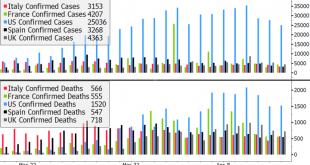

The virus news stream is negative today; the dollar is trying to build on its recent gains Weekly jobless claims are expected at 4.5 mln vs. 5.245 mln last week; regional Fed manufacturing surveys for April continue to roll out ECB confirmed reports that it will accept sub-investment grade debt as collateral; EU leaders will hold a video conference today Preliminary April eurozone PMI readings were awful; UK readings were even worse Japan reported weak preliminary...

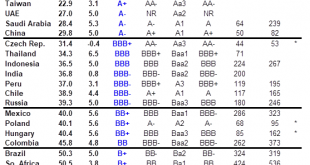

Read More »EM Sovereign Rating Model For Q2 2020

The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come. We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs. While the situation is still fluid with regards to the ultimate coronavirus impact on the global economy as well as the policy responses, we thought it...

Read More »Dollar Stalls as Market Sentiment Improves

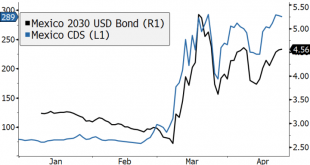

The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth $484 bln Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon ECB will consider accepting sub-investment grade bonds as collateral in its operations; reports suggest Italy will boost its fiscal stimulus efforts UK reported March CPI data; Turkey is expected...

Read More »Dollar Firm as Equities and Oil Start the Week Under Pressure

The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US Chicago Fed National Activity Index for March will be reported; late Friday, Moody’s downgraded Mexico a notch to Baa1 with negative outlook The debate about re-opening...

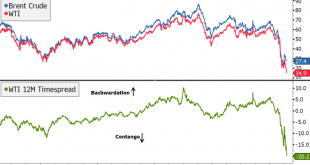

Read More »Overcapacity / Oversupply Everywhere: Massive Deflation Ahead

The price of a great many assets will crash, out of proportion to the decline in demand. Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy. Yes, there are shortages in a few high-demand areas such as PPE (personal protective equipment), but across...

Read More »Between a Rock and a Hard Place: Pandemic and Growth

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels. Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to “open for business.” The two demands are inherently incompatible, and so neither one can be fulfilled. The problem is the intrinsic natures of the virus and the global economy. This...

Read More »Dollar Firm in Thin Holiday Trading

The virus news stream is mostly positive today; yet risk assets are starting the week under some modest pressure The dollar took a hit last week but we think it will recover; some US data releases from Good Friday are worth repeating With most of Europe closed today, the news stream from the region is very light; oil prices could not extend their gains today after OPEC+ finalized output cuts over the weekend India March CPI is expected to ease to 5.90% y/y from 6.58%...

Read More »Dollar Under Modest Pressure as Europe Returns from Holiday

The tug of war between extending vs. softening lockdowns continues The dollar remains under modest pressure but we think it will eventually recover; Bernie Sanders has endorsed Joe Biden Europe reopens from holiday today but the news stream remains light; South Africa surprised with an emergency 100 bp rate cut Japan Prime Minister Abe’s approval rating is taking a hit; China’s trade figures for March came in far better than expected The dollar is mostly softer...

Read More »There’s No Going Back, We Can Only Go Forward

What I see is a global collapse of intangible capital that is invisible to most people. It’s only natural that the conventional expectation is a return to the pre-pandemic world is just a matter of time. Whether it’s three months or six months or 18 months, “the good old days” will return just as if we turned back the clock. I think the situation is much more akin to being injured. Since I worked for decades in construction, I’ve had numerous potentially serious...

Read More »Buy The Tumor, Sell the News

The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. No, buy the tumor, sell the news ™ is not a typo: the stock market is a lethal tumor in our economy and society. Buy the rumor, sell the news encapsulates the old traders’ wisdom that markets rise on the sizzle of hope, promises, projections, Federal Reserve pimping (see below), tax cuts, etc. etc. etc., not on the actual steak of sales and profits. Buy the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org