One sure way to identify a system “optimized for failure” is if all the insiders are absolutely confident the system is “optimized for my success”. I often discuss optimization here because it offers an insightful window into how systems become fragile and break down. When we optimize something, we’re aiming to get the most bang for our buck: maximize our efficiency, profit, productivity, etc., while minimizing our costs. To maximize our goal, whatever it is–profits,...

Read More »A Dimly Lit Thanksgiving

Our overweening faith and confidence in our wealth and power make this a dimly lit Thanksgiving. A public expression of gratitude by victorious sports stars, lottery winners, etc. is now the convention in America: coaches, teammates, family and mentors (or agents) are recognized as an expression of the winners’ humility and gratitude for everyone that contributed to the success. As sincere as each individual’s gratitude may be, there’s something forced and phony...

Read More »Dollar Weakness Resumes as Short-Covering Fades

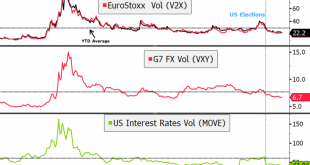

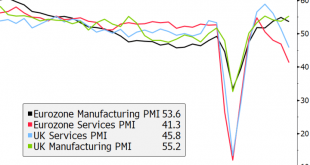

Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings German IFO Business Climate survey for November was mixed; UK national lockdown will end next...

Read More »Dollar Weakness Resumes as Markets Start Another Week in Risk-On Mode

Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising President-elect Biden has reportedly picked his diplomatic team; it’s a...

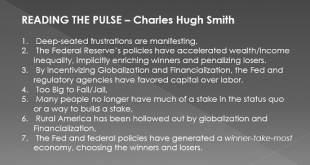

Read More »Our Frustrations Run Far Deeper Than Covid Lockdowns

The reality is the roulette wheel is rigged and only chumps believe it’s a fair game.It’s easy to lay America’s visible frustrations at the feet of Covid lockdowns or political polarization, but this conveniently ignores the real driver: systemic unfairness. The status quo has been increasingly rigged to benefit insiders and elites as the powers of central banks and governments have picked the winners (cronies, insiders, cartels and monopolies) and shifted the losses...

Read More »Why I’m Hopeful About 2021

What we need is not a return to the corrupt, tottering kleptocracy of 2019, but a re-democratization of capital, agency and money. I’m hopeful about 2021, and no, it’s not because of the vaccines or the end of lockdowns or anything related to Covid. The status quo is cheering the fantasy that we’ll soon return to the debt-soaked glory days of 2019 when everything was peachy. The problem with this “brand” of magical thinking is that stripped of self-serving PR, the...

Read More »EM Preview for the Week Ahead

Most EM currencies were up last week, once again taking advantage of broad dollar weakness. In addition, EM equities also performed well, with MSCI EM up for the third week in a row and for seven of the past eight. We expect EM assets to continue benefiting from the global liquidity story as well as the weak dollar trend. AMERICAS Brazil reports mid-November IPCA inflation Tuesday. Inflation is expected at 4.15% y/y vs. 3.52% in mid-October. If so, this would be the...

Read More »Vaccines–Too Little, Too Late?

Trust in institutions, authorities and Big Pharma is scraping the bottom of the barrel, and rushing these vaccines into mass use with extremely high expectations of efficacy is setting up the potential for a devastating loss of trust in the vaccines should they fail to live up to the claims of 100% safety and 95% effectiveness. We’re being assured by Pfizer and Moderna that their Covid vaccines are 95% effective and are safe enough to be injected into hundreds of...

Read More »Dollar Bounce Likely to Fade

The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely The row about EU funding takes center stage today as leaders hold a conference call to iron out their differences; UK CBI November industrial...

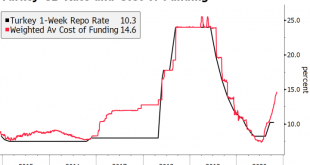

Read More »Turkey Central Bank Preview

We expect the Turkish central bank (CBRT) to deliver a substantial rate hike at Thursday’s meeting but not as aggressive as consensus. Bloomberg’s median expectation is for a 475 bp hike. Our call is for a somewhat less aggressive move (perhaps around 400 bp) because the recent price action is likely to afford the new CBRT administration the confidence not to have to surprise on the upside. We think this makes sense. A large enough move to reaffirm the change of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org