In early 2015, a contract dispute between dockworkers’ unions and 29 ports on the West Coast of the US escalated into what was a slowdown strike. Cargoes piled up especially at some of the largest facilities like those in Oakland, LA, and Long Beach, threatening substantial economic costs far and away from just those directly involved. Each side predictably blamed the other for it. Management’s view: The ILWU has...

Read More »Cows continue to suffer for ‘beauty ideal’

Cow shows are public festivals in Switzerland. Everyone wants to lead the most beautiful cow into the ring, doing her hair, rubbing her with lotion, using sprays to make her glisten. But this year people are nervous at Expo Bulle, the Swiss National Holstein and Red Holstein Show. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More »The little boat that cleans the ocean

A Swiss skipper’s solution to clean the oceans. Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube...

Read More »Vers une décroissance inéluctable

Nous avertissons depuis quelques années sur les risques de récession. La déflation de la BNS qui s’est installée en 2011 en était un indicateur avancé. Le risque d’un effondrement global de l’économie ne peut être exclu pour les temps à venir. - Click to enlarge Les indicateurs monétaires clés des États-Unis, de l’Europe, du Japon et de la Chine sont en train de clignoter, un ralentissement économique au cours...

Read More »FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Swiss Franc The Euro has risen by 0.20% to 1.1846 CHF. EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Between Syria, trade tensions, and the US special investigator into Russia’s attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short...

Read More »Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

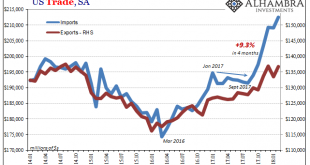

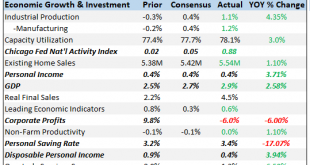

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

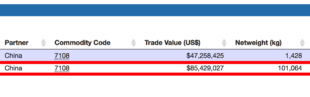

Read More »China’s Secret Gold Supplier Is Singapore

Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking...

Read More »Understanding the Latest International Reserve Figures

At the end of every quarter, the IMF publishes the most authoritative reserve data with a three-month lag. On Good Friday, the IMF published Q4 17 reserve holdings. A recent article on Bloomberg played up an economist’s forecast that euro reserves would increase by $500 bln over the next couple of years. A review of the reserve data may help us evaluate such a claim, which if true, could have important implications for...

Read More »The important role of official statistics in a world of fact, fiction and everything in between

- Click to enlarge Neuchâtel, 4 April 2018 (FSO) – Facts provide the foundation for political and social dialogue. But what happens when instead of facts, purposely spread untruths begin to dominate that dialogue? And what can be done about it, or better still, what can be done to stop it? Possible answers can be found at the conference entitled “Truth in numbers – the role of data in a world of fact, fiction and...

Read More »FX Daily, April 10: XI’s Day, but Not So Good for Putin

Swiss Franc The Euro has risen by 0.25% to 1.1807 CHF. EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump’s lawyer’s office, house and hotel were the subject of search warrants. A...

Read More » SNB & CHF

SNB & CHF