There are two forces that shape the investment climate: politics and economics, and they are both at the fore in the coming weeks.Among the highlights will be the European Central Bank meeting that will mostly likely begin its easing cycle. The Bank of Canada is a close call. If it does not cut rates in June, it will probably do so in July. The Swiss National Bank may deliver its second hike in the cycle, while the Bank of England will likely continue to prepare the ground for a cut in the second half.Four months ago, the market was still pricing in two rate cuts by the Federal Reserve by the end of the first half. While giving up on the notion, the derivatives market has one cut fully discounted late this year and almost a 50% chance of a second cut. In the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Featured, macro, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

There are two forces that shape the investment climate: politics and economics, and they are both at the fore in the coming weeks.

Among the highlights will be the European Central Bank meeting that will mostly likely begin its easing cycle. The Bank of Canada is a close call. If it does not cut rates in June, it will probably do so in July. The Swiss National Bank may deliver its second hike in the cycle, while the Bank of England will likely continue to prepare the ground for a cut in the second half.

Four months ago, the market was still pricing in two rate cuts by the Federal Reserve by the end of the first half. While giving up on the notion, the derivatives market has one cut fully discounted late this year and almost a 50% chance of a second cut. In the March Summary of Economic Projections, a closely divided central bank generated a median projection of three rate cuts this year. We suspect that the median dot may be a closer to one cut in the next iteration (June 12).

The European Parliament election will result in a new European Commission, and possibly a new EC President. The low level of support for most European governments warns of the risk of polarized voting and a general shift to the right. However, the political right in Europe seems divided between a pro-NATO/pro-EU-wing and a populist-wing. The former is the path of Italy's Meloni has taken. Current EC President von der Leyen is backed by the center right EEP, the largest party in the current parliament. There has been some speculation that former ECB President Draghi may be an acceptable compromise candidate. Still, given the challenge that a second Trump term may present to Europe, the weakness of current national leadership, Russia's aggressiveness, and the economic challenge posed by China, the period ahead argues for a strong European Commission.

Modi has led India since 2014. The results national election are expected to be announced June 4, and he is widely seen securing a third term. Modi initially targeted 400-seats (350 in 2019) in the 543-member lower legislative chamber. The shift to more divisive rhetoric in late May could be response to less favorable developments. A narrow victory for Modi's BJP could endanger his extensive reform agenda. This could see foreign investors extend the sales of Indian assets (~$5.8 bln in Q2) and weigh on the rupee. Perhaps blunting it would be the inclusion of Indian bonds in JP Morgan emerging market indices starting in June. This represents a gradual start of the India's integration into the world's capital markets. While trying to balance between Russia and the US, the nationalist Modi is well within the non-aligned tradition.

South Africa went to the polls on May 29. There are around 70 political parties and some independents competing for seats in the national parliament and nine provincial legislatures. The results will be announced in early June. The ANC has dominated South African politics for the 30 years and it appears to have lost its majority. President Ramaphosa recently introduced measures for national health care and basic income grants that would not be implement even if the ANC secures a majority until 2026. It was seen an election appeal. A coalition government with a small party or two on the left would do little to assuage investors. Exit polls show the ANC drawing a little more than 40% of the vote, which has scared investors and set the rand down more than 2% since the election. The benchmark 10-year yield has risen by about 85 bp this year to a little above 12.2%, more than a fifth came in the two days after the election. In April, South Africa's is CPI is nearly flat this year at 5.2% year-over-year. The FTSE-All Shares Index is nearly flat this year through May, surrendering almost 2.5% since the election.

Mexico holds national elections on June 2. There is little doubt that former mayor of Mexico City, and AMLO's handpicked successor Sheinbaum will become the new president of Mexico. While she is candidate of continuity, the outcome of the congressional elections will likely frame her efforts for the next three years. Three large issues must be addressed, the north and south borders, Pemex and the need to develop green energy, and navigating between foreign countries, especially China, operating in Mexico and US sensitivities. Mexico is still a poor country with GDP per capita of about $11.5k and around a third of the population is below the national poverty line.

