Despite rising infections worldwide, the virus news stream has turned positive; the dollar is consolidating its gains today With the 10-year yield rising to near 1.0%, US financial conditions are tightening; the Fed released its Financial Stability report yesterday and it pulled no punches; with the Fed media embargo over, many officials will speak today UK House of Lords altered the Internal Market Bill; UK employment numbers were slightly better than expected;...

Read More »Vaccine and Split Government

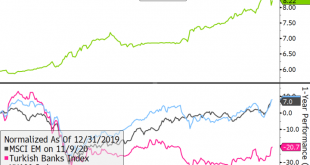

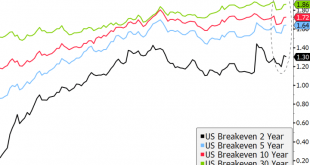

The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around. While the policy-driven (fiscal and monetary) reflation theme from earlier in the year helped backstop the worst of the economic fallout, its reflationary impact was skewed towards asset price inflation....

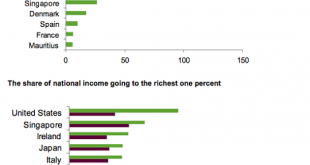

Read More »No Wonder the Super-Rich Love Inflation

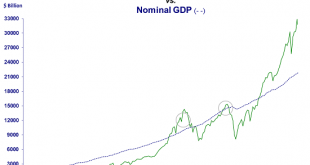

Asset inflation benefits the super-rich more than anyone else because they own the vast majority of these assets. With the reflation euphoria running full blast, maybe central banks will finally get all that inflation they’ve been pining for. So let’s ask cui bono–who will benefit from inflation? The Super-Rich love inflation and the money-printing that generates it. Longtime correspondent Michael M. explains the dynamic behind billionaires’ adoration of...

Read More »Forget GOAT, Look at GBOAT: The Greatest Bubble Of All Time

So enjoy the GBOAT (greatest bubble of all time) but watch the clock. Sports fans debate who qualifies as GOAT–the greatest of all time: in hoops, Kobe, Jordan, Kareem, Magic; in boxing, Ali, and so forth. What we have today is GBOAT–the greatest bubble of all time That it’s GOAT is beyond doubt, as the charts below reveal. Bubbles have a few unique characteristics which cannot be captured by financial metrics. The most important such characteristic is that...

Read More »Here’s Our Historical Analogy Menu: Rome, the USSR or Revolutionary France

The core dynamic is ultimately the loss of social cohesion within the ruling elites and in the social order at large. There’s a definite end of days feeling to the euphoria that the world didn’t end on November 3. And what better way to celebrate the victory of what passes for normalcy with a manic stock market rally? It’s as if everyone knows there is no returning to the good old days of a well-oiled Imperial machine chewing through any and all obstacles, and this...

Read More »Markets Gyrate Ahead of Protracted Period of Uncertainty

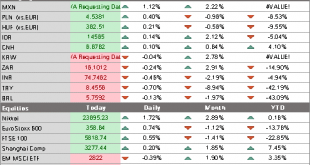

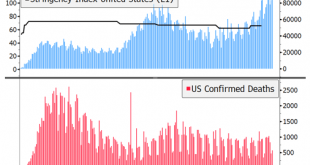

Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities The two day FOMC meeting starts today and concludes with a likely...

Read More »What We Don’t Elect Matters Most: Central Banking and the Permanent Government

We’re Number One in wealth, income and power inequality, yea for the Fed and the Empire! If we avert our eyes from the electoral battle on the blood-soaked sand of the Coliseum and look behind the screen, we find the powers that matter are not elected: our owned by a few big banks Federal Reserve, run by a handful of technocrats, and the immense National Security State, a.k.a. the Permanent Government. These entities operate the Empire which hosts the electoral...

Read More »Our Imperial Presidency

Regardless of who holds the office, America’s Imperial Project and its Imperial Presidency are due for a grand reckoning. While elections and party politics generate the emotions and headlines, the truly consequential change in American governance has been the ascendancy of the Imperial Presidency over the past 75 years, since the end of World War II. As commander-in-chief of the armed forces, the Constitution grants the President extraordinary but temporary powers...

Read More »FOMC Preview: Coronavirus Daily Change

The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4. While we are confident about our call for this meeting, the medium-term outlook will remain highly uncertain until we get a firm result from the US elections and a better grasp of how the pandemic will impact...

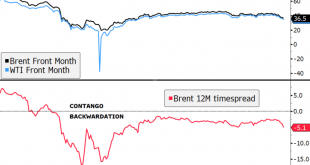

Read More »Dollar Firm at Start of Very Eventful Week

Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week The outlook for the virus in Europe continues to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org