– Yahoo admits every single one of 3 billion accounts hacked in 2013 data theft– Equifax hacking and security breach exposes half of the U.S. population– Some 143 million people vulnerable to identity theft– Deloitte hack compromised sensitive emails and client data– JP Morgan hacked and New York Fed hacked and robbed– International hacking group steals $300 million– Global digital banking and financial system not...

Read More »Emerging Markets: What has Changed

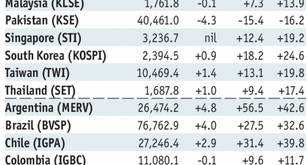

Stock Markets In the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%. In the EM local currency bond space, Argentina (10-year yield -13 bp), Nigeria (-5 bp), and Thailand (-4 bp) have...

Read More »FX Daily, October 6: Look Through the US Jobs Report

Swiss Franc The Euro has risen by 0.27% to 1.1485 CHF. EUR-CHF and USD-CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that...

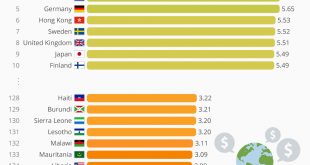

Read More »Switzerland Tops World’s Most Competitive Countries Index (Yemen Least)

Something else ‘Murica is no longer #1 in… A recently released World Economic Forum report has found that the global economy is recovering well nearly a decade on from the start of the global financial crisis with GDP growth hitting 3.5 percent in 2017. The eurozone in particular is regaining traction with 1.9 percent growth expected this year. As Statista’s Niall McCarthy points out, the improvement in...

Read More »Thoughtful Disagreement with Ted Butler

Too Big to Fail? Dear Mr. Butler, in your article of 2 October, entitled Thoughtful Disagreement, you say: “Someone will come up with the thoughtful disagreement that makes the body of my premise invalid or the price of silver will validate the premise by exploding.” Back in the late 90s this was actually a fairly well-timed case, as silver eventually rose from a low of around $4 in 2000/2001 to a high of almost $50...

Read More »Surprise! The Rules Will Change (But Not to Your Benefit)

These expedient fixes end up crippling the mechanisms that are needed to actually solve the systemic sources of the crisis. We can add a third certainty to the two standard ones (death and taxes): The rules will suddenly change when a financial crisis strikes. Why is this a certainty? The answer is complex, as it draws on human nature, politics and the structure of societies/economies ruled by centralized states...

Read More »Sterling Unwinds Most of BOE-Inspired Gains, but Rates Market Does Not

Summary: Sterling has given up 50% of the gains score since late August’s lows. Rate hike expectations are running high. Speculative market positioning has adjusted, and for the first time in a couple of years, speculators in the futures market are net long. Sterling peaked on September 20 near $1.3660. It traded to nearly $1.3220 today. It has fallen in nine of the past dozen sessions. The main culprits are...

Read More »Run On The Pound? Jeremy Corbyn Says Should Plan For

Run On The Pound ? Jeremy Corbyn Says Should Plan For – Right to plan for ‘run on pound’ if Labour wins says Corbyn and Labour party – British pound already down 20% since Brexit, collapse already in play– Run on the pound likely due to Labour’s ‘command economy’ approach– Collapse in Sterling would undermine UK financial system– Portfolios holding sterling and related assets would be significantly affected– Pension...

Read More »Zerohedge, Charles Hugh Smith, Inflation is most likely 7% and wages are stagnant.

♞ Charles Hugh Smith – TBuried In The Fed’s Report It Reveals The Truth About The Economy ♘

'News Brief' Report date: 10.05.2017 Guest: Charles Hugh Smith Books: Why Our Status Quo Failed and Is Beyond Reform Get a Job, Build a Real Career... Why Things Are Falling Apart and What We Can Do About It A Radically Beneficial World Most of artwork that are included with these videos have been created by FP&FA and they are used as a representation of the subject matter. The representative artwork included with these videos shall not be construed as the actual events that are...

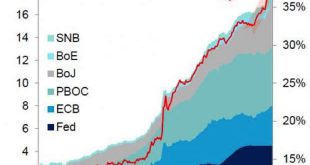

Read More » SNB & CHF

SNB & CHF