Some are holding out hope but we think the stimulus package remains dead; Fed releases its Beige Book report Wednesday; there is a full slate of Fed speakers this week Fed manufacturing surveys for October will continue to roll out; weekly jobless claims will be reported Thursday; BOC releases results of its Q3 Business Outlook Survey Monday Renewed virus restrictions are weighing on the economic outlook for the eurozone; no wonder ECB officials are sounding very dovish Despite all the threats and bluster, it appears that Brexit talks will continue this week; Moody’s downgraded the UK a notch to Aa3 with stable outlook ahead of the weekend; UK has another big data week Japan has a heavy data week; RBA minutes will be released Tuesday; NZ Prime Minister Ardern and

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Some are holding out hope but we think the stimulus package remains dead; Fed releases its Beige Book report Wednesday; there is a full slate of Fed speakers this week

- Fed manufacturing surveys for October will continue to roll out; weekly jobless claims will be reported Thursday; BOC releases results of its Q3 Business Outlook Survey Monday

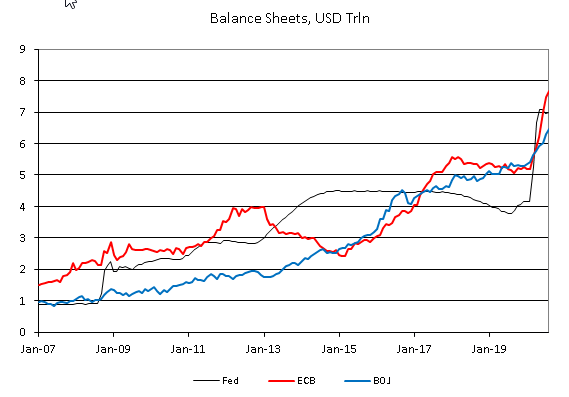

- Renewed virus restrictions are weighing on the economic outlook for the eurozone; no wonder ECB officials are sounding very dovish

- Despite all the threats and bluster, it appears that Brexit talks will continue this week; Moody’s downgraded the UK a notch to Aa3 with stable outlook ahead of the weekend; UK has another big data week

- Japan has a heavy data week; RBA minutes will be released Tuesday; NZ Prime Minister Ardern and her Labour Party easily won weekend elections

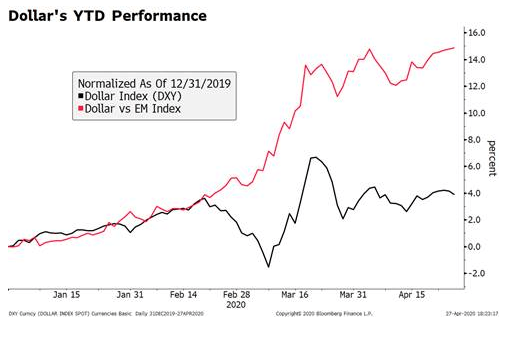

![]() The dollar is coming off a strong week but is unlikely to extend its gains. DXY traded last week at the highest level since October 2 but remains unable to breach the 94 area. Indeed, past bouts of risk-off gains have also tended to hit a brick wall around that level. With the US economic outlook softening, we feel this level will remain very tough to break and look for dollar weakness to resume. Strong China GDP data should help market sentiment recover. The euro continues to find support near $1.17, while sterling continues to see some support just below the $1.29 area as its continues to be buffeted by Brexit-related headlines. USD/JPY continues to hold above 105.

The dollar is coming off a strong week but is unlikely to extend its gains. DXY traded last week at the highest level since October 2 but remains unable to breach the 94 area. Indeed, past bouts of risk-off gains have also tended to hit a brick wall around that level. With the US economic outlook softening, we feel this level will remain very tough to break and look for dollar weakness to resume. Strong China GDP data should help market sentiment recover. The euro continues to find support near $1.17, while sterling continues to see some support just below the $1.29 area as its continues to be buffeted by Brexit-related headlines. USD/JPY continues to hold above 105.

