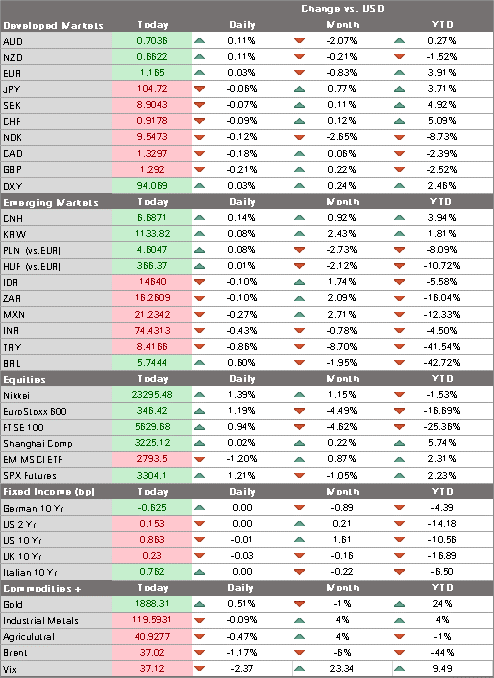

Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week The outlook for the virus in Europe continues to worsen; eurozone reported firmer final October manufacturing PMI readings; there appears to have been some progress made in Brexit talks Japan reported firmer data; Caixin China manufacturing PMI came in slightly higher than expected at 53.6 in October Oil prices continue their rapid decline due to both

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges

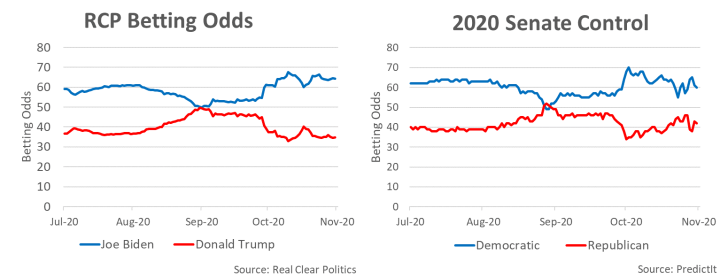

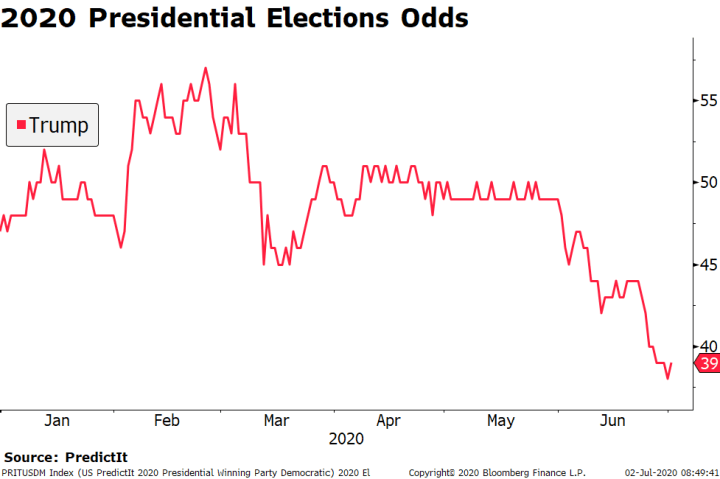

- This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week

- The outlook for the virus in Europe continues to worsen; eurozone reported firmer final October manufacturing PMI readings; there appears to have been some progress made in Brexit talks

- Japan reported firmer data; Caixin China manufacturing PMI came in slightly higher than expected at 53.6 in October

