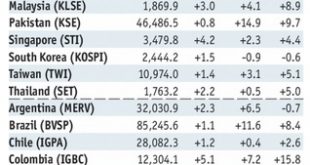

Stock Markets EM FX was mixed Friday, capping a mixed week as a whole. COP, CLP, and MXN were the best performers last week, while RUB, BRL, and TRY were the worst. While concerns about trade wars and Syrian missile strikes have ebbed, risks to EM remain elevated. US retail sales Monday and Fed Beige Book Wednesday are the economic highlights this week. Stock Markets Emerging Markets, April 11 Source:...

Read More »Motocraft coaching session and debrief With Mark O’Byrne

One of our guests, Anthony Planz works with Motocraft coach Mark O'Byrne at Circuit Monteblanco i April 2018 Full on-circuit session followed by video debrief - Debrief starts at 6:15

Read More »“Swissleaks” author arrested in Spain at Switzerland’s request

Hervé Falciani – source: Wikipedia - Click to enlarge According to Tribune de Genève, Hervé Falciani was arrested in Madrid last week at Switzerland’s request. In 2008, Falciani a French-Italian who grew up in Monaco, took confidential information from the Geneva offices of HSBC, his employer, and fled to Lebanon where some claim he attempted to sell it. Later he shared the information with authorities in France and...

Read More »Great Graphic: Loonie Takes Big Step toward Technical Objective

Summary: USD has been carving out a head and shoulders pattern against the Canadian dollar. The neckline was retested yesterday and the follow-through selling materialized today after an outside down day yesterday. The measuring objective is near CAD1.2475. For a little more than two weeks, we have been monitoring the formation of a possible head and shoulders top in the US dollar against the Canadian dollar....

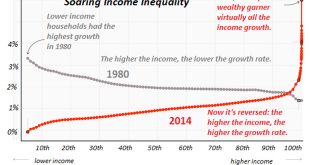

Read More »The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing

Though the Powers That Be will attempt to placate or suppress the Revolt of the Powerless, the genies of political disunity and social disorder cannot be put back in the bottle. The saying “the worm has turned” refers to the moment when the downtrodden have finally had enough, and turn on their powerful oppressors.The worms have finally turned against the privileged elites — who have benefited so greatly from...

Read More »Trump Tweets Russia “Get Ready” For Missiles In Syria – Gold, Oil Rise and Stocks Fall

– Dow set to drop 300 points at open after Trump tweet today – Stocks see sell off and gold pops to test resistance at $1,350/oz – US stock futures suggest over 1% losses at New York open – Oil surged to a two-week high and has surged nearly 7% this week – U.S. bombing Syria may provoke escalation of conflict with Russia and wider conflict in volatile Middle East - Click to enlarge President Donald Trump warned...

Read More »Monnaie pleine… ou monnaie vide?

(Crédits: Keystone) - Click to enlarge Dans cette contribution critique de l’initiative, l’auteure souligne l’insuffisance totale de gages ou richesses tangibles pour couvrir la production massive d’une «monnaie centrale». Qui doit créer notre argent: les banques privées ou la Banque nationale? Cette question, a priori simple, est en réalité abyssale. Soumise au vote le 10 juin, l’initiative «Monnaie pleine» est...

Read More »Hard data proves soft in the euro area

Euro area industrial production (excluding construction) was weak in February (-0.8% m-o-m) and follows the recent release of other disappointing pieces of hard data such as retail sales, German factory orders and trade. Based on available ‘hard’ data, real GDP growth rate in the euro area is projected to be 0.1-0.2% q-o-q in Q1 2018 (see chart below), a sharp slowdown from 0.6% q-o-q in Q4 2017. However, ‘soft’ data,...

Read More »SR Technics to cut jobs at Zurich airport

SR Technics has already shed more than 500 jobs in 2016 citing high staff costs (Keystone) - Click to enlarge Aviation support company SR Technics has announced plans to cut a net 200 jobs at Switzerland’s main airport as part of a business review. The company, which is part of China’s HNA group, announced that it could reduce its workforce in aircraft services by as many as 300 positions while adding more...

Read More »Emerging Markets: What Changed

Summary Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential...

Read More » SNB & CHF

SNB & CHF