The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4. While we are confident about our call for this meeting, the medium-term outlook will remain highly uncertain until we get a firm result from the US elections and a better grasp of how the pandemic will impact the economy. RECENT DEVELOPMENTS The US outlook has worsened since the September FOMC meeting. Infection numbers are making new highs with no sign of abating. There is no national strategy to contain the virus, and so we are seeing a hodgepodge of state level responses. Currently, the midwestern

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4. While we are confident about our call for this meeting, the medium-term outlook will remain highly uncertain until we get a firm result from the US elections and a better grasp of how the pandemic will impact the economy.

| RECENT DEVELOPMENTS

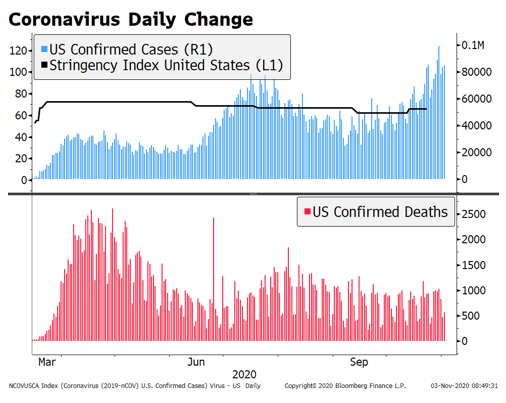

The US outlook has worsened since the September FOMC meeting. Infection numbers are making new highs with no sign of abating. There is no national strategy to contain the virus, and so we are seeing a hodgepodge of state level responses. Currently, the midwestern states are seeing a surge in infections and hospitalizations. With the pandemic stretching on, markets are coming to the realization that the recovery will be pushed out further into next year with the risk of further tightening of restrictions. Yet fiscal stimulus is unlikely until 2021. While some may hold out for a package during the lame duck session, we think this is unlikely unless President Trump wins. If so, the Republican Senate has some incentive to help boost growth during a second term. If Biden were to win, we do not think the Senate would have any incentive to help him during his first term. If there is a Blue Wave, then significant fiscal stimulus is likely but not until February 2021, and even then there may be residence from a Republican minority. If Biden wins and the Republicans hold on to the Senate, this would likely be the worst case scenario for stimulus as a protracted period of legislative gridlock becomes very likely. |

Coronavirus Daily Change, 2020 |

We believe that the outlook for Fed policy in 2021 critically depends on what is done on the fiscal side. Massive US Treasury issuance under a Blue Wave scenario is unlikely to be fully absorbed by the private sector. This will require the Fed to adjust its asset purchases, further blurring the line between fiscal and monetary policy. The dollar tends to come under pressure as markets pricing in a new round of QE, before recovering. This time around, that recovery will be made more difficult by the rise of infections across the nation. As Fed Chair Powell has said countless times, there can be no sustainable economic recovery until the virus is under control. And of course, the dollar outlook will depend on what other central banks (especially the ECB and BOE) decided to do in reaction to rising economic downside risks there.

WHAT ELSE CAN THE FED DO?

Despite the aggressive measures taken by the Fed so far, it still has some tools at its disposal. Here, we look at several moves that the Fed could make in the coming months if needed.

- Tweak existing loan and liquidity programs – POSSIBLE AT ANY TIME. Last week, the Fed announced that it was lowering the minimum loan amount for its Main Street Program to $100k from $250k previously. This isn’t the first time that the Fed has tweaked its lending and liquidity programs just days before an FOMC. The move just underscores that the Fed is not constrained by the calendar and will act whenever it sees a need. That said, we don’t think this tweak moves the needle much in terms of stimulus. Nor does it necessarily imply that the Fed is going to add more stimulus at this week’s FOMC meeting.

- Tweak its macro forecasts – POSSIBLE IN DECEMBER. The Fed just updated its Summary of Economic Projections at the September meeting. 2023 was added to the forecast horizon and the Dot Plots see steady policy for another year. The median GDP forecasts from September (June) were -3.7% (-6.5%) in 2020, 4.0% (5.0%) in 2021, 3.0% (3.5%) in 2022, and 2.5% in 2023 while the median core PCE forecasts were 1.5% (1.0%) in 2020, 1.7% (1.5%) in 2021, 1.8% (1.7%) in 2022, and 2.0% in 2023We suspect Powell at this meeting will highlight downside risks due to the spread of the virus and lack of fiscal stimulus. Forecasts will then be updated at the December meeting.

