The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come. We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs. While the situation is still fluid with regards to the ultimate coronavirus impact on the global economy as well as the policy responses, we thought it would be useful to measure the potential ratings impact of this unprecedented economic crisis. We have to stress that we are assuming that the ratings agencies have not changed their methodologies. Our own model was constructed on the long-standing metrics that help determine a country’s

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come.

We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs. While the situation is still fluid with regards to the ultimate coronavirus impact on the global economy as well as the policy responses, we thought it would be useful to measure the potential ratings impact of this unprecedented economic crisis.

We have to stress that we are assuming that the ratings agencies have not changed their methodologies. Our own model was constructed on the long-standing metrics that help determine a country’s creditworthiness. With most countries blowing out their budget deficits and many engaging in Quantitative Easing, many lines have blurred. This bears watching, but the fact that we have already seen several EM downgrades (see below) suggests no change yet in the agencies’ way of thinking. Stay tuned.

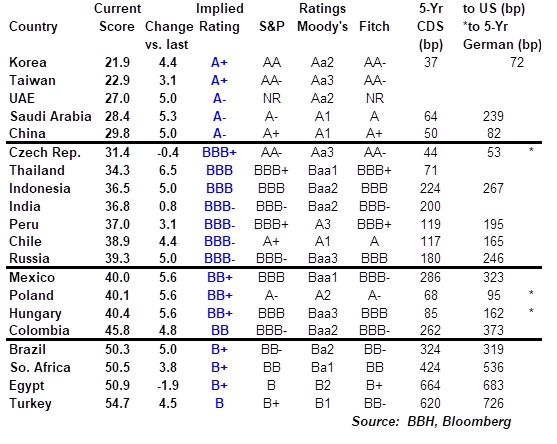

| EMERGING MARKETS RATINGS SUMMARY

There have been nearly thirty major EM rating actions recorded this year. As the spread of the coronavirus picked up, virtually all have been negative and it will only get worse. Yet we must take care to net out two special cases, Argentina and Ecuador. They were both teetering on default even before markets crashed, but the coronavirus likely accelerated their downdrafts. These two countries account for twelve of the twenty-four negative actions but are left out of this interim model update. Fitch has made the most negative moves this year with thirteen. Seven were concentrated in Ecuador and Argentina. Elsewhere, Fitch downgraded Colombia a notch to BBB- with negative outlook, downgraded South Africa a notch to BB with negative outlook, and downgraded Mexico a notch to BBB- with stable outlook. Fitch also moved the outlooks on Panama, Chile, and Malaysia from stable to negative. Moody’s has made six negative moves this year. Three were concentrated in Ecuador and Argentina. Elsewhere, Moody’s downgraded South Africa a notch to Ba1 with negative outlook and downgraded Mexico a notch to Baa1 with negative outlook. Moody’s also moved the outlook on Thailand from positive to stable. S&P has also made six negative moves this year. Three were concentrated in Ecuador and Argentina. Elsewhere, S&P downgraded Mexico a notch to BBB and maintained CreditWatch Negative. S&P also moved the outlook on Brazil from positive to stable and on Indonesia from stable to negative. There have been only four positive moves so far this year. Two of them were in Argentina and subsequently reversed. Elsewhere, S&P moved the outlook on Hungary from stable to positive and Moody’s moved the outlook on the Philippines from stable to positive. |

Emerging Markets Q2 2020 |

EMERGING MARKETS RATINGS OUTLOOK

Even within the stronger EM credits, scores were broadly lower. Furthermore, the revised scores had a direct impact on the implied ratings and pushed the two strongest down into single-A territory. Korea’s implied rating fell a notch to A+/A1/A+, moving it further below actual ratings of AA/Aa2/AA-. Taiwan’s implied rating also dropped down to A+/A1/A+ and below actual ratings of AA-/Aa3/AA-.

Within the A credits, most scores worsened significantly. The implied ratings of both UAE and Saudi Arabia fell two notches to A-/A3/A-. In particular, this is significantly below UAE’s actual rating of Aa2. China’s implied rating fell a notch to A-/A3/A-, which puts it further below actual ratings of A+/A1/A+.

Within the BBB credits, most scores worsened significantly. The two exceptions were Czech Republic and India, but it was enough to push India’s implied rating down a notch to BBB-/Baa3/BBB-. Elsewhere, Thailand fared the worst as Its implied rating fell two notches to BBB/Baa2/BBB. This puts it below actual ratings of BBB+/Baa1/BBB+. Indonesia’s implied rating fell a notch to BBB/Baa2/BBB, putting it right at actual ratings. The implied ratings of Peru, Chile, and Russia all fell a notch to BBB-/Baa3/BBB-. This suggests heightened downgrade risk for the two Latin American countries, while putting Russia pretty much at its actual ratings.

Within the BB credits, scores were uniformly bad and there are now three fallen angels. Mexico, Poland, and Hungary all saw their implied ratings drop two notches to BB+/Ba1/BB+. This suggests heightened downgrades risks for all three. Lastly, Colombia saw its implied rating fall a notch further into sub-investment grade territory to BB/Ba2/BB.

Within the B credits, most scores worsened significantly. The exception here was Egypt and its implied rating was steady at B+/B1/B+ and keeps it near actual ratings of B/B2/B+. Elsewhere, both Brazil and Turkey were pushed out of double-BB territory to B+/B1/B+. Lastly, Turkey’s implied rating fell a notch to B/B2/B and moves it further below actual ratings of B+/B1/BB-.

CONCLUSIONS

EM sovereign creditworthiness is falling precipitously because of the virus. Virtually all model scores worsened, with many leading to significant downgrades to the implied ratings. While the ratings agencies have been focusing on corporate issuers recently, we believe sovereigns will be next to come under significant downgrade pressures. We continue to believe that our model helps investors identify dislocations and potential divergences in the agency ratings.

METHODOLOGICAL APPENDIX

An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term external debt/reserves, import cover, current account/GDP, GDP growth, and budget balance. These scores translate into a BBH implied rating that is meant to reflect the accepted rating methodology used by the major rating agencies.

In order to make our model more forward looking, we had to come up with estimates for 2020 macroeconomic data across countries. Whenever possible, we used forecasts from the just-released IMF World Economic Outlook. However, in some instances, we had to use Bloomberg consensus forecasts.

Tags: Articles,Emerging Markets,Featured,newsletter