For the first time since Q2 23, no G10 economy is contracting. Helped by a large budget deficit and a resilient consumer, the US economy continues to expand near or above trend growth. The UK and eurozone economies contracted in Q3 23 and Q4 23, but both expanded in Q1 24, and that recovery has continued in Q2. Japan's economy contracted in Q3 23 and was flat in Q4 23. The contraction in Q1 24 seems largely a function of the earthquake on January 1 and a scandal in the auto sector. Recent data lends credence to ideas that the economy is expanding again.

Australian economic activity slowed sequentially every quarter in 2023 but it remained in positive territory. Growth is expected to stabilize around 0.3%-0.4% a quarter and the market has priced out a rate cut this year. The New Zealand economy shrank in three of the four quarters last year (expanding by 0.5% in Q2 23). It is expected to have returned to the growth path in Q1 24 (June 20). The swaps market anticipates a cut toward the end of the year.

Sweden may be have been the weak link. Its economy shrank last year in the middle two quarters and stagnated in the fourth. Growth at the start of the year has been stronger than expect and Q1 GDP surprised on the upside at 0.7%. The central bank delivered its first rate cut in May. High-frequency data suggests the recovery has continued into the second quarter. The swaps market is pricing in another interest rate reduction in Q3. Norway's mainland economy contracted in the middle two quarters of 2023 but its growth in Q4 made up for it plus some with a 1.6% quarterly expansion. The economy appears to be a on stronger path now. The swaps market is not pricing in a cut this year.

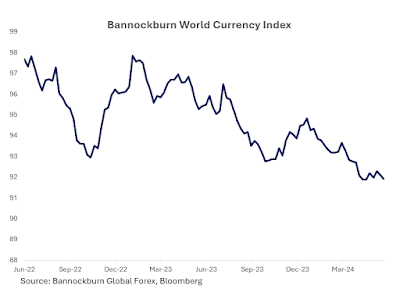

Bannockburn's World Currency Index, a basket of the currencies of the dozen largest economies (split evenly between G10 and developing economies), snapped a four-month slide. After falling to its lowest level in more than 20 years in early May, BWCI spent most of the month in a narrow trading range. We suspect a base is forming, which implies a weaker US dollar. However, it will take some time and is unlikely to be smooth. The key now seems to be evidence the US economy is slowing. The apparent resilience of the US economy and prices have seen expectations for Fed cuts this year gradually diminish. Given that several other major central banks are likely to cut at least once before the Fed moves, one is still paid to be long US dollars through the interest rate differential.

All the G10 currencies in index rose against the US dollar. The Australian dollar was the strongest, gaining about 2.6%, followed by sterling, which rose almost 2%. The yen was the weakest with its 0.4% gain. The two emerging market currencies with the highest weightings, the Chinese yuan and Indian rupee, were virtually flat in May. Together, they account for a little more than a quarter of BWCI. The net change of the South Korean won, Brazilian real, and Mexican peso were less than 1% and together they account for almost 6.5% of the index. The Russian rouble, which is not so much a market-traded currency anymore, appreciated by 3.4%, the top performer in BWCI in May.

U.S. Dollar: May was a month of

two halves for the dollar. In the first half, the downside correction against

most of the G10 currencies, but the Japanese yen, and, to some extent, the

Swiss franc, which began in mid-April extended through mid-May. Real sector

data surprised mostly on the downside and the two-year Treasury yield that

finished April above 5% fell to around 4.70% by the

middle of May. In the second half of May, hawkish Fed comments, including the May FOMC minutes, and some better-than-expected

data saw the two-year yield climb back toward 5% and the dollar recovered

broadly. Around the middle of May, the futures market had a quarter-point

cut in September nearly fully discounted. By the end of the month, it was downgraded to 60%. In mid-May, the market was still pricing in two cuts

this year. This has been downgraded to one cut and almost a 50% chance

of a second cut. While we think the US economy is gradually slowing, we suspect

the April data overstated the case and look for sequentially better economic

activity in May. At the same the May CPI will likely be a small step in the

right direction, but not sufficient to change policymakers' or investors' minds.