AMERICAS

Some are holding out hope but we think the stimulus package remains dead. Treasury Secretary Mnuchin and House Speaker Pelosi reportedly spoke over the weekend, after which Pelosi gave the White House until Tuesday to come up with a comprehensive compromise. President Trump continued to claim that he can “quickly convince” Republicans to support a “good” deal. To the Democrats, good means $2.2 trln. To Trump, it means something north of $1.8 trln. To Senate Republicans, it means something around $500 bln and that is why we think a deal is ultimately unreachable. Furthermore, Mnuchin travels to Israel, Bahrain, and the UAE this week, removing a key player in stimulus negotiations.

The Fed releases its Beige Book report Wednesday. It is being prepared by for the upcoming FOMC meeting November 5. The last Beige Book report September 2 noted “Economic activity increased among most districts, but gains were generally modest and activity remained well below levels prior to the Covid-19 pandemic. Continued uncertainty and volatility related to the pandemic, and its negative effect on consumer and business activity, was a theme echoed across the country.” That report flagged uneven labor market conditions as “Some districts also reported slowing job growth and increased hiring volatility, particularly in service industries, with rising instances of furloughed workers being laid off permanently as demand remained soft.” Since the beginning of September, the labor market has stalled out and the economy has lost more momentum and so we expect a sober tone to be seen in this Beige Book.

There is a full slate of Fed speakers this week. Powell, Williams, Clarida, Kashkari, Bostic, and Harker all speak Monday. Quarles, Evans, and Bostic speak Tuesday, followed by Mester, Kashkari, and Kaplan Wednesday. The media embargo goes into effect Saturday and so we will get no more Fed speakers until Chair Powell’s post-decision press conference.

Fed manufacturing surveys for October will continue to roll out. Kansas City Fed reports Thursday and is expected to remain steady at 11. Last week, Empire survey came in at 14.0 vs. 17.0 in September while the Philly Fed came in at 14.8 vs. 15.0 in September. Markit preliminary October PMI readings will be reported Friday. Manufacturing PMI is expected to rise three ticks to 53.5 while services PMI is expected to remain steady at 54.6. These are the first broad-based snapshots for October and will help set the tone for other manufacturing data to come. Last week, September IP fell -0.6% m/m vs. +0.5% expected and manufacturing fell -0.3% vs. +0.6% expected.

Weekly jobless claims will be reported Thursday. Initial claims are expected at 865k vs. 898k the previous week, the highest reading since August. We don’t want to make too much of last week’s claims data, as we know California is still working out its distortions for another week or two. That said, the lack of another stimulus deal pretty much guarantees that the claims data will move higher and the labor market will get worse. This week’s initial claims data will be for the BLS survey week containing the 12th of the month, but even a bad number shouldn’t be over-processed. While there’s no consensus yet for the October jobs report November 6, we do expect downside risks.

Otherwise, it’s a quiet week for US data. September building permits and housing starts will be reported Tuesday and are expected to rise 2.0% m/m and 2.8% m/m, respectively. These will be followed by September existing home sales and leading index Thursday, which are expected to rise 5.0% m/m and 0.7% m/m, respectively.

Bank of Canada releases results of its Q3 Business Outlook Survey Monday. August retail sales and September CPI will be reported Wednesday. Headline sales are expected to rise 1.1% m/m vs. 0.6% in July, while ex-autos are expected to rise 0.9% m/m vs. -0.4% in July. Headline inflation is expected to rise 0.5% y/y vs. 0.1% in August, while common core is expected to rise 1.6% y/y vs. 1.5% in August. Next Bank of Canada meeting is October 28 and it is widely expected to remain on hold as it awaits more details from the government regarding fiscal stimulus.

EUROPE/MIDDLE EAST/AFRICA

Renewed virus restrictions are weighing on the economic outlook for the eurozone. Some softness is expected to be reflected in the Markit preliminary October PMI readings that will be reported Friday. Headline manufacturing PMI is expected to fall to 53.0 from 53.7 in September, services PMI is expected to fall to 47.0 from 48.0 in September, and composite PMI is expected to fall to 49.2 from 50.4 in September. If so, it would be the first sub-50 composite reading since June. Germany and France, the two largest eurozone economies, are expected to see their composite readings fall to 53.3 and 48.0, respectively. However, we know that Spain and Italy (to be reported in the final PMI readings out in early November) are also suffering.