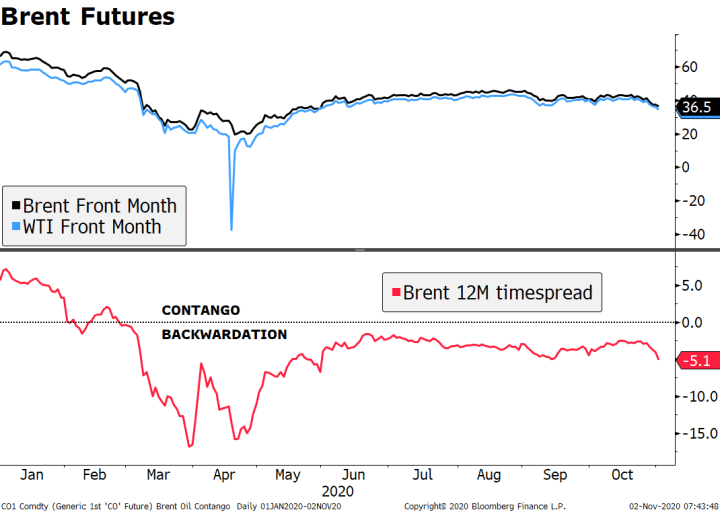

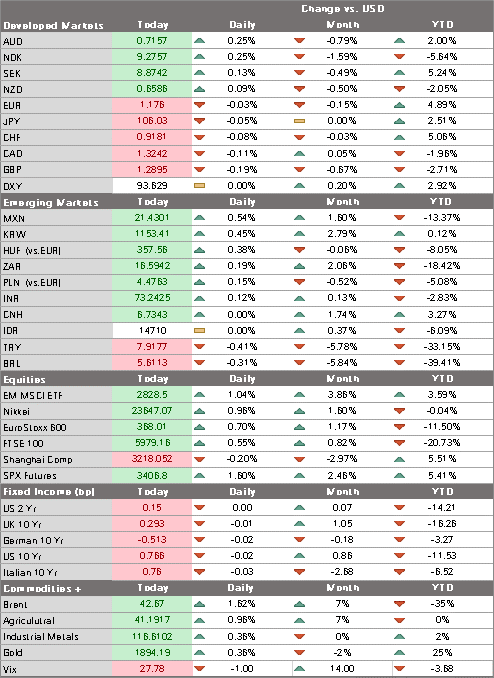

| Oil prices continue their rapid decline due to both supply and demand concerns. Libya’s output has been rising faster than expected to 800K bpd, compared to just 100K bpd a couple of months ago. On the margin, some have been speculating that a Biden presidency (and especially a Democratic blue wave) could bring about a chance in policy towards Iran allowing the now heavily sanctioned country to increase supply. The demand side story is obvious: lockdowns in Europe and fears of eventual harder measures in the US. Consistently, crude futures curves have become increasingly inverted (backwardated). While there is no fighting the short-term trend, we fear that the sector will become critically under-invested leading to an eventually supply shock down the line.