A 0.1% rise in May headline CPI would be the lowest monthly increase this year,

but because it also rose 0.1% in May 2023, the year-over-year print will likely

be unchanged at 3.4%. The core rate could rise by 0.3%, for the second month in

a row, after rising 0.4% each month in Q1. In May 2023, the core rate increased

by 0.4%. This suggests that year-over-year rate could tick down to 3.5% from

3.5%. The US Treasury began a buyback program where it purchases older, less

liquid issues, and replaces them later with larger new issues. The goal is improving market liquidity. Also, starting

in June, the Federal Reserve will taper its "quantitative tightening"

whereby it does not reinvestment the full amount of maturing bonds on its

balance sheet. It has been allowing as much as $60 of Treasuries a month to

roll-off. Starting in June, it will allow only $25 bln a month to mature

without being replaced. The roll-off of its Agency holdings will continue at

$35 bln a month. Although some observers have argued these two developments

will be supportive of the Treasury market, we are less sanguine and suggest that

other drivers are more important. The 10-year yield rose from about 4.30%

in mid-May but bond buyers emerged when the yield rose above 4.60% a couple of weeks later. The yield finished the month near 4.50%. .

Euro: The market has more confidence

that eurozone's economic recovery is continuing and that the European Central

Bank will deliver its first rate cut on June 6. The question is what is next.

The swaps market has scaled back the extent of the ECB's easing this year. In

early May, the market had three cuts this year discounted. Now there are two

cuts fully priced in about a 25% chance of a third. Less favorable base

effects warn of upside rise to CPI and the sum of the monthly gains this year

through May is 1.8% for an annualized rate of 4.3%. For comparison, US CPI has

rose 1.4% through April for an annualized pace of 4.2%. The ECB will update its

economic forecast. It may feel more optimistic on growth, which in March was

projected at 0.6% this year. The preliminary May CPI was 2.5%, so the ECB's

March forecast of 2.3% this year implies no meaningful further progress this

year. The US two-year premium over Germany fell from above 200 bp in late April

to below 180 bp at the end of May. Last month, we suggested a target of

$1.0870-$1.0900, which was met. We also suggested a secondary target in the

$1.0935-50 area, which has not been met. The price action underscores the important of support near $1.0785.

(As of May 31,

indicative closing prices, previous in parentheses)

Spot: $1.0850 ($1.0760) Median

Bloomberg One-month forecast: $1.0700 ($1.0830) One-month

forward: $1.0865 ($1.0800) One-month implied vol:

5.2% (5.5%)

Japanese Yen: The dollar posted

its first monthly loss of the year against the Japanese yen, but its 0.35% pullback was the least among the G10 currencies. After the material

intervention by Japanese officials to support the yen in late April and again

in early May produced an unusually large monthly range of a little below JPY152

to almost JPY158. That range was set in the first three trading days of May. Afterward

the dollar gradually climbed higher, with a notable hiccup in the middle of the

month, when the US 10-year yield dropped more 20 bp in three days after a

slight softening of US CPI. The dollar was pushing to about JPY157.70 in

late May before turning cautious. The 10-year JGB yield rose above 1.0% last for the first time since

April 2012. After contracting in Q1, a recovery is taking hold. Income tax cuts

kick-in next month, while the household energy subsidies are winding down. The

swaps market anticipates a 10 bp rate hike at the end of July BOJ meeting and

another 15 bp move in Q4. The US 10-year premium over Japan fell from about 380 bp

in late April, the year's high, to below 340 bp in mid-May before settling near

350 bp.