- Tweak its forward guidance – VERY UNLIKELY NOW, POSSIBLE in 2021. The Fed just updated its forward guidance at the September meeting to incorporate its new policy framework, and so it’s too soon to expect another change. “The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.” This is about as explicit as outcome-based forward guidance can get and yet it still leaves the Fed with a lot of wiggle room. The phrases “moderately exceed” for “some time” are suitably vague. Because of this built-in strategic ambiguity, there’s really no need to update forward guidance anytime soon. Only when inflation remains elevated will the Fed be called on to better define “moderately exceed” for “some time” and we are a long way from that.

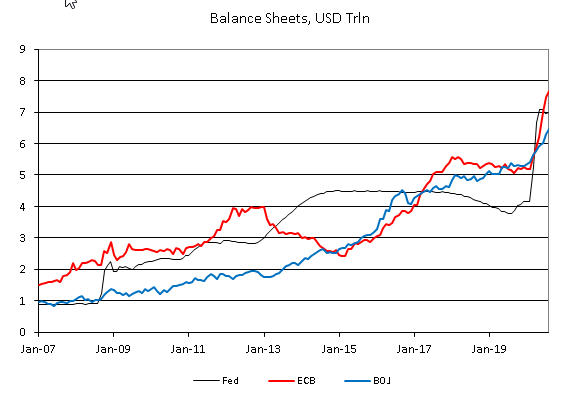

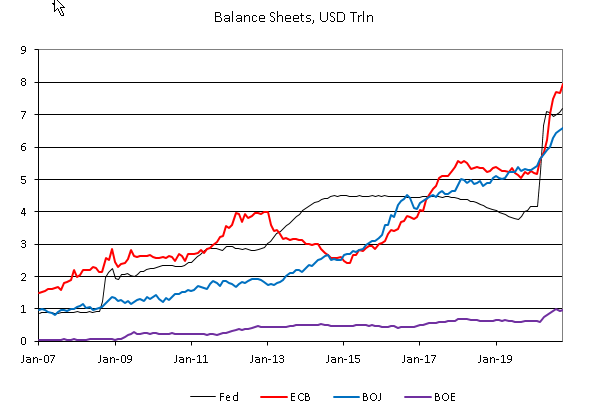

- Adjust asset purchases – UNLIKELY NOW, LIKELY IN 2021 IF AGGRESSIVE FISCAL STIMULUS PASSED. QE was initially ramped up in March to help keep markets functional. However, at the September meeting, the FOMC committed using QE to “maintain an accommodative stance of monetary policy.” It’s a subtle shift but a noteworthy one. For now, the Fed’s asset purchases remain on autopilot with the Fed currently buying $80 bln of US Treasuries and $40 bln of mortgage-backed securities each month. This has led the Fed’s balance sheet to increase to a record-high $7.15 trln at the end of October, a 72% increase from end-2019. We posit that the Fed’s QE will have to increase if there is a Blue Wave that leads to aggressive fiscal stimulus. Debt issuance would spike and we think the natural tendency would be for long rates to rise. It would fall on the Fed to prevent such a rise by boosting QE. Purchases are currently spread out evenly across the maturity spectrum. Another possibility for the Fed is to shift its purchase more towards the long end but this would fall short of explicit YCC (see below).

- Introduce Yield Curve Control – VERY UNLIKELY NOW, POSSIBLE IN 2021 AND BEYOND IF LONG RATES RISE TOO MUCH. Fed officials were all over the place regarding YCC over the summer. Mester said back in early September that it’s not preferred at the moment, while Clarida and Brainard said it remains in the Fed’s tool kit. Yet since the September FOMC decision and the updated forward guidance, there has been nary a mention of YCC in official commentary. Note that the 10-year yield traded at 0.88% today, the highest since June 8 and on its way to test the June 5 high near 0.96%. We do not think the Fed will be happy with the steepening yield curve and may offer some verbal pushback this week. That said, we think the Fed remains far from instituting official YCC. If perceived improvements in the US economy were to push US yields significantly higher, then we think there would first be a series of QE changes highlighted above. We think YCC would only become more likely if these more “traditional” asset purchases fail to halt that rise in yields. The Fed simply does not want tighter financial conditions over the next several years. Period.

