Q4 2017 In the fourth quarter of 2017, the current account surplus amounted to CHF 20 billion, or CHF 2 billion less than the year -back quarter. Lower receipts from investment income resulted in a slight expenses surplus on primary income (labour and investment income), which had shown a receipts surplus in the corresponding quarter of 2016. Moreover, the expenses surplus on secondary income (current transfers) rose. These developments were countered by a higher income surplus in goods trade. The income surplus in services trade was unchanged. In the fourth quarter, transactions shown in the financial account resulted in a net acquisition on the assets side of the account (CHF 3 billion) and a net incurrence on the

Topics:

George Dorgan considers the following as important: Featured, newsletter, SNB, SNB Press Releases, Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account

This could be interesting, too:

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Q4 2017

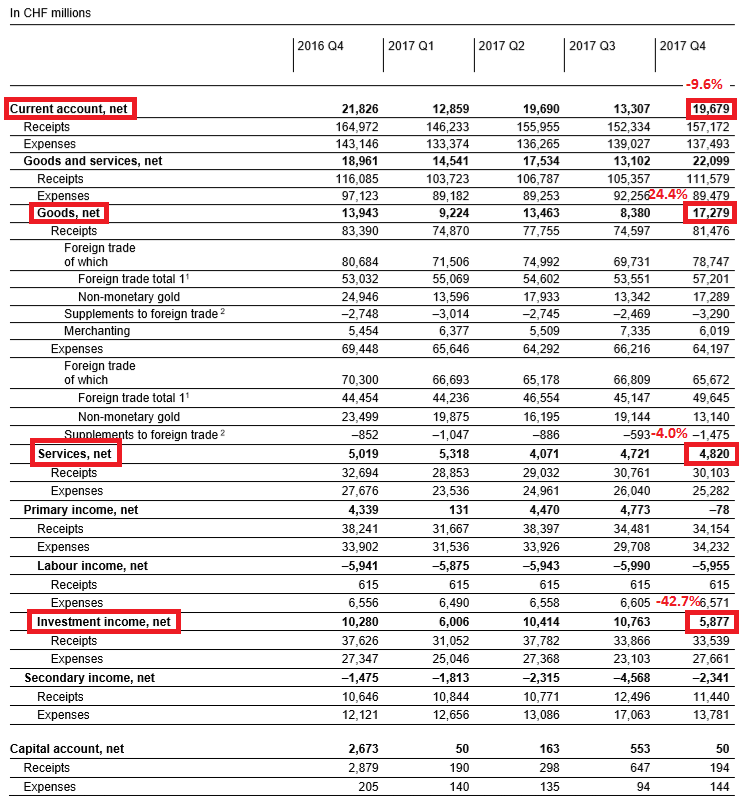

In the fourth quarter of 2017, the current account surplus amounted to CHF 20 billion, or CHF 2 billion less than the year -back quarter. Lower receipts from investment income resulted in a slight expenses surplus on primary income (labour and investment income), which had shown a receipts surplus in the corresponding quarter of 2016. Moreover, the expenses surplus on secondary income (current transfers) rose. These developments were countered by a higher income surplus in goods trade. The income surplus in services trade was unchanged.

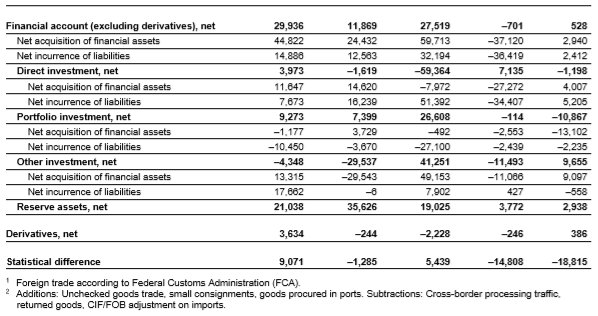

In the fourth quarter, transactions shown in the financial account resulted in a net acquisition on the assets side of the account (CHF 3 billion) and a net incurrence on the liabilities side (CHF 2 billion). On the assets side, a net acquisition was recorded under the other investment item, under direct investment and under reserve assets. By contrast, portfolio investment posted a net reduction in liabilities of CHF 13 billion. On the liabilities side, direct investment recorded a net incurrence. Meanwhile there was a net reduction in portfolio investment and the other investment item. Overall, the financial account, including derivatives, reported a positive balance of CHF 1 billion.

