The latest data releases from China point to a sluggish start to the second half of 2016, but we are sticking to our 2016 growth forecast of 6.5%. Economic data released by China’s National Bureau of Statistics on 12 August remain largely consistent with our expectation of moderating growth momentum in China. Especially noteworthy has been the drop in fixed asset investment (FAI) growth. Going forward, we expect a further slowdown in property investment to be offset by fiscal support for infrastructure investment so that, for the moment, we remain comfortable with our GDP growth forecast of 6.5% for China in 2016.FAI in the first seven months of 2016 rose by 8.1% compared with the same period last year, down from 9% in the first six months. While we had expected a decline in FAI growth, its magnitude was greater than we thought. We believe the particularly sharp drop in FAI in July may be partly attributed to serious floods in southern China and exceptionally hot weather.The slowdown in FAI growth was essentially attributable to property and infrastructure investment. China’s property market had rebounded strongly since late 2015, when the government relaxed policy to encourage demand.

Topics:

Dong Chen considers the following as important: Chinese data, Chinese fixed asset investment, Chinese growth, Chinese property investment, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest data releases from China point to a sluggish start to the second half of 2016, but we are sticking to our 2016 growth forecast of 6.5%.

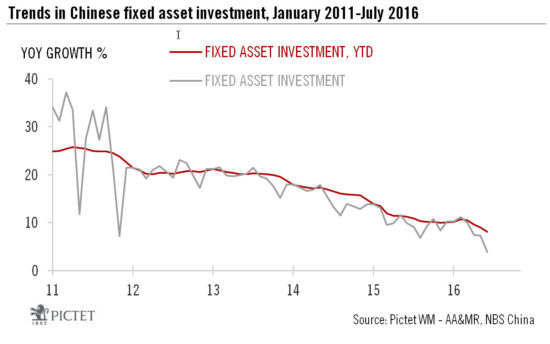

Economic data released by China’s National Bureau of Statistics on 12 August remain largely consistent with our expectation of moderating growth momentum in China. Especially noteworthy has been the drop in fixed asset investment (FAI) growth. Going forward, we expect a further slowdown in property investment to be offset by fiscal support for infrastructure investment so that, for the moment, we remain comfortable with our GDP growth forecast of 6.5% for China in 2016.

FAI in the first seven months of 2016 rose by 8.1% compared with the same period last year, down from 9% in the first six months. While we had expected a decline in FAI growth, its magnitude was greater than we thought. We believe the particularly sharp drop in FAI in July may be partly attributed to serious floods in southern China and exceptionally hot weather.

The slowdown in FAI growth was essentially attributable to property and infrastructure investment. China’s property market had rebounded strongly since late 2015, when the government relaxed policy to encourage demand. The resultant surge in home prices, especially in first-tier cities , has raised concerns of asset bubbles, and some local governments are considering the re-introduction of measures to curb home prices. We therefore expect property investment growth to decline further in the months ahead.

Industrial production and retail sales in China were relatively stable in July, while there were mixed signals from external trade. Growth in industrial production (IP) edged down slightly to a year-on-year rate of 6.0% in July from 6.2% in June, while growth in IP in the six months of 2016 overall was 6.0%. Retail sales growth also declined slightly in July, but remained largely stable at around the 10% mark, where it has been since the beginning of this year. Sales in rural areas continued to outstrip sales in urban centres, reflecting stronger rural income growth.

International trade data released earlier this week show that Chinese exports are still sluggish, although there were some signs of improvement due to favourable base effects. Thus, the year-on-year drop in imports to the US from China fell to -2% in July from -11% in the previous month. Demand from Europe was fairly stable in July, but exports to Japan and ASEAN economies continued to disappoint.