6%As global growth probably slowed to 3.2% in the second half of 2018, a 3.3% growth estimate for 2019...

Read More »Getting ready for tiering

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.Despite nearly four years of asset purchases and five years of negative rates,...

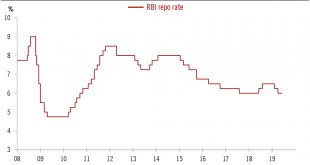

Read More »India: RBI cuts interest rate again

As widely expected, the Reserve Bank of India announced a cut to its policy interest rate last week. We expect that monetary policy will likely stay accommodative in order to support growth going forward.The Reserve Bank of India (RBI) cut its policy interest rate (RBI repo rate) by 25 basis points (bps) last week, bringing it down to 6.0%. This was the RBI’s second interest rate cut this year under its new governor Shaktikanta Das. With this move, the RBI has fully reversed last year’s rate...

Read More »Weekly View – Flextension?

The CIO office’s view of the week ahead.Risk assets were positive across the board last week, with volatility falling back into low territory. The rally was driven by encouraging signs from the world’s two biggest economies. In China, a turn in economic indicators has started to show through with manufacturing purchasing manager indices (PMI) moving back into expansion territory in March. At the same time, the US has returned to a ‘Goldilocks’ environment, with Friday’s solid employment...

Read More »China PMIs jump in March

Industrial gauges rebound on seansonality as well as policy easing. Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report...

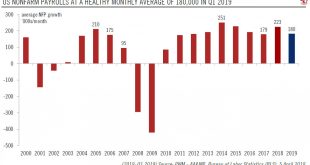

Read More »The US labour market chugs along

Latest nonfarm payroll report shows the ongoing resilience of the US economy, although some cyclical sectors are being affected by global headwinds.US employment rose by 196,00 in March, bringing the three-month average to a healthy 180,000/month— less than the 2018 average of 223,000, but more than in 2017.The unemployment rate was unchanged at 3.8%, below the Federal Reserve’s (Fed) ‘full employment’ estimate of 4.4%.Wage growth softened to 3.2% year-on-year (y-o-y) from 3.4% in...

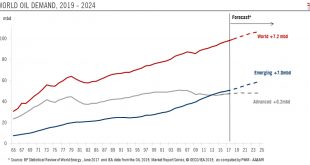

Read More »Oil prices supported by OPEC+ cuts…before market risks being flooded again

Increased US export capacity would probably force OPEC+ to change its current tactics. After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018. The recent release of the International...

Read More »US and euro investment-grade credits: similar, but different

We have moved up our stance on euro investment-grade credits to neutral, believing they have better potential than their US peers.US and euro investment grade (IG) indices have posted solid returns year-to-date thanks to a rally in credit spreads and sovereign yields linked to the dovish turn taken by some large central banks.We have turned neutral from underweight on euro IG credit, while retaining our underweight stance on US IG credit. First, euro IG offers an attractive yield pick-up...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org