No wonder ECB officials are sounding very dovish. Over the weekend, Madame Lagarde warned that new restrictions meant to curb the viral spread will increase uncertainty for companies and families. Also over the weekend, Executive Board member Panetta warned that new restrictions will push the economic recovery further out, while Governing Council member Knot said that the growth outlook is uncertain due to the resurgence in the virus numbers. Governing Council members Rehn warned that inflation risks are to the downside, while Visco said too early withdrawal of stimulus must be avoided. We expect more stimulus from the ECB at its December 10 meeting, when new macro projections will be released.

Despite all the threats and bluster, it appears that Brexit talks will continue this week. While some UK officials said the talks were over, top negotiators Frost and Barnier will nevertheless speak early this week. As it is, Johnson did not definitively walk away as threatened and so the door to a deal remains ajar, as Cabinet Minister Gove confirmed. EC President von der Leyen said the EU will intensify talks. Keep an eye on the Internal Market Bill as it makes its way through the House of Lords this week. Some hope that it will be watered down in an effort to help seal a Brexit deal.

Moody’s downgraded the UK a notch to Aa3 with stable outlook ahead of the weekend. The agency cited softer economic growth, an erosion of fiscal strength, and a weakening in institutions and governance as factors behind the downgrade. It added that “Even before the coronavirus-induced shock, a combination of persistently low productivity growth since the global financial crisis, tepid business investment since the June 2016 EU referendum, and prolonged uncertainty over the eventual future trading relationship with the EU were weighing on the UK’s growth performance.” Ouch. Moody’s move matches Fitch, which cut the UK a notch to AA- back in March. S&P’s AA rating stands out now and is likely to announce a downgrade at its review Friday. Our own sovereign ratings model has the UK at A-/A3 /A-currently and so deeper downgrades are warranted.

The UK has another big data week. September CPI and public sector net borrowing will be reported Wednesday. Headline inflation is expected at 0.6% y/y vs. 0.2% in August, while CPIH is expected at 0.8% y/y vs. 0.5% in August. PSNB ex-banks is expected to come in at GBP34.0 bln vs. GBP35.9 bln in August. Industrial trends for October will be reported Thursday, with orders expected at -50 vs. -48 in September and business optimism expected at -28 vs. -25 in September. September retail sales will be reported Friday along with Markit preliminary October PMI readings. Headline sales are expected to rise 0.4% m/m vs. 0.8% in August, while sales ex-auto fuel are expected to rise 0.5% m/m vbs. 0.6% in August. Headline manufacturing PMI is expected to fall to 53.0 from 54.1 in September, services PMI is expected to fall to 53.4 from 56.1 in September, and composite PMI is expected to fall to 53.8 from 56.5 in September.

ASIA

Japan has a heavy data week. September trade will be reported Monday, with exports expected to contract -2.6% y/y vs. -14.8% in August and imports expected to contract -21.5% y/y vs. -20.8% in August. September convenience store sales will be reported Tuesday, followed by supermarket sales Wednesday and department store sales Thursday. September national CPI and preliminary October PMI readings will be reported Friday. Headline inflation is expected to be flat y/y vs. 0.2% in August, while ex-fresh food is expected to remain steady at -0.4% y/y.

Reserve Bank of Australia minutes will be released Tuesday. It delivered a dovish hold at that meeting, as the language left the door open for further easing. The bank said it “continues to consider how additional monetary easing could support jobs as the economy opens up further.” A cut at the November 3 seems very likely at this point, with the futures market implying nearly a 75% chance, according to the Bloomberg WIRP model. September preliminary retail sales and leading index will be reported Wednesday. Preliminary October PMI readings will be reported Friday.

New Zealand Prime Minister Ardern and her Labour Party easily won weekend elections. With the biggest share of the vote in over 70 years at 49%, Labour won 64 out of 120 seats in parliament. This is the first outright majority won by any party since proportional representation was introduced in 1996. Labour will have to decide whether or not to include coalition ally Green Party in her government, which favors tough action on poverty and climate change. Overall, we believe continuity in fiscal policy and the pandemic response is positive for the nation’s outlook.

Tags: Articles,developed markets,Featured,newsletter