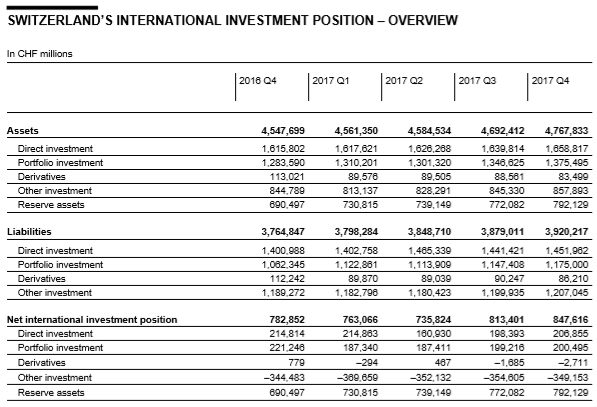

In the international investment position, stocks of financial assets increased by CHF 75 billion to CHF 4,768 billion in the fourth quarter of 2017. This increase was attributable to capital gains from stock market and exchange rate movements. Stocks of liabilities were up by CHF 41 billion to CHF 3,920 billion, also mainly as a result of capital gains from price increases on the Swiss stock exchange. Thus, the net international investment position rose by CHF 34 billion to CHF 848 billion.

Review of the year 2017

In 2017, the current account surplus amounted to CHF 66 billion, CHF 4 billion higher than in 2016. The increase was largely attributable to primary income, the receipts surplus expanded by CHF 5 billion to CHF 9 billion. This was countered by a rise in the expenses surplus for secondary income (current transfers), by CHF 1 billion to CHF 11 billion. In goods trade, the receipts surplus was unchanged at CHF 48 billion. In services trade, too, the receipts surplus remained the same, at CHF 19 billion.

The financial account showed a net acquisition of CHF 50 billion (2016: net acquisition of CHF 148 billion) and a net incurrence of CHF 11 billion (2016: net incurrence of CHF 81 billion). Thus, overall, this account, including derivatives, reported a positive balance of CHF 37 billion (2016: CHF 74 billion). The assets side of the account was dominated by SNB foreign currency purchases, which resulted in high net acquisition of financial assets under reserve assets. The other investment item also recorded high net acquisition, while portfolio investment and direct investment showed a net reduction of financial assets. On the liabilities side of the account, transactions in connection with takeovers had the strongest impact. Non-resident investors acquired majority holdings in domestic companies whose shares had previously been held in free float, both domestically and abroad. As a result, direct investment recorded a net incurrence. By contrast, portfolio investment showed a net reduction, reflecting the sale of shares in free float by the previous investors abroad. The other investment item recorded a net incurrence of liabilities.

In the international investment position, stocks of financial assets increased by CHF 220 billion to CHF 4,768 billion. Apart from the net acquisition of financial assets, capital gains were a decisive factor in this increase. It was above all the strengthening of the euro against the Swiss franc that led to substantial currency gains. In addition, higher prices on foreign stock markets contributed to the increase. Stocks of liabilities rose by CHF 155 billion to CHF 3,920 billion; this growth was largely attributable to capital gains resulting from stock market advances in Switzerland. The net international investment position thus increased by CHF 65 billion to CHF 848 billion in 2017.

A detailed presentation of the annual data will be provided in the Swiss Balance of Payments and International Investment Position 2017, to be published on 31 May 2018.

Current AccountThe current account was bellow 9.6% against the same quarter in 2016. Key figures: Current Account: -9.6% against Q4/2016 to 19,679 bn. CHF

ReceiptsAt CHF 81 billion, receipts from total goods trade were CHF 2 billion less than in the year -back quarter. The decrease was primarily due to lower receipts from non -monetary gold trading, which fell by CHF 8 billion to CHF 17 billion. By contrast, receipts from goods exports according to the foreign trade statistics (total 1) increased by CHF 4 billion to CHF 57 billion, mainly as a result of higher exports of chemical and pharmaceutical products as well as machinery and electronics. Net receipts from merchanting also expanded, by CHF 1 billion to CHF 6 billion. Receipts from foreign trade in services amounted to CHF 30 billion, down CHF 3 billion on the year-back quarter. This decrease was mainly attributable to licence fees, which had been unusually high in the corresponding quarter of 2016. At CHF 34 billion, receipts for primary income (labour and investment income) were down by CHF 4 billion on the year -back quarter due to lower income from direct investment abroad. Receipts for secondary income (current transfers) rose by CHF 1 billion to CHF 11 billion. ExpensesExpenses for total goods trade amounted to CHF 64 billion, a CHF 5 billion reduction from the year-back quarter attributable to the decline in expenses for non-monetary gold trading, which receded by CHF 10 billion to CHF 13 billion. Expenses for goods imports according to the foreign trade statistics (total 1), by contrast, grew by CHF 5 billion to CHF 50 billion. As on the receipts side of the account, chemical and pharmaceutical products as well as machinery and electronics showed the strongest growth. At CHF 25 billion, expenses for services imports were CHF 2 billion lower than in the year-back quarter. The decline was driven mainly by the ‘personal services; cultural and recreational services’ category, where expenses had been unusually high in the corresponding quarter of 2016. Expenses for primary income (labour and investment income) were almost unchanged from the year-back quarter and amounted to CHF 34 billion. Expenses for secondary income (current transfers) rose by CHF 2 billion to CHF 14 billion due to the payment of claims abroad by reinsurance companies. NetThe current account surplus amounted to CHF 20 billion, which was CHF 2 billion lower than in the year-back quarter. It was calculated as the sum of all receipts (CHF 157 billion) minus the sum of all expenses (CHF 137 billion). |

