Risk-off sentiment has intensified; as a result, the dollar is getting some more traction Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%There have been growing discussions about negative rates in the UK; weak UK data, rising Brexit risks, and a more dovish BOE have taken a toll...

Read More »Dollar Mixed as Markets Await Fresh Drivers

The virus news stream is mixed; the dollar continues to consolidate; US-China tensions continue to rise US Treasury wraps up its quarterly refunding; April budget statement is a harbinger of things to come; the next round of stimulus will be contentious We got some dovish BOE comments yesterday; UK continues to play Brexit hardball; UK data was slightly better than expected but awful nonetheless Japan reported March current account data; RBNZ expanded its QE program...

Read More »Different Type of Crisis, Some Old Concerns

Over the past two months we have witnessed historic turmoil followed by unprecedented intervention by policy makers and central banks in supporting the capital markets (and more). In many ways the 2020 COVID-19 pandemic is very different from the 2008 global financial crisis, but for some, certain old concerns still linger. In the face of short selling bans and worries about market liquidity, we discuss below how best to navigate some of the common objections and...

Read More »The Way of the Tao Is Reversal

As Jackson Browne put it: Don’t think it won’t happen just because it hasn’t happened yet. We can summarize all that will unfold in the next few years in one line: The way of the Tao is reversal. This is the opening line of Chapter 40 of Lao Tzu’s 5,000-character commentary on the Tao, The Tao Te Ching. There are many translations of this slim volume, and for a variety of reasons I favor the 1975 translation by my old professor at the University of Hawaii, Chang...

Read More »Restricted Market Trading Comments

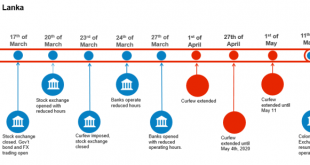

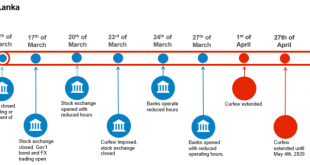

Restricted Market Trading Comments By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations today following an extended period of closure. Foreign exchange trading is...

Read More »Surviving 2020 #3: Plans A, B and C

Readers ask for specific recommendations for successfully navigating the post-credit/speculative-bubble era and I try to do so while explaining the impossibility of the task. As the bogus prosperity economy built on exponential growth of debt implodes, we all seek ways to protect ourselves, our families and our worldly assets. There are any number of websites, subscription services and books which offer two basic “practical recommendations:” 1. Buy gold (and/or...

Read More »Dollar Mixed as Doves Fly

Measures of cross-market implied volatility have been stable for a few weeks now Weekly jobless claims are expected at 3 mln; reports suggest House Democrats are pushing ahead with a possible vote next week on another relief package Canada reports April Ivey PMI; Peru is expected to keep rates steady; Brazil COPOM delivered a dovish surprise last night The Bank of England delivered a dovish hold; The Norges Bank surprised markets with a 25 bp cut to 0%; Czech...

Read More »Negative News from Europe Helps Dollar Build on Gains

UK has been confirmed to have the highest death toll in Europe the dollar is getting more traction Reports suggest Congress is resisting President Trump’s call for a payroll tax cut; ADP private sector jobs data is expected to come in at -21 mln Brazil is expected to cut rates 50 bp; Fitch cut its outlook on Brazil to negative; Chile is expected to keep rates steady Sterling remains under pressure as Brexit talks sour; the EC warned that the future of the eurozone is...

Read More »Where the Rubber Meets the Road

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the second essay, from July 2008. Thank you, Paul, for the suggestion. I received this timely inquiry from astute reader Paul B.: I’m interested in # 1, while you seem to take into account 300 million people in your writings–would you comment on rubber-meets-the-road impacts and proactive actions we can take to help shield ourselves (and our local communities) from...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The government announced on May 1 that the current lockdown will remain in place until May 11, when it will be reviewed. The Colombo Stock Exchange (CSE) remains...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org