Global equity markets are gaining limited traction today after yesterday’s bloodbath; that sell-off helped test a now prevalent hedging thesis for investors The dollar remains bid; US Q3 GDP data will be the data highlight; weekly jobless claims will be reported BOC delivered a dovish hold yesterday; Canada Finance Minister Freeland defended the government’s aggressive fiscal stimulus plans; Brazil left rates unchanged, as expected ECB is expected to deliver a...

Read More »ALICE Doesn’t Work Here Anymore

What the political class and the Financial Nobility don’t yet grasp is that ALICE will never go back to her insecure, low-wage job, ever. Meet ALICE: Asset Limited, Income Constrained, Employed, at least she was employed until the pandemic presented impossible choices between taking care of her children and their education, and her aging parents, and keeping her demanding, low-wage job. Though it doesn’t fit in with the cute mythology of “capitalism” that...

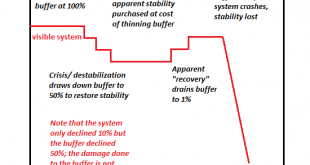

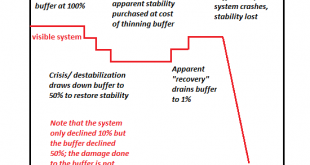

Read More »Flying Blind: Clueless about Risk, We’re Speeding Toward Systemic Failure

For all these reasons, the risks of systemic collapse are much higher than commonly anticipated. There’s an irony in discussing risk: since we all have an instinctive reaction to visible risk, we think we understand it. But alas, we don’t, especially when the risk is invisible and systemic. We even misjudge extremely visible risk. People routinely die rushing to save someone who foolishly waded into fast-moving water a few yards above a waterfall. The rescue is...

Read More »ECB Preview

The ECB meets Thursday and is widely expected to stand pat until the next meeting. Macro forecasts won’t be updated until the December 10 meeting, but the bank will have to acknowledge the deteriorating outlook now. There’s a small risk of more jawboning against the stronger euro, but it should otherwise be an uneventful meeting. We expect the ECB to increase QE in December but another rate cut seems very unlikely, as does activation of OMT. POSSIBLE NEXT STEPS...

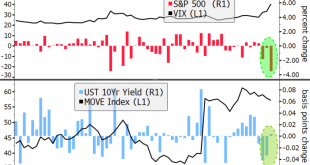

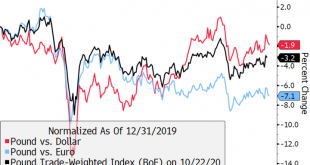

Read More »Dollar Bid as Markets Start the Week in Risk-Off Mode

Increasing virus numbers have pushed European governments to once again start imposing national measures; the week is starting off on a risk-off note Today may see the official end of stimulus talks; odds for Biden victory are increasing again but is already mostly priced in US manufacturing surveys for October will continue to roll out; Chile’s referendum on a new constitution passed in a landslide Brexit negotiations have been extended; Germany’s October IFO survey...

Read More »How Systems Collapse: Reaping What We’ve Sown

Don’t expect healthcare or any other hollowed-out, heavily optimized system to function as it once did. A great many Americans will be shocked when our healthcare systems start failing because they believed the PR that “we have the finest healthcare system in the world.” The ability to deliver the finest care to a few does not translate into an ability to deliver the finest care to the many, nor does it mean the system is robust enough to withstand a tsunami. As I...

Read More »EM Preview for the Week Ahead

EM FX took advantage once again of broad dollar weakness. Most EM currencies were up last week against the dollar, with the only exceptions being ARS, TRY, INR, THB, PEN, and MYR. We expect the dollar to remain under pressure this week and so EM should remain bid. However, the growing spread of the virus in Europe and the US supports our view that Asia is likely to continue outperforming. AMERICAS Chile held a referendum Sunday on whether to draft a new constitution....

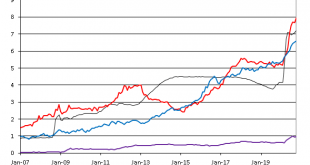

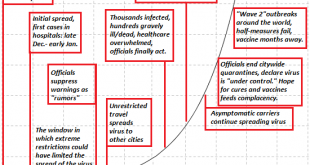

Read More »Next Up: Global Depression

The belief that central banks printing currency can “buy/fix” everything that’s broken, lost or scarce is the ultimate in denial, fantasy and magical thinking. Let’s revisit the pandemic projection chart I prepared on February 2, 2020, nine days after authorities publicly acknowledged the Covid virus outbreak in China. Wave 2 shown on the chart is now underway with a vengeance and next up is Global Depression. . This projection was based on two well-known...

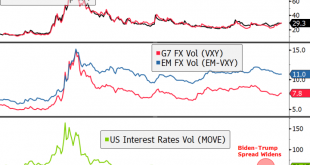

Read More »Dollar Catches Modest Bid but Weakness to Resume

Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections; the dollar has caught a modest bid today Stimulus talks continue; Pelosi warned that a deal may not come together before the November 3 election; whether Republican Senators change their minds after the elections depends on the outcome Measures of cross-asset volatility suggest a far too generous interpretation of the odds for a clean Democratic sweep; KC Fed...

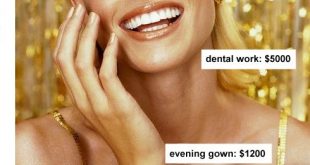

Read More »Everything is Staged

All the staging is a means to an end, and everyone in America is nothing more than a means to an end: close the sale so the few can continue exploiting the many. You know how realtors stage a house to increase its marketability: first, they remove all evidence that people actually live there. (Of course a vacant house is ideal for staging because there’s none of the messy real-life stuff to deal with.) All the clutter of everyday life must be moved elsewhere so the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org