Spot: JPY157.30 (JPY153.00) Median

Bloomberg One-month forecast: JPY153.50 (JPY152.45) One-month

forward: JPY156.60 (JPY152.30) One-month implied vol: 8.3% (9.5%)

British Pound: Sterling's roughly 2.0% gain in May not only

snapped a four-month slide, but offset those losses in full. It is virtually unchanged since the end of last year, making it the strongest G10 currency here in 2024. The UK's Q1

growth was well above market expectations, and at 0.6% quarter-over-quarter, it

was the strongest since the end of 2021. It activity returned to levels seen prior to H2 23 contraction. This was followed by somewhat stronger than expected wage growth and

April CPI. The market flirted with the idea of a rate cut in June, but it was

not much above a 60% probability in the first part of May, and in any event, was nearly ruled

after the data. Until the CPI on May 22, the swaps market had fully

discount a cut by the end August. It is now seen as a little less than a 40% probability. The market now has the the first cut fully discounted in November. Sterling's nickel rally since the low of the year was set on April 22 stretched

daily momentum indicators. Support is seen around $1.2675. After suffering steep losses in local elections, Prime Minister Sunak

called for elections on July 4. It has not emerged as an important factor in

the foreign exchange market.

Spot: $1.2740 ($1.2545) Median Bloomberg One-month forecast: $1.2500 ($1.2520) One-month forward: $1.2745 ($1.2550) One-month implied vol: 5.8% (6.3%)

Canadian Dollar: The Canadian

dollar's 1% gain in May was its best monthly performance so far this year. Among the G10 currencies, only the yen rose by less. Often,

it seems, in a softer greenback environment, the Canadian dollar lags the other

major currencies. In April, the Bank of Canada's core measures of CPI fell into

the target range, with the rolling three-month annualized rate at its lowest

since 2021. Over the course of May, the pricing in the swaps market reflecting

a little more confidence in a quarter-point rate cut at the June 5 Bank of

Canada meeting. The market has discounted about an 80% chance of a cut, up from

around 50% at the end of April. The economy expanded by 1.7% at an

annualized rate it Q1 24, which was a little slower than expected. Moreover, the pace of growth is likely slowing below 1% here in

Q2. While the exchange rate continues to be sensitive to the broader risk

environment (using the S&P 500 as a proxy), it is more sensitive to the

general direction of the dollar. The rolling 30- and 60-day correlation of

changes of the exchange rate and the Dollar Index are above 0.80, the highest

level in at least a decade. The US dollar established a range of roughly CAD1.36 to CAD1.3750 in May, A break is significant.

Spot: CAD1.3630 (CAD 1.3685) Median Bloomberg One-month forecast: CAD1.3600 (CAD1.3635) One-month forward: CAD1.3620 (CAD1.3680) One-month implied vol: 4.9% (4.9%)

Australian Dollar: The Australian

economy appears to be growing by a steady even if not impressive 0.2%-0.3%

quarter-over-quarter. Since hiking the cash target rate last November (25 bp to

4.35%), the central bank has been content to standpat. Few seem to take very

seriously the continued reference in the minutes that a hike was discussed.

Still, since the middle of April, the swaps market has not fully discounted a

single quarter-point cut this year. At the end of May, the probability was near 10%. Improvement in the monthly CPI reading has

stalled. It reached 3.4% year-over-year in December 2023 and was 3.6% in April. If the RBA is to cut rates sooner than the futures market is

currently pricing, it seems more likely to be prompted by weakness in the labor

market than dramatic moderation in price pressures. The Australian dollar's

recovery off the year's low, set mid-April, near $0.6365, extend to almost

$0.6715 in May, a four-month high. That met a key retracement objectives of the

decline from the peak (~$0.6870) at the very end of 2023. It pulled back and the

Aussie found support a little below $0.6600.

