The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly 0 bln; the extra fiscal stimulus will add to downward ratings pressure on the US Chicago Fed National Activity Index for March will be reported; late Friday, Moody’s downgraded Mexico a notch to Baa1 with negative outlook The debate about re-opening has intensified in the UK; EU and UK will start the second round of Brexit talks today Oil prices are under pressure again; Japan reported weak March trade data; China banks passed on the PBOC rate cuts, as expected The dollar is mostly firmer against the majors as the new week begins with oil and

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains

- Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US

- Chicago Fed National Activity Index for March will be reported; late Friday, Moody’s downgraded Mexico a notch to Baa1 with negative outlook

- The debate about re-opening has intensified in the UK; EU and UK will start the second round of Brexit talks today

- Oil prices are under pressure again; Japan reported weak March trade data; China banks passed on the PBOC rate cuts, as expected

The dollar is mostly firmer against the majors as the new week begins with oil and equities under pressure. The Antipodeans are outperforming, while Nokkie and Loonie are underperforming. EM currencies are mostly weaker. IDR and THB are outperforming, while MXN and RUB are underperforming. MSCI Asia Pacific was down 0.7% on the day, with the Nikkei falling 1.2%. MSCI EM is down 0.2% so far today, with the Shanghai Composite rising 0.5%. Euro Stoxx 600 is down 0.2% near midday, while US futures are pointing to a lower open. 10-year UST yields are down 1 bp at 0.63%, while the 3-month to 10-year spread is down 3 bp to stand at +53 bp. Commodity prices are mostly lower, with Brent oil down 3.6%, WTI oil down 25.8%, copper down 0.4%, and gold down 0.2%.

The lockdown vs. opening debate continues in just about every country. France will start to ease the lockdown within two weeks, New Zealand and Belgium within a week, and Germany is already re-opening. However, reports suggest that rising cases in Millan might delay the Italy’s plan to start re-opening on May 4. Sweden has moved to the center of the controversy given its strategy to no impose lockdowns; the country’s death rates are considerably higher than its Scandinavian neighbors but a lot lower than many countries in Continental Europe or the UK. There are no dates set to re-open business in the UK, with Prime Minister Johnson reportedly planning to only “modify” lockdown rules rather than lifting them for fears of a second wave of cases. Please see our report last week Comparing Lockdowns vs. Re-Openings.

The dollar is consolidating recent gains. DXY was unable to make a clean break above 100 last week and is trading just below that level. After 100, the April 6 high near 100.931 is the next hurdle. The euro bounce ran out of steam near $1.09, while sterling remains unable to make a clean break above the $1.25 area. Lastly, USD/JPY remains in very narrow ranges just below the 108 area. We remain constructive on the dollar, as poor economic data globally and lower oil prices are likely to weigh on market sentiment this week.

AMERICAS

Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln. House Majority Leader Hoyer reportedly asked his caucus to be ready for a vote as soon as Wednesday, though the timing remains up in the air as negotiations continue. The Paycheck Protection Program is basically out of funds already and so talks are focused on topping it off with another $310 bln. Reports of not-so-small businesses tapping into the program have also led policymakers to focus more on making sure that the new funds are funneled to truly small businesses. A separate $50-60 bln program called the Economic Injury Disaster Loan program is also being discussed, while reports suggest that Democratic demands for $100 bln for hospital funding and $25 bln for virus testing will be largely be met.

The extra fiscal stimulus will add to downward ratings pressure on the US. As we showed in our recent DM Sovereign Rating Model for Q2 2020, the US is very likely to lose its AAA/Aaa ratings from both S&P and Moody’s and move into AA-/Aa3 territory. Other countries are also at risk as government’s around the world utilize fiscal policy to offset the impact of the coronavirus.

The Chicago Fed National Activity Index for March will be reported. It is expected at -3.0 vs. +0.16 in February. If so, the 3-month average would fall to -1.06 from -0.21 and would be well below the -0.7 recession threshold. There is little doubt that April and beyond will show even more significant weakness. While this is usually a reliable indicator of US recession risk, this current downturn was so sudden and steep that CFNAI has lost any relevance here. Perhaps it will be more useful in determining the timing of the recovery, but that is still months and months away, in our view. Elsewhere, Canada reports February wholesale trade sales today and are expected to fall -0.4% m/m.

