The confidence that there will always be facilities and professionals to care for us is no longer realistic. I’ve covered the systemic problems of U.S. healthcare for over a decade, and as a result I’ve attracted numerous healthcare professionals as correspondents. I’ve been corresponding with some for almost 15 years, and this correspondence has given me a sobering education in the realities of our fully financialized (and thus hollowed-out) healthcare system....

Read More »Dollar Weakness Continues Ahead of US Retail Sales Data

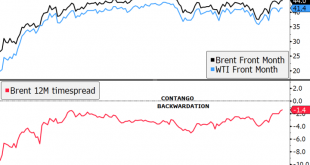

The dollar continues to soften October retail sales will be the US data highlight; Fed manufacturing surveys for November have started to roll out; Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed Newswires reported (again) that a Brexit deal is at hand; Hungary and Poland will veto the EU budget and recovery fund; ECB signaled that they are focused on asset purchases and long-term funding for the next round of stimulus; Hungary is expected...

Read More »Dollar Soft as Markets Start the Week in Risk-On Mode

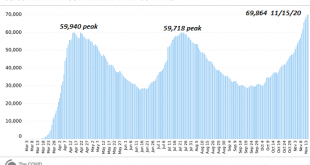

The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over; the dollar continues to soften There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary; Fed manufacturing surveys for November will start to roll out; Peru’s interim President Merino resigned under pressure from more demonstrations Several UK MPs and Prime Minister Johnson were forced to isolate due to a...

Read More »Roadblocks and Opportunities for International Trade in 2021

We see significant upside risk for global trade coming from “top down” forces (such as politics), but at the same time we expect the undercurrent reconfiguring many of the existing relationships to intensify. The “Peak Globalization” narrative (at least regarding trade) is being challenged by hopes of a revival of multilateral cooperation under Biden and the latest Asian trade agreement. But this doesn’t change our long-term view that the US and China are in an...

Read More »Don’t Blame Covid: The Economy is Imploding from Over-Capacity and Corrupt Cartels

Now that the bubble has burst, the hope is that removing the pin will magically restore the burst bubble. Sorry, it doesn’t work that way. Here’s the fantasy: if we stop the shutdowns, the economy will naturally bounce back to its oh-so wunnerful perfection of Q3 2019. This is a double-dose of magical thinking and denial. The U.S. economy was unraveling in 2019 from 11 long years of Fed-induced over-capacity in almost everything (except integrity, competition,...

Read More »Drivers for the Week Ahead

The virus numbers in the US show no signs of slowing; the dollar should continue to soften October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors Canada has an important data week; Brexit talks will (hopefully) wind up soon; UK reports key data Japan and Australia have...

Read More »Prepare for Winter

Realism must precede optimism or the optimism will collapse as the tsunami of reality comes ashore. It’s time to prepare materially and psychologically for a winter unlike any other in our lifetimes. Here’s the view from 30,000 feet: 1. The stock market and the general zeitgeist of optimism have soared based on expectations that the real-world economy and efforts to suppress Covid would also track a V-shaped recovery. While GDP did make a V-shaped recovery, GDP...

Read More »“The Great Reset” Already Happened

Put another way: the elites have cannibalized the system so thoroughly that there’s nothing left to steal, exploit or cannibalize. The global elites’ techno-fantasy of a completely centralized future, The Great Reset, is addressed as a future project. Too bad it already happened in 2008-09. The lackeys and toadies tasked with spewing the PR are 12 years too late, and so are the critics listening to the PR with foreboding. Simply put, events outran our...

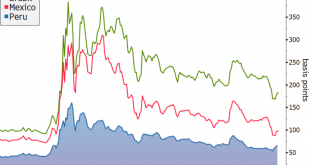

Read More »Dollar Softens Ahead of CPI Data

Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25% UK Q3 GDP rebounded strongly but September data show a loss of momentum; Brexit talks remain unresolved; the domestic...

Read More »Everything You Don’t Want to Know About Covid Vaccines (Because You Can’t Be Bullish Anymore)

In such a highly polarized, politicized environment, is such a scrupulously objective study even possible? Now that we’ve had the happy-talk about Pfizer’s messenger-RNA (mRNA) vaccine (and noted that Pfizer’s CEO sold the majority of his shares in the company immediately after the happy-talk), let’s dig into messenger-RNA (mRNA) vaccines which are fast approaching regulatory approval. Some people have concluded vaccines are not safe, regardless of their source or...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org