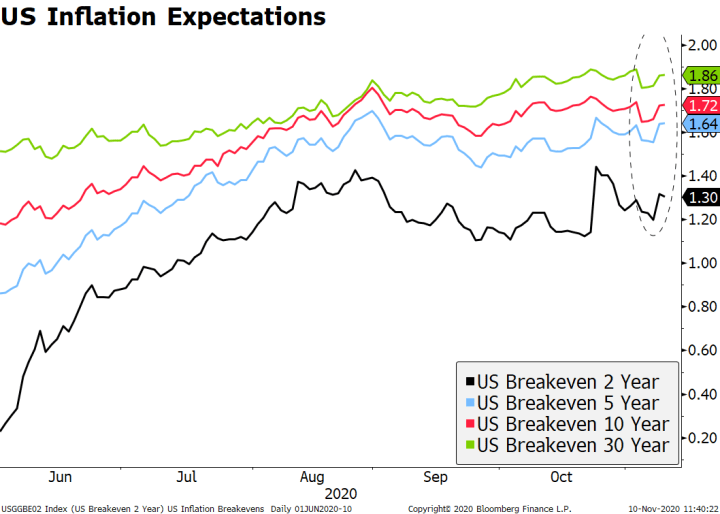

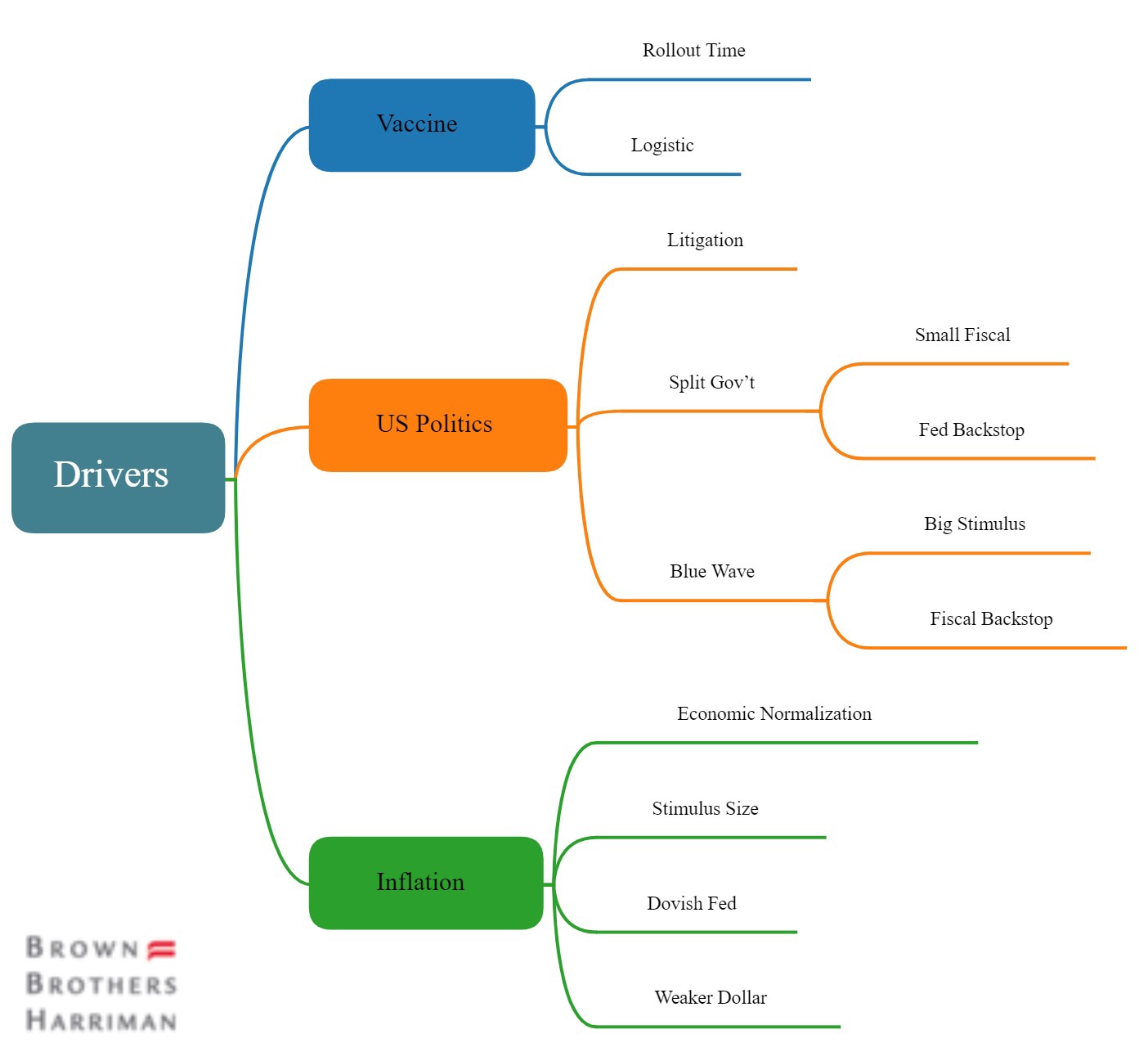

The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around. While the policy-driven (fiscal and monetary) reflation theme from earlier in the year helped backstop the worst of the economic fallout, its reflationary impact was skewed towards asset price inflation. What if it’s different now? The pickup in US inflation breakeven hints at this possibility. If so, we may have a huge readjustment of Fed policy expectations in store. At stake is a massive sector rotation in global equities, a reconfiguration of the cross currents facing the dollar, and a huge new

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around. While the policy-driven (fiscal and monetary) reflation theme from earlier in the year helped backstop the worst of the economic fallout, its reflationary impact was skewed towards asset price inflation. What if it’s different now? The pickup in US inflation breakeven hints at this possibility. If so, we may have a huge readjustment of Fed policy expectations in store. At stake is a massive sector rotation in global equities, a reconfiguration of the cross currents facing the dollar, and a huge new force in fixed income markets. |

US Inflation Expectations, 2020 |

| As of this writing, markets are assuming a Biden presidency with a Republican Senate; we conform with the former, but we are not as convinced about the latter. Our understanding is that Trump doesn’t have enough arguments to bring a successful case to courts. Despite lingering Republican support, this issue should gradually fade away. On the Georgia Senate race, the landscape has changed so dramatically that it’s impossible to make any confident prediction. But Democrats are likely to feel invigorated by Biden and the absence of Trump to motivate turnout means Republicans will be on the defensive, in our view. In other words, the fabled Blue Wave is still very much a possibility.

Against this complex backdrop, here is how our thinking around some of the risks and main issues has evolved. (1) Investors might come around to the idea of a constructive relationship between Biden and the Republicans, but not before Georgia is resolved. This may sound farfetched at the height of the political drama and many Republicans still giving Trump the benefit of doubt for a contested election. But Biden has a good relationship with McConnell after years of working with him across the Senate aisle. Yes, Republicans will play the obstructionist long-game with an eye on the mid-term elections (and the Georgia Senate runoff), but there is plenty of room for a positive surprise down the line. With markets pricing in a minimal stimulus package, we think the risks are tilted towards a favourable outcome here, even with the vaccine news. Republicans will want to share the credit for the economic improvement that will come from a vaccine. |

