Mar.20 -- Frederik Ducrozet, senior economist at Pictet Asset Management, discusses Federal Reserve monetary policy and its inflation target. He speaks on "Bloomberg Surveillance" alongside Peter Dixon, global equities economist at Commerzbank.

Read More »Fed to Show Tolerance for Higher Inflation, Pictet’s Ducrozet Says

Mar.20 -- Frederik Ducrozet, senior economist at Pictet Asset Management, discusses Federal Reserve monetary policy and its inflation target. He speaks on "Bloomberg Surveillance" alongside Peter Dixon, global equities economist at Commerzbank.

Read More »Data remains soft in China

China’s growth momentum is likely to continue to decelerate before staging a modest rebound in the second half of this year.The latest economic indicators show that Chinese growth momentum remained soft in January and February, consistent with our expectations.Industrial activity was especially weak, weighed down by the mining and utility sectors. Growth in fixed asset investment improved slightly, mainly driven by the acceleration in property investment, but investment in the manufacturing...

Read More »Brazil pension reform: Bolsonaro’s moment of truth

In a context of financial and demographic pressure, the pension reform in Brazil may be the single most important source of long-term fiscal savings for the country, and necessary to restore fiscal balance.The sharp deterioration of Brazil’s public debt in recent years, triggered by a deep recession in 2014-2016, now requires the imminent restoration of fiscal balance in order to bring public finances back onto a more sustainable path.In this regard, pension reform is widely seen as the...

Read More »Jerome Powell, central banker to the world

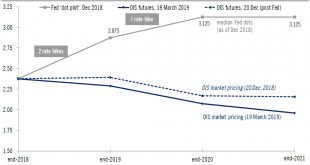

We expect the Federal Open Market Committee meeting this week to confirm the Fed’s pivot towards dovishness.We believe the Fed will wear its ‘central banker to the world’ hat during the Federal Open Market Committee meeting on March 19-20. Expressions of continued confidence in the US economy may prove secondary to concerns about Europe (including Brexit ) and China, meaning we expect the Fed to send a dovish message.Meanwhile, the Fed is gradually moving the goalposts on inflation even as...

Read More »Weekly View – Third time lucky?

The CIO office’s view of the week ahead.Last week, “Brextension” was confirmed by the UK Parliament, which voted in favour of a Brexit delay by 413 to 202. However, we are far from out of the woods yet as the EU must next approve the request, for which the UK must offer a satisfactory justification as to why they need it and how it would be used. For this reason, Theresa May’s deal may pass a third vote in parliament this week. If not, a long extension is possible, with president of the...

Read More »Brexit update: UK parliament opts for an extension

After an eventful week in parliament, the Brexit ball is set to keep rolling as MPs move to extend the 29 March deadline.The British Parliament concluded a series of votes on Brexit this week with an intention to extend the 29 March Brexit deadline. What remains unclear at this point is whether the UK will seek a short (two months) or a longer extension (two years). It is also not clear what this extension would be used for. A longer extension would help to fundamentally rethink and rejig...

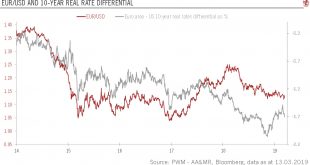

Read More »Euro slides against the dollar on ECB dovishness

The euro has declined further against the dollar but should strengthen over next 12 monthsThe euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months.That being said, recent euro area PMI surveys tend to favour a stabilisation of economic activity (after a relentless decline since...

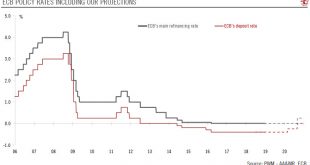

Read More »ECB rates and TLTRO-III: the devil in the details

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates.Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions to the ECB’s inflation and growth projections and ECB President Draghi‘s...

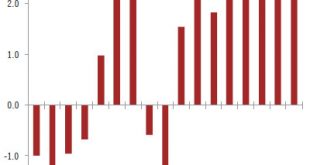

Read More »German economy set to recover

We expect German growth to pick up somewhat in the second half of the year, although we expect fiscal stimulus to remain limited.Germany’s economy weakened significantly in the second half of 2018. External headwinds remain strong and, in an environment where monetary-policy ammunition remains limited, all eyes have shifted towards German fiscal policy, especially as the country has generated significant budget surpluses since 2011.Beyond the already implemented 2019 fiscal stimulus, the...

Read More » Perspectives Pictet

Perspectives Pictet