- Negative interest rates – VERY UNLIKELY. Not one current FOMC member has advocated negative interest rates yet. Indeed, minutes from recent FOMC meetings show that the concept isn’t even being actively discussed. Uber-dove and former Minneapolis Fe d President Kocherlakota is the only Fed official that we can recall (past or present) that has advocated for negative rates. Simply put, there is no hard evidence that negative rates work and there is of course risks of lower bank profitability and damaging the financial system.

| INVESTMENT OUTLOOK

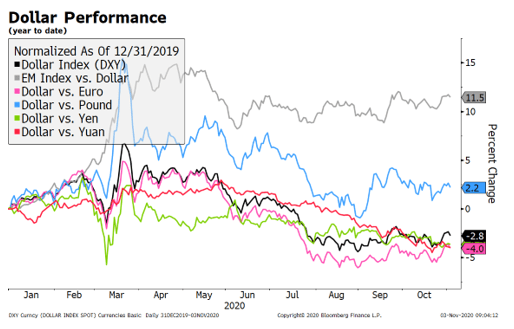

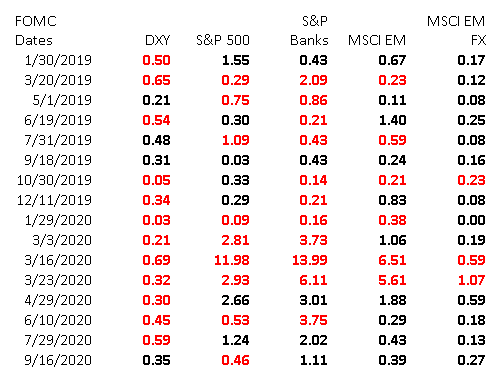

The dollar tends to weaken on recent FOMC decision days. In 2019, DXY weakened on five of the eight FOMC meeting days. Of the eight so far this year, DXY has weakened on seven of them. Stocks are a different matter this year, with the S&P rising six times and falling two times. MSCI EM has a record of five gains and three losses, while MSCI EM FX has fared slightly better with six gains and three losses. We believe the dollar’s recent bounce is due largely to positioning, safe haven demand, and the worsening virus situation in Europe. Fundamentally speaking, the US outlook has gotten worse with the continued rise in viral infections. At this point, the US seems more likely than Europe to fall behind the curve in containing the second wave, and this is yet to be priced in. The inability of Congress to pass another round of stimulus only complicates matters, possibly shifting the burden of adjustment to the Fed. We expect the Fed to deliver a dovish hold this week that underscores why investors should not be counting on a stronger dollar in Q4. A clean break below the 92.50 area is needed to set up a test of the September 1 low near 91.746. Similarly, the euro needs to break above the $1.1910 area to set up a test of its recent high near $1.2010. |

Dollar Performance, 2020 |

| Why do we remain negative on the dollar? We note that the dollar typically does poorly at the onset of each round of QE before eventually recovering. Looking back to the financial crisis, the Fed first started Quantitative Easing (QE) in November 2008 when it announced plans to purchase $600 bln of agency mortgage-backed securities (MBS). DXY fell around 12% over the next month but then recovered to trade even higher by March 2009. QE1 was extended in March 2009 with another round of agency MBS purchases worth $750 bln as well as $300 bln worth of longer-dated US Treasuries. DXY fell around 17% over the next eight months but then recovered nearly all its losses by June 2010.

This time around, the Fed announced unlimited QE on Monday March 23. It’s not a coincidence that the dollar peaked the previous Friday, with DXY putting in a cyclical top near 103. Since then, DXY has fallen nearly 10%. The euro bottomed on March 23 near $1.0635 and has since climbed nearly 10%. Sterling had done even better, climbing nearly 15% from its March 20 low near $1.1410. |

FOMC Asset |

What usually turns the dollar around after subsequent bouts of QE is the recovery in the US economy. We are not getting that now due to our failure to control the virus that has kept large swathes of the country from fully reopening. If and when the virus is under control, that is when the economy (and the dollar) could stage a sustainable recovery. But we are nowhere near that yet.

Tags: Articles,developed markets,Featured,newsletter