– Bitcoin price action shows cryptos vulnerable to commentary and government policies– Bitcoin falls to low of ,980, down by ,000 in week as China flexes muscles– Volatility major issue: In 3 days btc fell 40% before bouncing 25% off lows– BIS state risks of cryptos cannot yet be fully assessed and says technology still unproven– Apple and Google developing a payment API for cryptos – may give governments full oversight– Bitcoin and cryptos current volatility and exposure to governments underlines gold’s safe haven status Bitcoin Price in USD, 12 September(see more posts on Bitcoin, ) - Click to enlarge Governments will soon want in Currently bitcoin and cryptocurrencies are being seen as the new tech guys,

Topics:

Jan Skoyles considers the following as important: Bitcoin, Daily Market Update, Featured, GBP/USD, GoldCore, newslettersent

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| – Bitcoin price action shows cryptos vulnerable to commentary and government policies – Bitcoin falls to low of $2,980, down by $1,000 in week as China flexes muscles – Volatility major issue: In 3 days btc fell 40% before bouncing 25% off lows – BIS state risks of cryptos cannot yet be fully assessed and says technology still unproven – Apple and Google developing a payment API for cryptos – may give governments full oversight – Bitcoin and cryptos current volatility and exposure to governments underlines gold’s safe haven status |

Bitcoin Price in USD, 12 September(see more posts on Bitcoin, ) |

| Governments will soon want in

Currently bitcoin and cryptocurrencies are being seen as the new tech guys, like those in Silicon Valley before them they are breaking new ground and challenging our thoughts and government policies over something we thought was long past debate. For Silicon Valley they challenged how we communicate, for bitcoin etc its what money is and how we use it. But the pioneers might not last long. Over the weekend One River Asset Management’s Eric Peters outlined his biggest concern when it comes to cryptocurrencies:

This may seem an extreme viewpoint but reality shows he might not be far off. Last week the World Wide Web Consortium (W3C) with the help of Microsoft, Google, Facebook, Apple and Mozilla, announced work on the Payment Request API. |

|

| Gold proves itself once againVolatility, cyber-attacks and investment fraud are just some of the concerns regarding the bitcoin community. Add to that the new possibility that governments could have oversight into your crypto spending then it all seems even less appealing.

Gold is all too often compared to bitcoin. The latter is frequently called the new gold. For many, the surge in the bitcoin price has been to the detriment of the gold price. In truth, they may ultimately end up being complementary assets. For now, the new kid on the block is far from being able to offer the same qualities that we see in gold. When you buy physical, segregated gold you cannot link it to an API which may or may not expose it to hackers or government’s sticky fingers. When you buy gold bullion or coins you can be careful not to invest in something that exposes you to a big pile of hot air and fraud. Finally, gold is not a volatile currency. It does not react like a toddler when a government makes an announcement. Governments are not paranoid about gold and the possibility that it puts investors’ money at risks. Governments already own gold, they understand it. Gold has been around for millennia and its role is far past debate. This last week, in fact the last year, serves as an important reminder that the shiniest and safest asset might not be the newest one and that investors should look for the calm amongst the storm. |

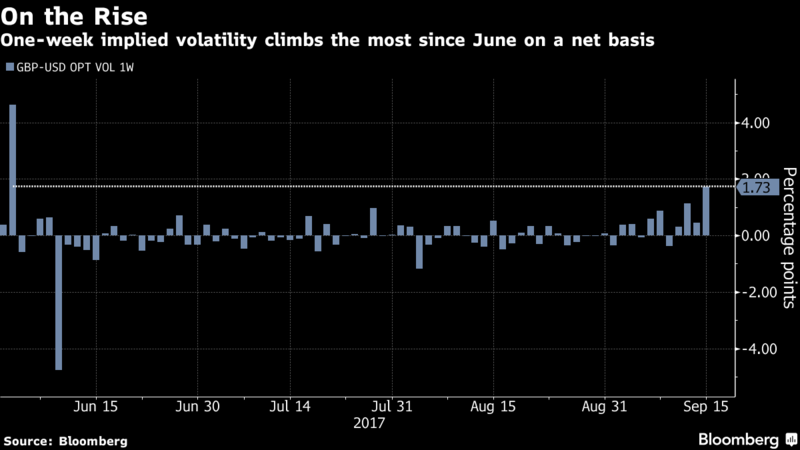

GBP/USD, Jun - Sep 2017(see more posts on GBP/USD, ) |

Courtesy of CoinDesk

Even for bitcoin last week was an eventful week. The price hit a recent low of $2,980, falling 40% and recovering by nearly 25% in the space of three days.

Last week was a good example of the vulnerabilities in the cryptocurrency space to government announcements regarding the infrastructure the ecosystem.

This last year has seen unprecedented progress and development in the bitcoin and crypto arena. From the price reaching new highs to an explosion in Initial Coin Offerings.

The fall in price by over $1,000 should serve as a reminder that markets will stumble when they try to run before they can walk. As much as early adopters like to declare bitcoin the new currency and declare is true safe haven, the last week has shown that gold is a far better long-term safe haven.

Government meddling

Reasons for bitcoin’s (and other cryptos’) fall last week was mainly thanks to further crackdowns on bitcoin exchanges by the Chinese government. On Thursday bitcoin fell 16% against the U.S. dollar as the Chinese announced they were closer to shutting down cryptocurrency exchanges.

This week commentators believe crypto traders have now priced in the negative news from the East, however last week’s performance was yet another example of how vulnerable bitcoin still is to government announcements.

This weekend and this morning the price has begun to recover following a report from the Bank of International Settlements.

The BIS report said central banks needed to carefully consider their approach to the cryptocurrency markets.

“Central banks will have to consider not only consumer preferences for privacy and possible efficiency gains — in terms of payments, clearing and settlements — but also the risks it may entail for the financial system and the wider economy, as well as any implications for monetary policy,”

For many in the crypto space this was further validation for the likes of bitcoin etc. Whilst the BIS did not give their backing to central banks’ involvement in blockchain currencies it was an acknowledgement of them and the need for the authorities to find a way to deal with them.

Risks were at the forefront of the BIS’ minds, with cyber-attacks being the most obvious cause for concern.

“Some of the risks are currently hard to assess,” the report stated, given how little is known about the impact of cyber-attacks and their resilience.

This was yet another cautionary report from a leading monetary authority. The BIS and the Chinese regulators are just the most recent bodies to publish their concerns.

We recently covered the issue of ICOs. A primary concern for many governments. ICOs are encouraging misinformed investors to jump on the tails of the crypto boom and sometimes put money into ventures that are extremely high risk .

We expect further words of warning between now and the end of the year. In the coming weeks the UAE government are also expected to issue their thoughts on cryptocurrencies.

It will be interesting to see how the volatility plays out with each new decision from higher authorities. In the mean time, the tech community may even be working with governments to make sure they are happy with the infrastructure that supports bitcoin.

The new API will sit in browsers and allow ‘new payment types, including bitcoin, ether any any other available cryptocurrency (as well as more traditional online payment methods) to be stored directly in the browser.’

Given all code developed in the U.S. is subject to government intelligence oversight users might want to be wary about using such a payment method. This could be an early step that allows third-party access to your transactions and possibly your online wallet. Confiscation and theft spring to mind.

Tags: Bitcoin,Daily Market Update,Featured,GBP/USD,newslettersent