By Dara O’Sullivan, Derrick Leonard, and Ilan Solot With many markets still under lockdown and some going out on Easter holidays this week, we continue to see amended trading hours. The most notable change has been in India with a reduction in trading hours, while in Nigeria we saw a small amount of liquidity being released by the Central Bank of Nigeria (CBN). Below are our updates for the week. Please get in touch if you would like further information or to discuss...

Read More »Dollar Mixed, Equities Higher as Virus News Stream Improves

It was a relatively good weekend in virus-related news; measures of implied volatility continue to trend lower The dollar is trying to build on its recent gains; investors continue to try and gauge just how bad the US economy will get hit The outlook for oil prices remains highly uncertain and volatile Germany signaled that its stance regarding aid to the weaker eurozone countries remains unchanged; the news stream for the UK has turned negative Prime Minister Abe...

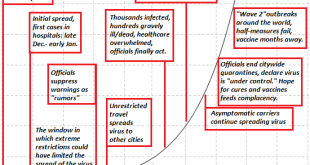

Read More »If Lockdown Is a Needless Over-Reaction, Then Why Did China Lockdown Half its Economy?

Recall that the initial deaths and related costs are only the first-order effects; policy makers have to consider the second-order effects. Everyone who reckons that the lockdown is needless and more destructive than the pandemic that triggered it has to answer this question: then why did China lockdown half its economy? The reasoning of those who reckon the lockdown is needless can be summarized as follows: 1. The lockdown is based on poorly executed extrapolations...

Read More »EM Preview for the Week Ahead

EM may get a little support from a potential OPEC+ deal to limit oil. Even if a deal is struck, the impact is likely to be fleeting as the global growth outlook remains terrible. We remain negative on EM for the time being. AMERICAS Mexico reports March CPI Tuesday, which is expected to rise 3.37% y/y vs. 3.70% in February. If so, inflation would move further towards the 3% target. February IP will be reported Wednesday, which is expected to contract -1.2% y/y...

Read More »When Bulls Are Over-Anxious to Catch the Rocketship Higher, This Isn’t the Bottom

Everyone with any position in today’s market will be able to say they lived through a real Bear Market. In the echo chamber of a Bull Market, there’s always a reason to get bullish: the consumer is spending, housing is strong, the Fed has our back, multiples are expanding, earnings are higher, stock buybacks will push valuations up, and so on, in an essentially endless parade of self-referential reasons to buy, buy, buy and ride the rocketship higher. The classic...

Read More »Dollar Bid as Market Sentiment Worsens

The virus news stream out of Europe has improved a bit The US is already taking about the next relief bill; the Fed continues to roll out measures to address dollar funding issues ADP and ISM manufacturing PMI are the US data highlights Regulators across Europe are asking banks to stop paying dividends; eurozone and UK reported final manufacturing PMIs Japan Q1 Tankan report was released; BOJ tweaked its bond buying program for April RBA minutes were released; Korea...

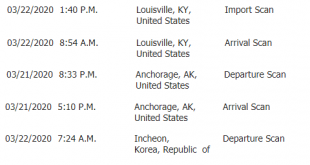

Read More »The Wonderful Insanity of Globalization

So here’s an April Fools congrats to globalization’s many fools. The tradition here at Of Two Minds is to make use of April Fool’s Day for a bit of parody or satire, but I’m breaking with tradition and presenting something that is all too real but borders on parody: the wonderful insanity of globalization. Like the famous emperor with no clothing, globalization’s countless glorious benefits have been flogged by neoliberal elites and its corporate media shills with...

Read More »The New (Forced) Frugality

There are only two ways to survive a decline in income and net worth: slash expenses or default on debt. In post-World War II America, the cultural zeitgeist viewed frugality as a choice: permanent economic growth and federal anti-poverty programs steadily reduced the number of people in deep economic hardship (i.e. forced frugality) and raised the living standards of those in hardship to the point that the majority of households could choose to be frugal or live...

Read More »Drivers for the Week Ahead

Markets continue to digest the implications of the Fed’s bazooka moment last week The data highlight this week will be March jobs data Friday; key manufacturing sector data will come out earlier in the week On Friday, BOC delivered an emergency 50 bp rate cut to 0.25% and started QE Final eurozone and UK PMI readings for March will be reported; late Friday, Fitch cut UK’s rating by a notch to AA- with negative outlook Japan has a fairly busy data week; RBA minutes...

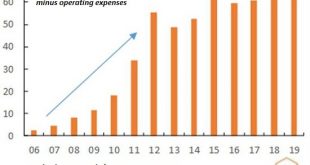

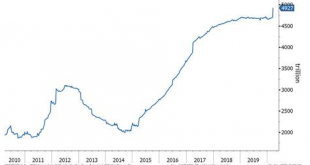

Read More »ECB Approaching its Bazooka Moment

The ECB appears to be moving closer to activating Outright Monetary Transactions (OMT). Despite being part of Draghi’s “whatever it takes” moment, OMT has never been used. If the Fed’s open-ended QE is seen as dollar-negative, then OMT should be seen as euro-negative. ECB Balance Sheet Total Assets, 2010-2019 - Click to enlarge RECENT DEVELOPMENTS At the regularly scheduled March 12 meeting, the ECB delivered a package of easing measures that were in hindsight...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org