Late Friday, Moody’s downgraded Mexico a notch to Baa1 with negative outlook. The previous A3 rating was an outlier in need of adjustment, as S&P cut Mexico to BBB in March and Fitch cut it to BBB- just last week. We are in the process of updating our EM sovereign rating model but note that we already had Mexico at BBB/Baa2 last November. The outlook has gotten much worse and so we suspect Mexico is in danger of eventually losing its investment grade rating.

EUROPE/MIDDLE EAST/AFRICA

The debate about re-opening has intensified in the UK. Press criticism of the government has picked up. In addition, the press is highlighting a split in the government between the more hawkish pro-reopening camp composed of Chancellor Rishi Sunak and cabinet officer minister Michael Gove vs. a more dovish health secretary Matt Hancock and supposedly senior advisor Dominic Cummings. The government is not only being criticized for taking too long to act but also for mishandling procurement of protective equipment and insufficient testing. That said, support for the government’s handling of the crisis has remained stable near comparatively high levels of 66%, according to YouGov, which is higher than similar ratings for the German and Spanish governments.

The EU and UK will start the second round of Brexit talks today. Last week, the UK stuck with its hardline stance and insisted it would reject any EU request to extend the transition deadline beyond December 31. While this may just be posturing, we don’t think markets need yet one more thing to worry about this year. Further hardline posturing by the UK will likely weigh on sterling.

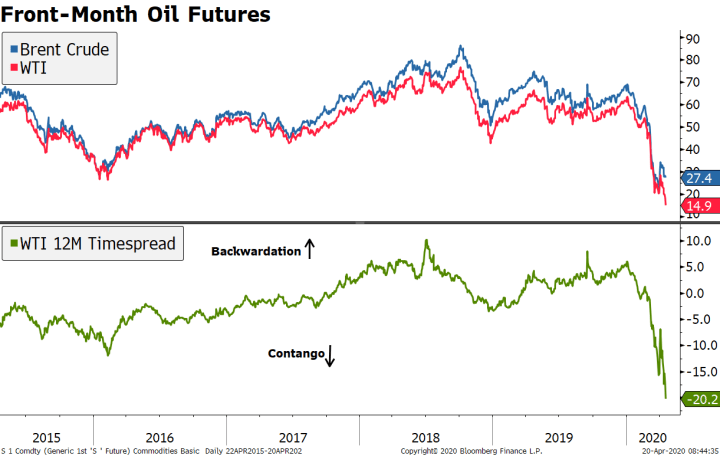

| Oil prices are under pressure again this morning, especially WTI. Discussions about production cuts in the US have done little to ease concerns over oversupply and the world running out of storage. The WTI front-month contract (for May) is trading near $14 dollars per barrel. However, the contract is expiring and so traders are rushing to close out their trades by tomorrow to avoid having to deliver physical oil into rapidly filling storage facilities. The June contract is trading near $23, much closer to the front-month Brent price around $27. The decline in WTI prices was concentrated on the front part of the curve, making the already deep contango even more severe. |

Front-Month Oil Futures, 2015-2020 |

ASIA

Japan reported weak March trade data overnight. Exports contracted -11.7% y/y vs. -9.4% expected, while imports contracted -5.0% y/y vs. -8.7% expected. This resulted in an adjusted deficit of -JPY190 bln vs. -JPY115 bln expected. The export sector is likely to remain a big drag on the Japanese economy in Q2, and will be made worse by the domestic impact of the lockdown now in place. No wonder there are reports that the Abe government is looking to increase its extra budget by another JPY8.8 trln ($82.5 bln) to fund cash payouts to the populace.

China commercial banks passed on the PBOC rate cuts, as expected. The 1-year Loan Prime Rate (LPR) fell 20 bp to 3.85%, while the 5-year rate fell 10 bp to 4.65%. This effectively lowers the cost for new loans and variable-rate ones. The move followed the PBOC’s 20 bp cut to the medium-term lending facility (MLF) last week. We expect more easing on the way, but at a cautious pace to avoid speculative excesses. Still, the underlying signal to us is that ongoing easing measures means that the mainland economy is not recovering as strongly as policymakers hoped.

Tags: Articles,Daily News,Featured,newsletter