|

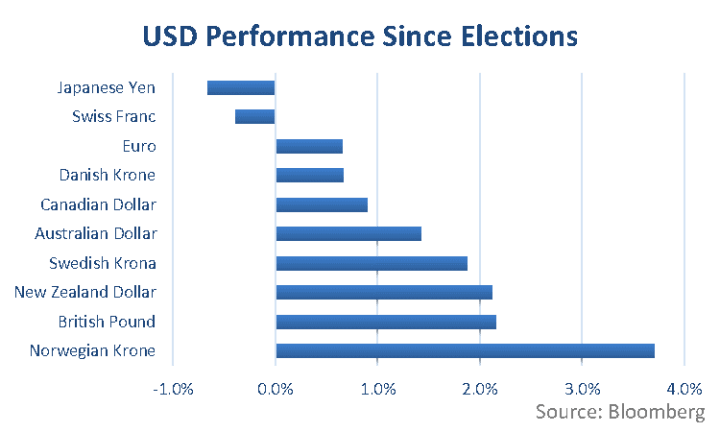

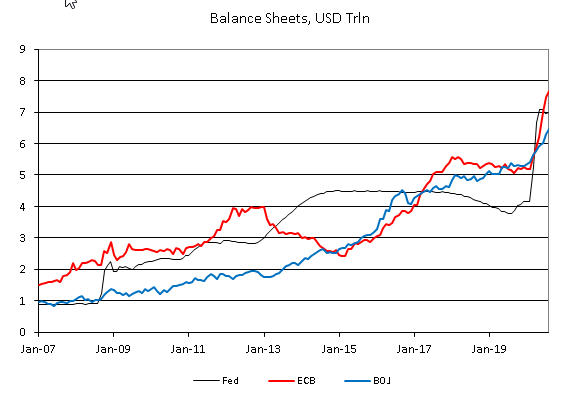

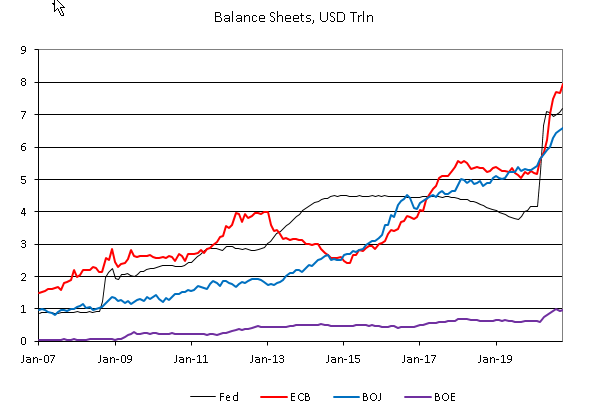

| (2) The Fed replaces fiscal stimulus as the ultimate backstop under a split government. If the economy falters, the Fed will save the day. So the punchbowl is half full again, but with another form of booze. The substitution of (potential) QE for fiscal stimulus has been an important driver for a weaker dollar (and higher gold and bitcoins) last week. Going forward, it means that the dollar impact of a big negative economic surprise will be a battle between risk aversion flows (dollar positive) and expected Fed easing (dollar negative). We expect the latter to prevail. In contrast, should the Democrats pull off a majority in the Senate, negative US economic news will be met with fiscal expenditure, which should be more effective in supporting growth, hence not as negative for the dollar (at least in the short term). |

