Stagnant growth and banks’ festering non-performing loan problems cast a pall over Italy’s prospects ahead of a referendum that could determine the fate of the prime minister Flat real GDP growth in Italy in the second quarter was below consensus expectations of 0.2% (quarter over quarter) and brought to an end five consecutive quarters of improving expansion. Overall, the outlook for Italy remains challenging. Assuming a pick-up in quarterly growth to 0.2% (the average since Q1 2015), the Italian economy will accelerate only slightly, according to our forecasts, from 0.7% in 2016 to 0.8% in 2017. Italian output is still 8.4% below its pre-crisis peak at the beginning of 2008 and the gap between Italy and the other major euro area economies has widened significantly. Importantly, the Italian economy still needs to tackle structural problems, in particular weak productivity.In the next few months, the focus will remain on the upcoming Senate reform referendum and on vulnerabilities in the Italian banking sector. Under the most favourable scenario, prime minister Matteo Renzi would win the referendum (possibly after a targeted fiscal stimulus package he has been hinting at has been announced) and the outlook for Italy’s banks would improve gradually over time.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Italian banks, Italian growth, Italian politics, Italian referendum, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Stagnant growth and banks’ festering non-performing loan problems cast a pall over Italy’s prospects ahead of a referendum that could determine the fate of the prime minister

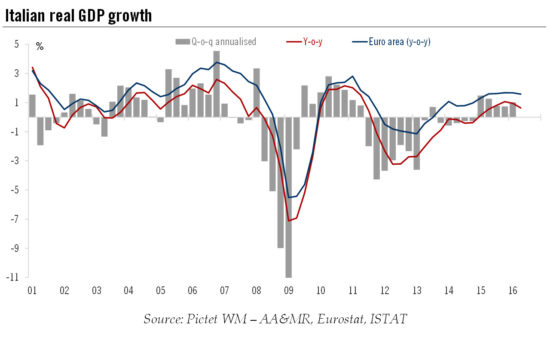

Flat real GDP growth in Italy in the second quarter was below consensus expectations of 0.2% (quarter over quarter) and brought to an end five consecutive quarters of improving expansion. Overall, the outlook for Italy remains challenging. Assuming a pick-up in quarterly growth to 0.2% (the average since Q1 2015), the Italian economy will accelerate only slightly, according to our forecasts, from 0.7% in 2016 to 0.8% in 2017. Italian output is still 8.4% below its pre-crisis peak at the beginning of 2008 and the gap between Italy and the other major euro area economies has widened significantly. Importantly, the Italian economy still needs to tackle structural problems, in particular weak productivity.

In the next few months, the focus will remain on the upcoming Senate reform referendum and on vulnerabilities in the Italian banking sector. Under the most favourable scenario, prime minister Matteo Renzi would win the referendum (possibly after a targeted fiscal stimulus package he has been hinting at has been announced) and the outlook for Italy’s banks would improve gradually over time. This may happen, provided that GDP growth remains at least slightly positive and unemployment starts to fall as rapidly as in other countries.

Under an alternative scenario, Italy could be confronted with a political crisis and/or a sustained economic slowdown that would jeopardise the recent stabilisation in banks’ non-performing loans. Renewed market pressures would then likely force the government to announce a more broad-based fix to the banking sector.

A rational and optimal fix of the Italian banking system would likely include the realisation of losses and system-wide recapitalisations. The reason why this fix has not happened is that a strict application of EU rules would force more bail-ins of shareholders and creditors. When creditors of four small banks had to bear losses in a public rescue in late 2015, Renzi faced significant public opposition. This opposition would only be worse if it involved larger banks and depositors.

Still, we are ruling out a systemic sovereign crisis in Italy as European Central Bank measures continue to benefit Italy, keeping borrowing costs in check.