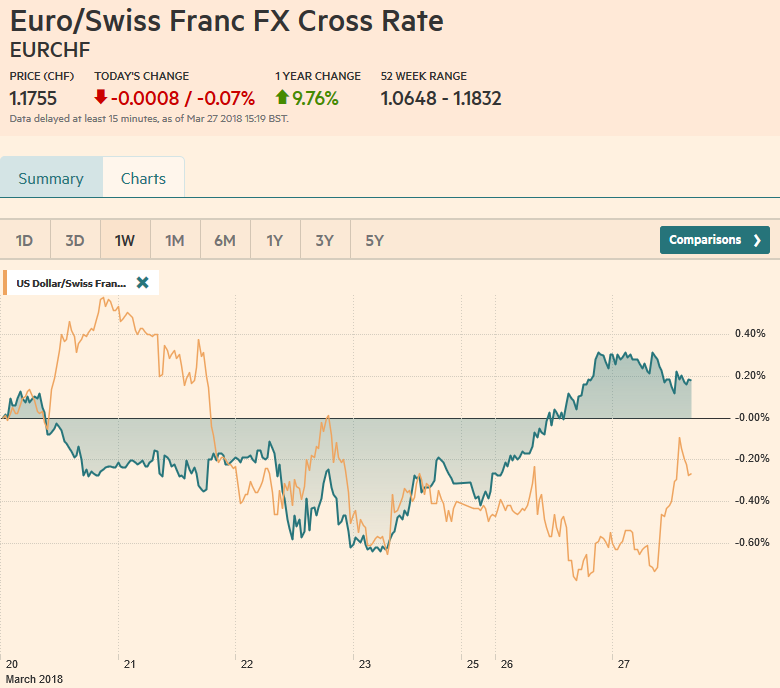

Swiss Franc The Euro has fallen by 0.07% to 1.1755 CHF. EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers and tactics with the Reagan Administration’s attempt to pry open Japanese markets. A combination of voluntary export restrictions and orderly market agreements are being unveiled, and are, contrary to the consensus not simply aimed at China. South Korea, for example, has agreed to limit it steel

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Eurozone Consumer Confidence, Eurozone M3 Money Supply, Eurozone Private Sector Loans, Featured, FX Trends, GBP, JPY, Korea, newsletter, Spain Consumer Price Index, SPY, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.07% to 1.1755 CHF. |

EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesWe argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers and tactics with the Reagan Administration’s attempt to pry open Japanese markets. A combination of voluntary export restrictions and orderly market agreements are being unveiled, and are, contrary to the consensus not simply aimed at China. South Korea, for example, has agreed to limit it steel exports to the US as part of reforming the bilateral trade deal. However, fears of a tit-for-tat trade war was the driver of the sell-off in equity markets at the end of last week. The top four steel exporters to the US last year have now been exempted from the tariffs (they account for 2/3 of the US steel imports and a little more than half of the aluminum imports). The fact that the Trump Administration is willing to declare victory with modest results suggests the “bark is worse than the bite.” |

FX Daily Rates, March 27 |

| The euro was pushed to $1.2475, its best level since the high was recorded on February 16 near $1.2555. It has reversed lower, seems to be in a consolidative mode. Initial support is seen a little below $1.2400. There is a 530 mln euro options struck at $1.2370 that expires today and another 516 mln euro option struck at $1.2470 that may mark today’s range.

The dollar posted a key reversal against the yen yesterday, by making new lows for the move before recovering and closing above the previous session high. There has been follow through buying today that lifted the greenback to JPY105.75. There are several chunk options that will be cut today. The $1.9 bln option struck at JPY105 may not be relevant, but the $834 mln option at JPY105.50 and another $425 mln struck at JPY106 may be important. Sterling made a marginal new high in Asia, edging up to almost $1.4245 before being sold heavily in the European morning. If it linked to the usual month-end or quarter-end official activity, no one apparently told Asian participants. Sterling is being sold through yesterday’s lows, setting up a possible key reversal. The close is important. Yesterday’s low was just below $1.4130, and a close below may spur some additional profit-taking. The euro continues its recovery against sterling and is gaining for the fourth consecutive session, after falling in 10 of the previous 11 sessions. |

FX Daily Rates, March 27 |

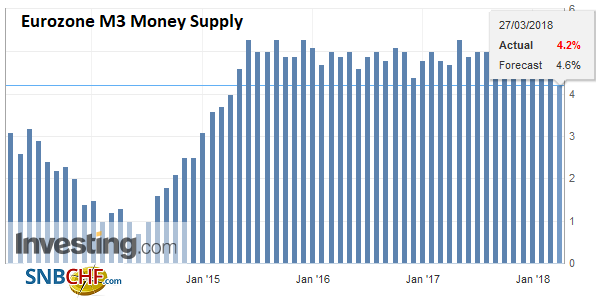

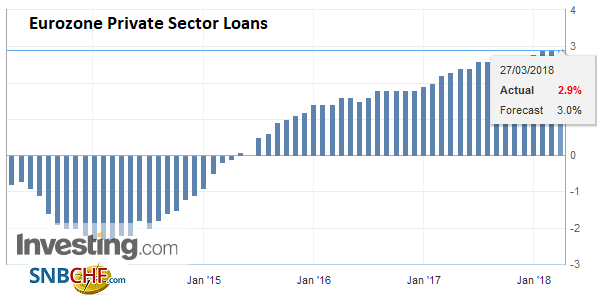

EurozoneThere is a light economic calendar today. The ECB reported money supply M3 and lending data. Money supply growth slowed to 4.2% year-over-year pace in Feb. The median had expected a growth to have stalled near 4.6%. This is the weakest M3 growth in three years. The ECB reported that bank lending also slowed in February. Lending to non-financial businesses slowed to 3.1% after 3.4% pace in January. Lending to households was unchanged at 2.9% year-over-year. |

