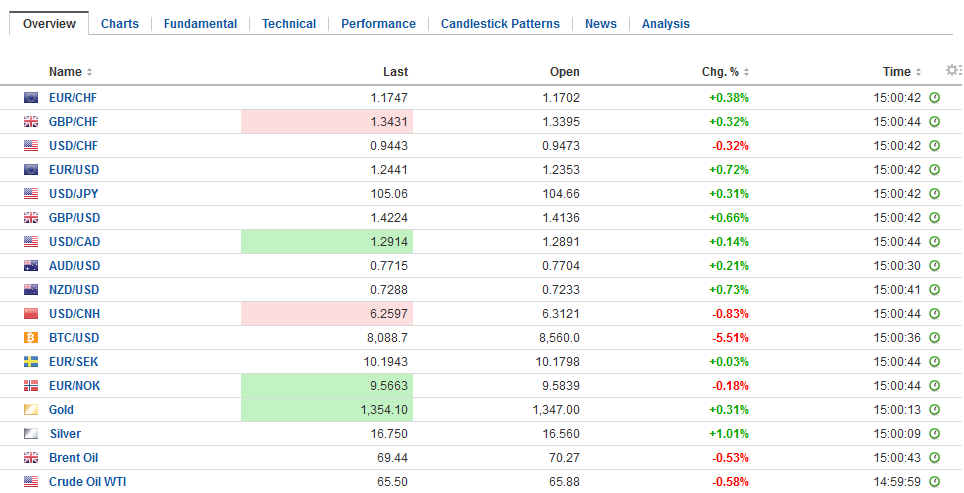

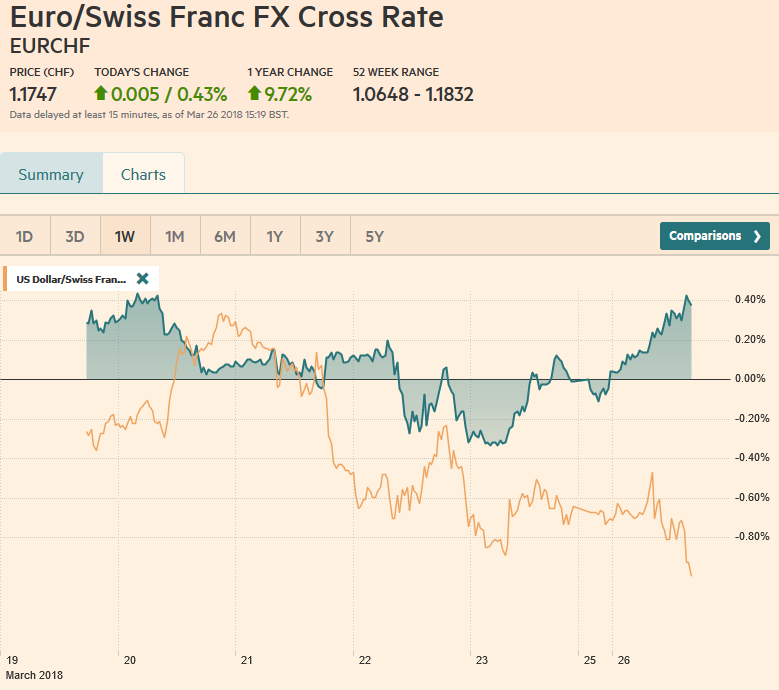

Swiss Franc The Euro has risen by 0.43% to 1.1747 CHF. EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week’s losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week’s close. European markets followed suit. They did not have to take out last week’s lows. The Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. Health care, energy led the wave, though consumer staples and retail lagged. The S&P 500 is trading a little more than 1% higher. Bond yields are firmer, with the US

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Featured, France Gross Domestic Product, FX Trends, GBP, JPY, Korea, newslettersent, SPY, TLT, USD, USD/CHF, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.43% to 1.1747 CHF. |

EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

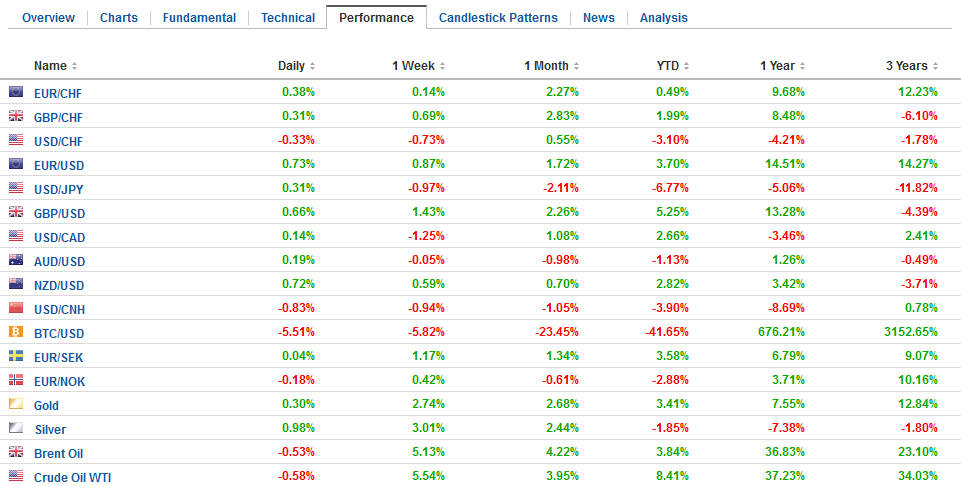

FX RatesAfter a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week’s losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week’s close. European markets followed suit. They did not have to take out last week’s lows. The Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. Health care, energy led the wave, though consumer staples and retail lagged. The S&P 500 is trading a little more than 1% higher. Bond yields are firmer, with the US 10-year yield up three basis points to almost 2.85%. European bond yields are mostly firmer. Spain is a notable exception; the yield is slightly softer following S&P’s decision before the weekend to match Fitch and upgrade Spain’s credit rating to A- from BBB+. S&P cited the strong economic performance, the current account surplus, and fiscal consolidation for the upgrade. In contrast, Italy’s stocks and bonds are underperforming as the prospect of a coalition between the Five Star Movement and the Northern League weighs on investor sentiment. |

FX Daily Rates, March 26 |

| What appeared to have stopped the equity meltdown was signs that a trade war could in fact be averted. We have argued that the market, egged on by the media, had exaggerated risks of trade war, just like it exaggerated the prospects of a currency war.

The dollar is on its back foot. It is only stronger against the yen, and there it is trying to re-establish a foothold above JPY105 that was violated at the end of last week. A move above JPY105.30 is needed lift the tone. Note that there are large option expires today including $1.3 bln at JPY!05 and $420 mln struck at JPY105.30. The euro is moving above $1.24 for the first time in eight sessions. Resistance is seen near $1.2450. Sterling is challenging last week’s high near $1.4220. The $1.4280 high form February is the main obstacle in the way of a challenge on the post-Brexit high reached in late January near $1.4345. There is a GBP335 mln options struck at $1.42 that expires today. |

FX Performance, March 26 |

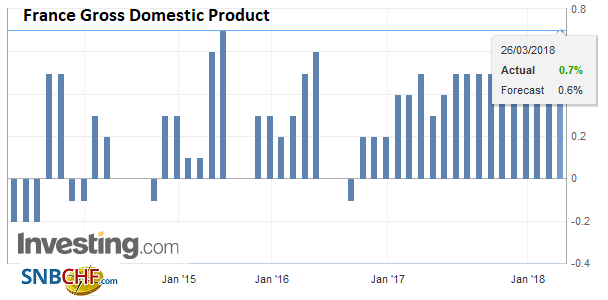

France |

France Gross Domestic Product (GDP) QoQ, Mar 2013 - 2018(see more posts on France Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

First, the US and Korea have reportedly struck an agreement that will modify the Korea-US free-trade agreement and exempts Korea from the steel tariffs. Still, Korea agreed to reduce the amount of steel it exports to the US (by ~30% of its three-year average), while increasing the quota of US autos to 50k per producer compared with 25k now. Korea is the third largest supplier of steel to the US and it is the largest importer of Chinese steel. GM and Ford exporter less than 10k vehicles each to Korea last year. Korea also agreed to extend the ban on pick-up truck exports to the US by another 20 years to 2041. Korean shares were among the best performers in Asia. The KOSPI advanced 0.85%, while the KOSDAQ rallied 2.9%.

Second, the US and China are reportedly engaged in extensive discussions that Treasury Secretary Mnuchin suggest could result in an agreement that would avert the tariffs announced at the end last week. Recall that last week, the US proposed tariffs on at least $50 bln of Chinese imports, intended on proposing new investment restrictions on Chinese investment, and sought a quantitative reduction of the bilateral imbalance (~$100 bln). China announced tariffs on $3 bln of US imports (in response to the steel and aluminum tariffs, but planned a different response to the new actions).

Some participants suspect that any agreement between the US and China will likely include more yuan appreciation. The offshore yuan rose 0.80% today, the most in two months. The onshore yuan is up 0.7%. Separately, China launched its yuan-denominated oil futures contract. China provided incentives to attract foreign participation by waiving taxes on oil futures trading profits. About a dozen and half foreign institutions registered to trade the contracts, but it is unclear whether it will become a key benchmark. There have been other attempts in Asia, including in Singapore and Japan, to create an Asian benchmark with little luck.

New Zealand unexpectedly reported a NZ$217 mln trade surplus for February (compared with a NZ$42.3 mln deficit in February 2017). This helped send the New Zealand dollar higher. The 0.85 gain puts it among the strongest of the major currencies, followed by the Scandis. The Australian dollar is trying to forge a base below $0.7700. Last week’s highs (~$0.7780) is the nearby objective.

The economic calendar is light for North America today. The Chicago Fed’s National Activity Index for February is due as is the Dallas Fed’s manufacturing index (March). These are not typically market movers. Three Fed officials speak but only Dudley during market hours. Mester and Quarles speak after the markets close. Meanwhile reports over the weekend suggest San Fran Fed President Williams is a lead candidate to replace Dudley who will retire near midyear. Reports also suggest Clarida is leading to become next Fed vice chairman.

Lastly, we note that US deluge of bills continues this week. Some $294 bln in bills will be sold this week, which appears to be a record. Today, $96 bln in bills will be sold as well as $30 bln in two-year notes. The two-year auction is the largest since 2014.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Featured,France Gross Domestic Product,Korea,newslettersent,SPY,USD/CHF,yuan