Swiss Balance of Payments Q4 2017(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

Financial accountNet acquisition of financial assetsOverall, the assets side of the financial account registered a net acquisition of CHF 3 billion (Q4 2016: net acquisition of CHF 45 billion). The other investment item saw a net acquisition of CHF 9 billion (Q4 2016: net acquisition of CHF 13 billion). While the SNB and the other sectors category increased their claims abroad, commercial banks in Switzerland reduced their claims in cross-border interbank business. Direct investment saw a net acquisition of CHF 4 billion (Q4 2016: net acquisition of CHF 12 billion). Resident companies granted loans to non-resident group companies. They also reinvested income, while at the same time withdrawing equity capital from subsidiaries abroad. Reserve assets posted a net acquisition of CHF 3 billion (Q4 2016: net acquisition of CHF 21 billion). By contrast, portfolio investment recorded a net reduction of CHF 13 billion (Q4 2016: net reduction of CHF 1 billion). In net terms, resident investors mainly disposed of long-term debt securities and shares issued by non-residents. Net incurrence of liabilitiesOverall, net incurrence of liabilities amounted to CHF 2 billion (Q4 2016: net incurrence of CHF 15 billion). Direct investment recorded a net incurrence of CHF 5 billion (Q4 2016: net incurrence of CHF 8 billion). Non-resident companies granted more loans to their resident subsidiaries. They also reinvested income, while withdrawing equity capital. By contrast, portfolio investment showed a net reduction of CHF 2 billion (Q4 2016: net reduction of CHF 10 billion). Non-resident investors primarily disposed of equity securities issued by residents. The other investment item registered a net reduction of CHF 1 billion (Q4 2016: net incurrence of CHF 18 billion). While resident commercial banks reduced their claims against customers and banks abroad, loan commitments of resident companies with respect to non-residents increased. NetThe financial account balance came to CHF 1 billion (Q4 2016: CHF 34 billion). This figure is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrences of liabilities plus the balance from derivatives transactions. The financial account balance corresponds to the change in the net investment position resulting from cross-border investment. |

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q4 2017 Source: snb.ch - Click to enlarge |

Switzerland’s International investment positionAssetsStocks of foreign financial assets were up CHF 75 billion on the previous quarter to CHF 4,768 billion. Valuation changes, in particular, were responsible for the increase. Since the major part of assets is held in foreign currencies, it was the strengthening of the euro against the Swiss franc, above all, which led to currency gains. In addition, capital gains arising from higher prices on foreign stock markets contributed to the increase. Stocks of portfolio investment rose by CHF 29 billion to CHF 1,375 billion. Reserve assets grew by CHF 20 billion to CHF 792 billion. Stocks of direct investment were up by CHF 19 billion to CHF 1,659 billion, while those of the other investment item also advanced, by CHF 13 billion to CHF 858 billion. By contrast, stocks of derivatives declined by CHF 5 billion to CHF 83 billion. LiabilitiesStocks of foreign liabilities were up by CHF 41 billion to CHF 3,920 billion, mainly due to valuation changes resulting from domestic stock market advances. Stocks of portfolio investment rose by CHF 28 billion to CHF 1,175 billion, while those of direct investment increased by CHF 11 billion to CHF 1,452 billion. Stocks of the other investment item advanced by CHF 7 billion to CHF 1,207 billion. By contrast, stocks of derivatives declined by CHF 4 billion to CHF 86 billion. Net international investment positionSince foreign financial assets climbed more markedly (CHF +75 billion) than foreign liabilities (CHF +41 billion), the net international investment position advanced by CHF 34 billion to CHF 848 billion. |

Switzerland International Investment Position(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Switzerland International Investment Position - Q4 2017 Source: snb.ch - Click to enlarge |

Remarks

The balance of payments (current account and financial account) covers Switzerland’s cross-border transactions with other countries over a given period. The international investment position indicates the stocks of Switzerland’s foreign financial assets (claims) and liabilities abroad at the end of this period. Changes in assets and liabilities in the international investment position are the result, first, of transactions recorded in the financial account. Second, capital gains and losses resulting from stock market and exchange rate movements, as well as other changes in stocks, have an impact on capital stocks.

In the comments on the balance of payments, period-by-period comparisons of transactions refer to the year-back quarter, since certain items are influenced by seasonal factors (e.g. tourism), especially in the current account. Seasonally adjusted data are not available. By contrast, the period-by-period comparisons in the international investment position refer to stocks at the end of the previous quarter. The focus in this case is on changes in stocks over the course of the period under review.

For comprehensive tables covering the balance of payments and the international investment position, cf. the SNB’s data portal, data.snb.ch, Table selection, International economic affairs.

Tags: Featured,newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account