Eurozone M3 Money Supply YoY, Mar 2013 - 2018(see more posts on Eurozone M3 Money Supply, ) Source: Investing.com - Click to enlarge |

Eurozone Private Sector Loans YoY, Mar 2013 - 2018(see more posts on Eurozone Private Sector Loans, ) Source: Investing.com - Click to enlarge |

|

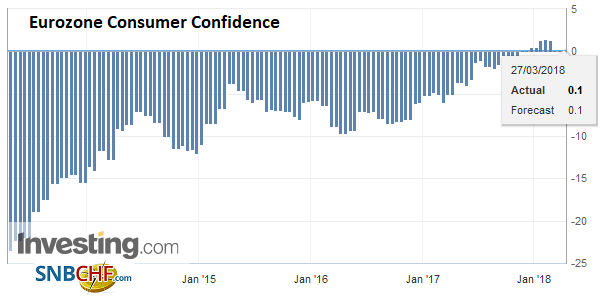

Eurozone Consumer Confidence, Apr 2013 - Mar 2018(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

|

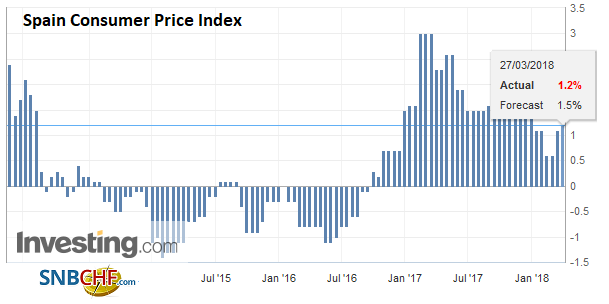

SpainThe slowing of money supply growth and lending to business is taking place in the context of several surveys (PMI, ZEW, IFO) pointing to a loss of momentum in Q1. This was echoed by today’s March confidence measures, which posted their third consecutive decline. Several EMU countries report preliminary March CPI. The month-over-month gains will likely be exaggerated by calendar effect of the early Easter. Spain was the first to report. The 1.2% rise on the month compares with forecasts of a 1.6% increase. The year-over-year rate edged up to 1.3% from 1.2%. France, Italy and Germany will also report CPI figures in the coming days, leading to the EMU report next week. On balance, the softer survey data and little progress of inflation moving toward its target pushes out expectations for a change in forward guidance until June. |

Spain Consumer Price Index (CPI) YoY, Apr 2013 - Mar 2018(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

A relief rally yesterday lifted the S&P 500 by 2.7%, the most since August 2015. That rally has lifted global equities today. The MSCI Asia Pacific Index rose 1.4%. Despite the gains it remains below the pre-weekend high. European bourses are also moving higher. The Dow Jones Stoxx 600 is 1.25% higher in late morning turnover. The breadth is healthy as all the main sectors are advancing, led by information technology, health care and materials. It has poked through the pre-weekend highs, but has only marginally surpassed yesterday’s high. US shares are trading higher and at pixel time, the S&P 500 is about 0.5% higher.

Rising equities have not weighed on the debt markets. The US 10-year yield is flat at 2.85%, while European bonds yields are a little lower. Despite concerns that Italy’s Five Star Movement is moving closer to a coalition with the nationalist Northern League is not causing Italy to underperform today. The benchmark 10-year bond yield is off 1.5 bp, about the same as Spain though more than France, and the premium over German has narrowed a bit. Italian stocks are up 1.25%, slight better than Spain’s bourse.

Outside of the continued flood of US supply ($89 bln of bills to be sold today and $35 bln five-year notes), the rally in Indian bonds is the fixed income story du jour. The Indian government announced it would sell few bonds in the next six months than expected. It will raise INR2.88 trillion (~$44.5 bln) in the first half of the fiscal year. This is a little less than half of its annual need. In past years, it front-loaded its financing and raised 60-65% in the first half.

India’s 10-year benchmark yield fell 25 bp on the news to 7.37%. The yield had risen 125 bp over the past seven months. State-owned banks, which had been significant buyers (last year they bought INR366 mln a day) have turned to the sell side this year. There are also reports suggesting that the cap on foreign purchases may be lifted.

The US dollar is firmer against all the major currencies and most of the emerging market currencies. The South Korean won is a notable exception. It gained 1% against the dollar. The yen has soared from KRW9.36 in early January to KRW10.36 yesterday, which is the strongest level in six-months, before reversing lower. The dollar briefly fell to CNY6.243, its lowest level since August 20. The greenback recovered to CNY6.285 in late dealings.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Confidence,Eurozone M3 Money Supply,Eurozone Private Sector Loans,Featured,Korea,newsletter,Spain Consumer Price Index,SPY,USD/CHF