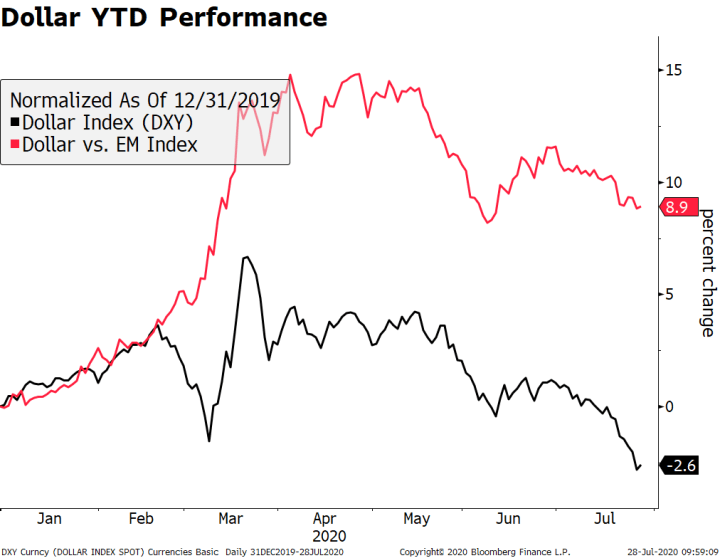

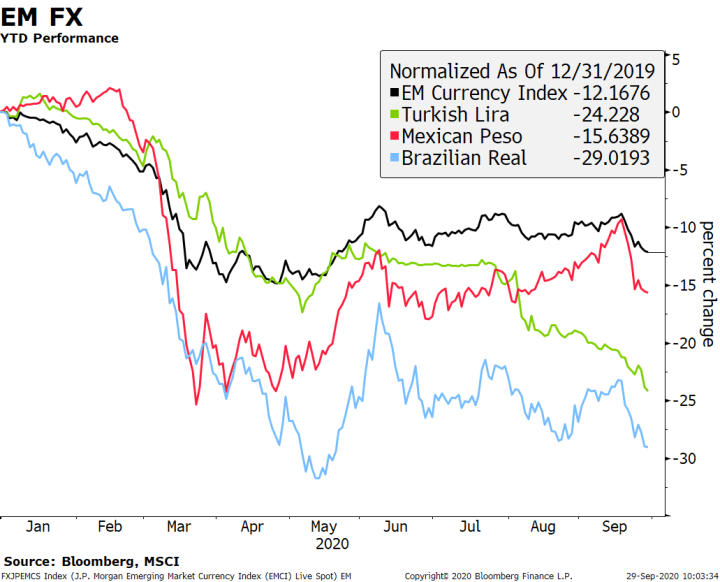

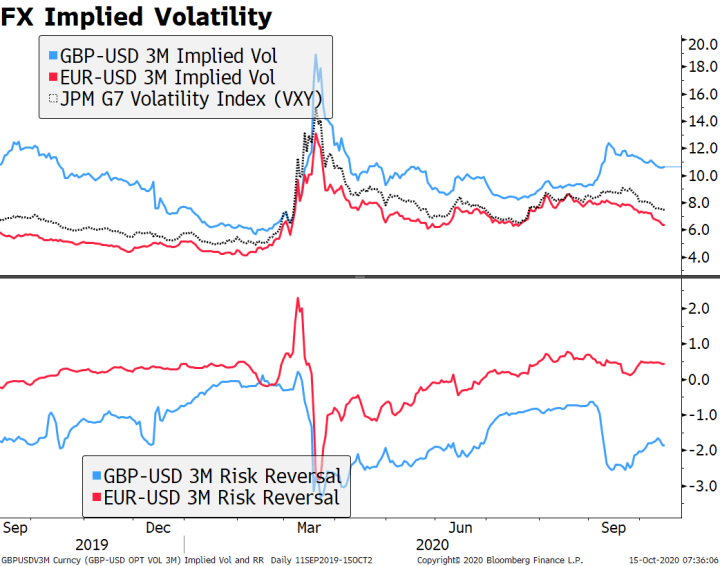

The dollar is trading at the top end of recent trading ranges. Still, DXY has been unable to break much above the 94 area and the ongoing lack of a large-scale move higher in the dollar in the midst of this week’s risk-off environment is telling. With DXY likely capped around 94, the euro is likely to see strong near-term support near $1.16. Sterling should be helped by the positive Brexit vibe, while USD/JPY has been unable to break above the 105 area. If dollar weakness picks up again as we expect, the pair should move back towards 104. While directional bets are going to be trick this week, most are prepared for greater volatility across all markets. |

