Political risks never completely disappear from the European landscape, but we are not convinced that the US elections have materially increased the odds of another populist ‘accident’ in the euro area.While the Italian referendum is the most obvious near-term risk, we see extremely low chances of a nationalist, anti-European party winning a major election next year or holding a legally-binding referendum on EU/EMU membership. Apart from any other consideration, electoral processes are too...

Read More »Referendum at heart of Italian uncertainties

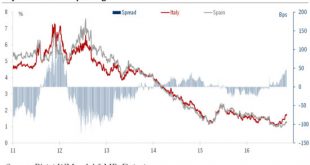

A ‘No’ vote in the 4 December referendum would be seen as a negative by investors in Italy, adding to the challenges the country must face.The 4 December referendum on senate reform is the next big event on the European political calendar, coming just ahead of the next ECB and Fed policy meetings on 8 December and 14 December, respectively.We believe a ‘Yes’ vote would boost government confidence and marginally help Italian securities, but is unlikely to represent a significant game changer...

Read More »Growth, banks and politics in Italy

Stagnant growth and banks’ festering non-performing loan problems cast a pall over Italy’s prospects ahead of a referendum that could determine the fate of the prime minister Flat real GDP growth in Italy in the second quarter was below consensus expectations of 0.2% (quarter over quarter) and brought to an end five consecutive quarters of improving expansion. Overall, the outlook for Italy remains challenging. Assuming a pick-up in quarterly growth to 0.2% (the average since Q1 2015), the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org