The CIO office’s view of the week ahead.Chinese equities stole the show last week on optimism over US-China trade negotiations and MSCI’s decision to gradually increase inclusion of Chinese A-shares from the current 5% to 20% in 2019. This will bring China’s weighting in the MSCI Emerging Market (EM) index to 3.3% in November from its current 0.71%, translating to up to USD 125 billion of Chinese domestic equity inflows this year. Market participants reacted positively, despite a weakening...

Read More »Brexit update

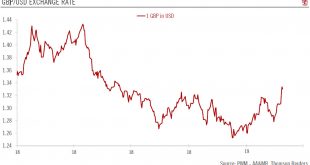

An extension of the Brexit deadline looks likely, but for what?Recent political developments in the UK and the increased focus on an extension to the current Brexit deadline in particular, have reduced the risk of a ‘no deal’ Brexit on 29 March. Prime Minster Theresa May will put her divorce deal to another Parliament vote on 12 March. While the vote will likely be much narrower than the initial vote in January, we assume that it will also be rejected.This will open the door for another vote...

Read More »US GDP update

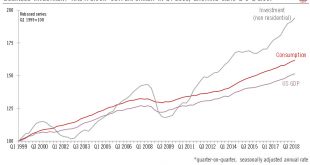

With stronger US growth than expected in the fourth quarter, we do not expect a recession in 2019.Q4 2018 GDP growth was healthy at 2.6% quarter-on-quarter (q-o-q) seasonally adjusted annual rate (SAAR), close to the average over the previous three quarters (2.5%). Annual growth for 2018 was 2.9%.A particularly bright spot in Q4 was business investment, led by spending on equipment and software. Such business investment strength is particularly good news for the sustainability of the US...

Read More »After a slight rebound, Chinese business sentiment falls again

Latest data point toward continued deceleration in China in February, especially in the external sector.Chinese official manufacturing and non-manufacturing purchasing manager indexes (PMI) fell again in February, following a pause in January. The manufacturing PMI came in at 49.2, down from 49.5 in the previous month. The non-manufacturing PMI, while continuing to signal expansion, also fell in February—to 54.3, from 54.7 the previous month.The data show a divergence between the...

Read More »Germany: economy and sovereign bonds

After a difficult second half of 2018, the outlook for Germany's economy and soverign bonds turns brighter.A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018, the economic slowdown and the Bund’s safe haven status are all factors...

Read More »Weekly View – Extend and pretend

The CIO office’s view of the week ahead.On Sunday, President Donald Trump prolonged market calm by confirming over Twitter that he would extend the deadline for raising tariffs on USD 200 billion of Chinese goods beyond 1 March. He omitted reference to a new deadline as well as any specifics on the “substantial progress” in talks between the world’s two largest economies. Whether Trump will succeed in extracting the concessions sought from the Chinese government remains to be seen, but we...

Read More »Fed wrap-up: staying dovish

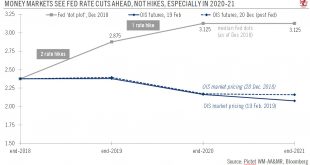

The Fed enters the 'acceptance stage' regarding its debt and market dominance monetary regime.The US Federal Reserve (Fed) is further reinforcing its stance on ceasing its balance sheet shrinkage before year end, essentially yielding to the demands of markets, which have been anxious about the potential for market liquidity shrinkage. Officially, the balance sheet question is still rooted primarily in the technical – commercial banks’ high demand for safe, liquid assets – rather than...

Read More »Gold to consolidate before further leg up

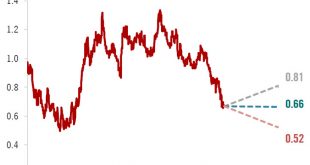

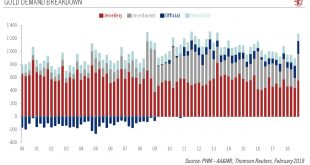

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018, continuing a structural trend in place for the past decade.It is worth...

Read More »China: Credit surges in January

The PBoC's policy easing is gaining traction but growth deceleration may continue in H1.China’s credit numbers for January surprised on the upside. The figures show strong credit creation in the first month of the year, especially in corporate bonds and bank bill financing. The contraction in the shadow banking sector has also moderated. This suggests that the PBoC’s monetary easing measures, which started in Q2 2018, are gaining traction.Although this is an encouraging development, we...

Read More »Weekly View – US retail flash crash

The CIO office’s view of the week ahead.Last week we saw disappointing data across the board. In China, spending around the Lunar New Year Holiday grew at its lowest rate since 2011, reflecting the downward pressure burdening the Chinese consumer. Puzzlingly, December retail sales data in the US printed the biggest month-on-month decline since 2009, communicating a sharply contrasting message to the robust US jobs data. We suspect there could be a data error at play there. Meanwhile, with...

Read More » Perspectives Pictet

Perspectives Pictet