Brent Futures, 2020 |

| AMERICAS

This is one of the most eventful weeks for the markets in recent memory. US elections, an FOMC meeting, and October jobs data will likely ensure that markets remain volatile. The election outcome will probably be the biggest driver near-term for risk assets, with rising virus numbers and widening lockdowns a close second. Yet looking through the potential noise and volatility, we must reiterate what we perceive to be the true signals. To us, that includes (but is not limited to) limited potential for US fiscal stimulus until 2021, an ultra-dovish Fed, a softening US economic outlook, and rising virus numbers that are leading to lockdowns globally. These main drivers still support our weak dollar call extending well into Q1. With nearly 100 million ballots already cast as we stand one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks. Biden’s implied odds are still around 65%, according to betting markets, while the odds for a Democratic victory in the Senate are hovering about 60%. Real Clear Politics’ average poll spread stands at 7.2 ppts, which is considerably narrower than the mid-October level (around 10 ppts), but still far more comfortable than Clinton’s advantage at this juncture in 2016. The polling error would have to be even larger this time around, which we find highly unlikely. It is also worth repeating that pollsters have adjusted their models to try and eliminate the skew that undercounted white non-college educated voters that were the key to Trump’s 2016 victory. That said, this is an unusual election cycle to say the least, meaning that no one should feel too confident about their forecasts. We certainly don’t, though our base case is for a Blue Wave. Ahead of the weekend, the Fed announced that it was lowering the minimum loan amount for its Main Street Program to $100k from $250k previously. This isn’t the first time that the Fed has tweaked its lending and liquidity programs just days before an FOMC. The move just underscores that the Fed is not constrained by the calendar and will act whenever it sees a need. That said, we don’t think this moves the needle much in terms of stimulus. Nor does it necessarily imply that the Fed is going to add other stimulus at this week’s FOMC meeting. We expect the Fed to deliver a dovish hold Wednesday. October ISM manufacturing PMI will start the ball rolling for a key US data week. It is expected to rise to 55.8 from 55.4 in September. Final Markit manufacturing PMI and September construction spending will also be reported today. Canada reports October Markit manufacturing PMI. Ivey PMI, which covers the entire economy, will be reported Friday. |

RCP Betting Odds / 2020 Senate Control |

| EUROPE/MIDDLE EAST/AFRICA

The outlook for the virus in Europe continues to worsen. Between greater infection and hospitalization rates and rising political backlash against lockdown measures, Europe is clearly moving in the wrong direction. Clashes across several Spanish cities intensified over the weekend in reaction to Prime Minister Sanchez’ decision to extend the country’s state of emergency for six months. Portugal’s government imposed a partial lockdown starting Wednesday, impacting about 70% of the population. In line with the Second Wave pattern, Portugal’s measures won’t be as heavy handed, and schools will remain open. Greece will enact similar measures. Because Europe was able to do limit the virus before, we have confidence that it can do so again. However, the protests complicate the situation. Eurozone reported firmer final October manufacturing PMI readings. The headline PMI rose to 54.8 from the 54.4 flash reading. Both German and France improved from their flash readings to 58.2 and 51.3, respectively, while Italy and Spain improved from September to 53.8 and 52.5, respectively. Final services and composite PMI readings will be reported Wednesday and are expected to show weakness given the widening lockdowns across Europe. There appears to have been some progress in Brexit talks. It’s impossible to say whether this will lead to a substantial deal or not, but we think the odds for our base-case “skinny” or “skeleton” deal is rising. This would mean a more favorable tariff regime than a no-deal scenario and, more importantly, it would provide a platform to build on for further improvement after both sides take home the necessary face-saving headlines. Recent headlines suggest that the fishing dispute appears to be going away soon, and there were some encouraging comments about the level playing field issue. Talks were held over the weekend and will continue Monday. Elsewhere, UK final October manufacturing PMI rose to 53.7 from 53.3 preliminary. Final services and composite PMI readings will be reported Wednesday and here too are expected to worsen due to lockdowns. ASIA Japan reported firmer data. Final October manufacturing PMI rose to 48.7 from 48.0 preliminary, while October auto sales jumped 31.6% y/y vs.-15.6% in September. This was the fastest growth in over eight years but warrants a note of caution. Just as high base effects from last September dampened y/y comparisons in Q3, low base effects should boost y/y rates in Q4. This distortion came as consumers tried to front run their spending ahead of the October 2019 consumption tax hike. Prime Minister Suga reiterated that the economic situation remains severe but noted signs of recovery. Caixin China manufacturing PMI came in slightly higher than expected at 53.6 in October, up from 53.0 in September. A weaker reading in the new export orders sub-index suggest external demand headwinds to come, as one would expect. China reports October trade and foreign reserves data this coming weekend. Exports are expected to rise 8.5% y/y and imports by 7.4% y/y. The question now is how fast the country can rebalance towards domestic demand as much of the developed western world re-enters lockdowns. |

Tags: Articles,Daily News,Featured,newsletter