USD Performance Since Elections |

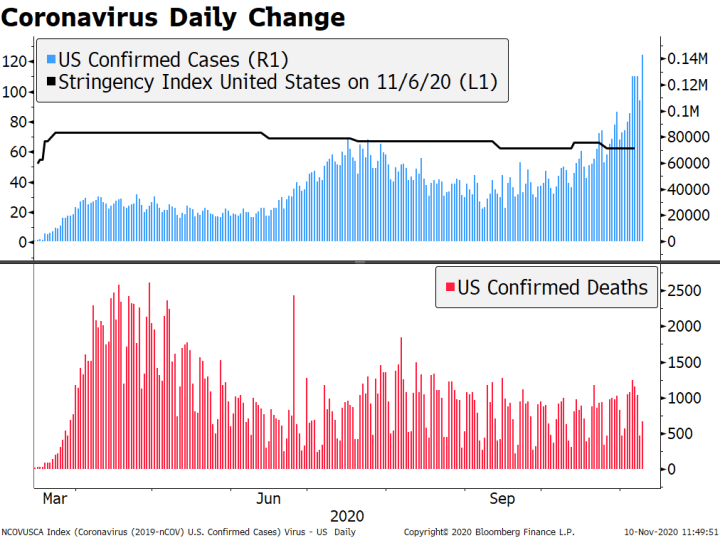

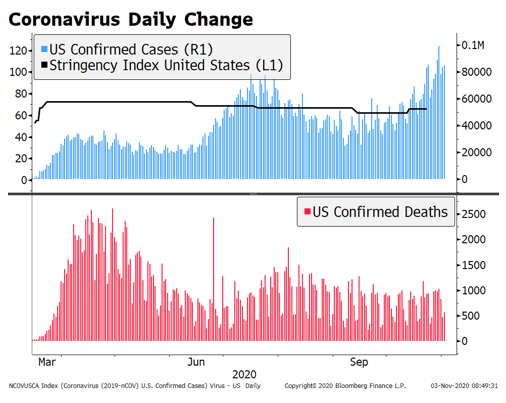

| (3) The US may fall behind the curve in the pandemic response with the transition of power. Biden is preparing a 12-member pandemic task force “built on a bedrock of science” that will “put our plan to control this virus into action.” The problem is that the Trump administration (and many elected Republican officials) may not cooperate. This could mean a worsening of the pandemic until the end of the year, forcing a more vigorous response by the Biden administration in terms of pushing for new restrictions. While this could be a longer-term positive for the US economic outlook, it would be a short-term negative. Here we assume that even if the Pfizer vaccine proves effective, the rollout will take time. |

Coronavirus Daily Change, 2020 |

|

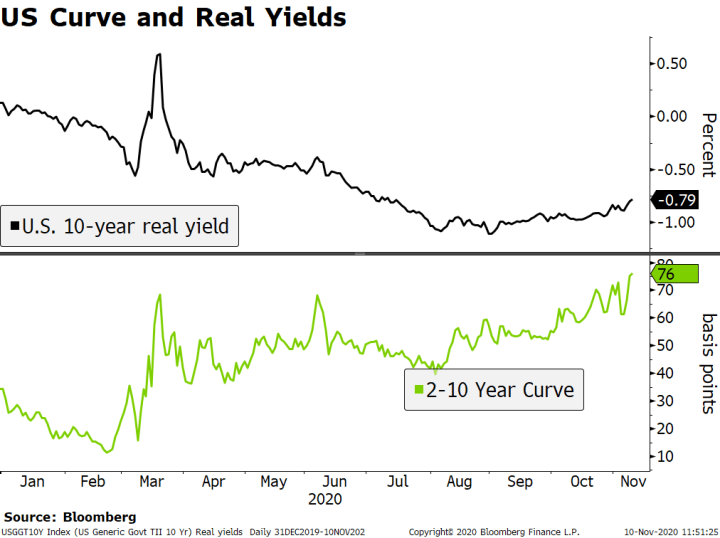

(4) The inflation shock scenario became more vivid, but still arguably under-priced. Imagine the combination of events: (1) Vaccine(s) are successfully being rolled out; (2) reopening is underway, consumer and corporate behaviour start to normalize; (3) Democrats win the Senate and seize the window to deliver stimulus and infrastructure spending; (4) dollar weakness provides an extra inflationary boost; and (5) markets grow concerned that Fed might fall behind the curve, having given up some degrees of freedom for announcing its new brand new average inflation targeting (AIT) framework. Even a more limited combination of these events is likely to require a substantial repricing in markets. For example, it could revive discussions of YCC by the Fed, or concerns about MMT. We would expect the Fed’s response to escalate over time, with jawboning the first line of defence, but it will be an awkward conversation to have with markets so soon after AIT. After that, adjustments to its QE would be the next line, with potential increases or shifts in the composition towards the long end. YCC should be seen as a very last resort. |

US Curve and Real Yields, 2020 |

Tags: developed markets,Featured,newsletter