What I see is a global collapse of intangible capital that is invisible to most people. It’s only natural that the conventional expectation is a return to the pre-pandemic world is just a matter of time. Whether it’s three months or six months or 18 months, “the good old days” will return just as if we turned back the clock. I think the situation is much more akin to being injured. Since I worked for decades in construction, I’ve had numerous potentially serious injuries, including slipping off roofs, being perched on ladders that fell, my finger sliced open by a steel stud, high winds peeling a heavy sheet of plywood off a stack and sending it flying into me, etc. Immediately after impact, your first instinct is to assess how badly you’re injured. Of course we

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

What I see is a global collapse of intangible capital that is invisible to most people.

It’s only natural that the conventional expectation is a return to the pre-pandemic world is just a matter of time. Whether it’s three months or six months or 18 months, “the good old days” will return just as if we turned back the clock.

I think the situation is much more akin to being injured. Since I worked for decades in construction, I’ve had numerous potentially serious injuries, including slipping off roofs, being perched on ladders that fell, my finger sliced open by a steel stud, high winds peeling a heavy sheet of plywood off a stack and sending it flying into me, etc.

Immediately after impact, your first instinct is to assess how badly you’re injured.

Of course we all hope we’re not seriously hurt, but the initial adrenaline-fueled relief can be misleading: we might have suffered internal injuries that we can’t feel.

That’s the global situation: we want to assure ourselves the injury is minor and we’ll be back on our feet in no time, but I think the financial-economic injuries are severe and to some branches of global capital and labor, fatal.

Those in power around the world crave one thing above all else: control. If you can’t control the situation and key assets, then what good is your supposed power? If you can’t control the situation and key assets, your power is illusory.

Those in power cannot completely control the forces unleashed by the pandemic. The tide has turned, and everyone trying to return their corner of the world to its pre-pandemic conditions is swimming against the tide–or shoveling sand against the tide, if you prefer that analogy. In either case, they will exhaust themselves and the tide will continue on, regardless of their titanic efforts to print money and maintain control of their populaces.

In my recent book, Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World, I focused on intangible capital, which includes all the forms of capital that cannot be commoditized and purchased for cash like goods and services. Intangible capital includes social capital, social stability, a diverse, resilient local economy and control of one’s own capital.

What I see is a global collapse of intangible capital that is invisible to most people. This includes confidence, trust in institutions and a complacent sense that the tide is carrying us all to greater prosperity.

The tide has reversed, and the key dynamics are income, net worth and costs. As I explained in The New (Forced) Frugality (March 28, 2020), incomes are falling and will continue to fall. Since income is the foundation of asset valuations, asset values will also fall. This will reverse the “wealth effect” that supported the enormous increases in spending and borrowing globally.

When our net worth is rising, we feel wealthier and are more likely to borrow and spend more, confident that our rising wealth will support the debt and higher expenditures. When our assets are declining in value, we feel poorer and are less likely to borrow and spend.

Income is fragile and prone to instant decay, while costs are extremely resistant to declines.

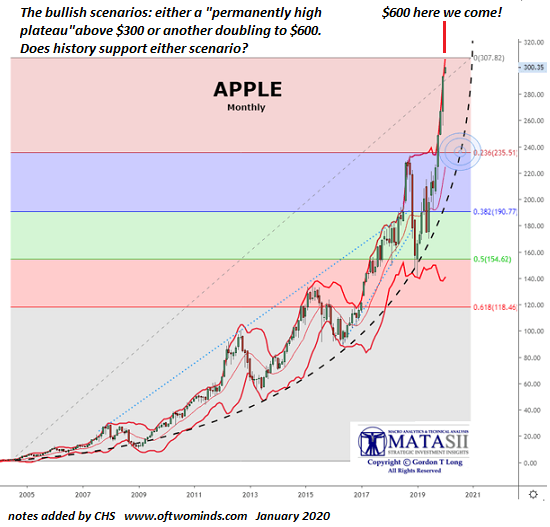

Consider stock valuations: the core driver is profit, which is revenues minus costs. As revenues drop and costs rise, profits vanish literally overnight. That sudden erosion of profits is global, and it will affect companies previously perceived as bulletproof. Facebook and Google depend on advertising, and with the global economy in free-fall, what’s the point in wasting scarce cash on marketing? Essentially no one needs a $1,000 iPhone or a $40,000 Tesla. Aspirational spending is as fragile as income.

Consider real estate: commercial real estate is based on the income generated by enterprises renting space. If businesses fold or stop paying rent, the value of the property falls accordingly.

|

Even residential real estate is intimately connected to income: as household incomes plummet, the number of potential buyers plummets, too. Institutional buyers of houses base the value on rental income, just like commercial property. As household income plummets, fewer people can afford sky-high rents, and so supply exceeds demand and rents will fall accordingly. Consider bonds: the value of any bond, government or corporate, is based on the yield paid to the owner. While the general expectation is that yields will fall to zero because central banks are buying bonds, this may be less of a guarantee than generally assumed. The volume of bonds being issued may well exceed central bank buying, and yields (and interest rates) will rise despite central bank intervention. The world depends on expanding debt to pay for government services and private-sector spending. Debt is also dependent on income; lenders who issue loans to households and enterprises with faltering income are very likely to lose money as these marginal borrowers default. As income falls, lending dries up, as lenders cannot afford to risk making loans to people and businesses that are practically guaranteed to default. This is especially true for borrowers who are already burdened by existing debts. As incomes decline, asset values decline and borrowing dries up. Once borrowing dries up, spending dries up, and enterprises and governments must cut payrolls by any means available: don’t replace retiring employees, cut wages and benefits, and eliminate overtime and bonuses. As stock values fall, so do the value of employee stock options–another example of the reverse wealth effect. Meanwhile, costs will continue rising as cash-strapped governments eventually seek more tax revenues and supply-chain shocks lead to higher prices. We cannot go back to the pre-pandemic side of the river of time, and it’s dangerous to focus on returning to a time that has already been lost. We cannot go back, we can only go forward. |

US financial assets now 5.6 times GDP |

Tags: Featured,newsletter