Spot: $0.6655 ($0.6610) Median Bloomberg One-month forecast: $0.6600 ($0.6605) One-month forward: $0.66 60($0.6615) One-month implied vol: 8.2% (8.5%)

Mexican Peso: The peso continued to recover from April's flash

crash in May. It reached its best level since mid-April, with the dollar slipped a little through MXN16.53 before recovering. Mexico's 10-year government dollar bond slightly outperformed the

dollar-bond in May. Mexican stocks, on the other hand underperformed. The Bolsa fell by about 2.5%

(after a 1.1% loss in April), leaving it down around 3.6% year-to-date. The MSCI

Emerging Market equity index rose 1.1% in May and is up almost 3.5% for the year.

The moderation of inflation appears to have slowed, and coupled with the

reassessment of the trajectory of Fed policy, buys the central bank some time

before following up the March rate. Still, the stepped-up government spending

in Q2 may mask weaker economic impulses. The swaps market leans toward two cuts

in the next six months. Surveys suggest many asset managers are overweight Mexican exposure, and non-commercials (speculators) in the futures market have a large net long peso position. This leaves the peso somewhat vulnerable to risk-off swings in sentiment. However, the demand for peso has seen good buying on counter-trend pullbacks. Ironically, as Mexico has taken only one step on its monetary easing cycle, Brazil

may be done for at least several months. Brazil's central bank delivered 325 bp of cuts since last August.

After a series of 50 bp move, the cut last month was 25 bp. The swaps market

implies that the next move is more likely to be a hike. The Brazilian real was

almost flat in May (-0.20%) but snapped a four-month losing streak that tagged

it for nearly 6.5%.

Spot: MXN17.01 (MXN16.9750) Median Bloomberg One-Month forecast: MXN17.10 (MXN17.0450) One-month forward: MXN17.10 (MXN17.05) One-month implied vol: 10.5% (10.4%)

Chinese Yuan: Tension between

China and most of the rest of the world arises from three considerations. First is trade. Even

several countries in the "Global South," have taken action to protect

themselves from a deluge of Chinese products, like steel. The US announced a wide range of

tariff increases on China's EV, solar panels, and a range of other product. The

EU is expected to announce new tariffs after the new European Commission is in place. China has announced new export licensing requirements for a range of dual purpose products, including plane parts, engines, gas turbines, and bullet-proof material. In yuan terms,

China's trade balance is nearly flat in the January-April period compared with

a year ago. In dollar terms, it is slightly smaller. Second, China continues to

pursue aggressive tactics toward many of its neighbors, including Taiwan, and the

Philippines, and Japan. Beijing does not seem to understand that its actions encourage

countries to seek alliances to protect themselves. Third, US and European

officials are increasingly convinced that Beijing is providing material aid to

Russia in its war on Ukraine. Despite some improved communications and colorful photo opportunities, the relationship between the US/Europe and China remain strained. One difference between the US and Europe is that the latter seems more open to Chinese direct investment than the former. Meanwhile, China announced a new fund to

support the semiconductor industry and a new initiative to aid the property market. The central government will loan to banks to re-lend

to local governments to buy unsold houses to create affordable housing. Most

observers have concluded it is an important step in the right direction but too

small. Following the new measures, and based on the Q1 growth, in late May, the IMF revised up its forecast for Chinese growth to 5% this year, up 0.4% from the previous forecast a month earlier. Beijing estimates that the Chinese economy grew by 1.6%

quarter-over-quarter in Q1. Economic activity appears to have slowed here in Q2.

More economic reforms will likely be announced at July's Third Plenum

session. With the Federal Reserve policy being higher for longer, diverging

from China's monetary policy, downside pressure on the yuan remains. We

continue to see risk that dollar moves back into the previous trading range

(CNY7.25-CNY7.30).

Spot: CNY7.2420 (CNY7.2410) Median Bloomberg One-month forecast: CNY7.2500 (CNY7.2460) One-month forward: CNY7.1125 (CNY7.0965) One-month implied vol 4.8% (4.6%)

Tags: Featured,macro,newsletter