Consumers increasingly spend more on luxury experiences and less on luxury goods, and are developing an appetite for novel benefits when buying high-end products and servicesWhen people talk about Swiss brands, they often think about the luxury products and services for which the country is justly famous – its watches, jewellery, chocolates and deluxe hotels, for example. Over the last decade, my own research and teaching activities at INSEAD have taught me that decoding luxury consumption...

Read More »Brexit update: a very British fudge

The EU has granted a Brexit deadline extension to 31 October of this year. The next step after this extension could be another extension.Following the EU Council summit, 31 October 2019 is the new Brexit deadline. Given that we see limited probability of a sudden unknotting of the current UK parliamentary gridlock, our core scenario is that the deadline will be extended again. The current timeframe is too short to really work on an alternative to the current ‘Withdrawal Agreement’, which has...

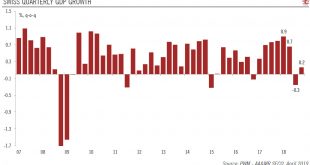

Read More »Switzerland: Lower growth, lower inflation

Growth and price rises should moderate in 2019.The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside.Looking ahead, we expect the Swiss economy to slow. Fundamentals supporting domestic demand remain solid, but the...

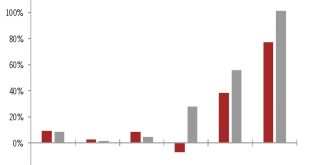

Read More »Update to our earnings scenario

After a stellar 2018, earnings expectations for the S&P 500 have been ratcheted down for this year. Total returns will increasingly come from sources other than earnings.Earnings estimates in developed markets have been cut continuously over the past six months. The consensus expectation for earnings growth in 2019 for the S&P 500 is now around 3.5%. This compares with stellar earnings growth of 24.1% in the US in 2018, thanks in large part to the end-2017 US tax cuts announced by...

Read More »Indian elections start today

Understanding what is at stake and what it means for markets as the world's largest elections commence.Today, India’s 2019 general elections to determine the next Lok Sabha (the lower house) kick off. India is divided into 543 constituencies, each represented by one member of the Lok Sabha. The party or the coalition that wins a simple majority (272 seats) will form the government. Nearly 900 million voters across the nation will head to election booths to cast their votes over the next five...

Read More »Limited room for Swiss franc depreciation

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings.The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less unfavourable to the franc.The upward pressure on the...

Read More »Signs of global rebound are appearing

Recent data suggest the downturn in the world economy is bottoming out after a prolonged period of deterioration. We expect the world economy to expand by 3.3% this year.At its Spring Meeting, the International Monetary Fund (IMF) revised downward its 2019 global growth forecast from 3.5% to 3.3% (the same as our own forecast). The IMF left its estimate for 2020 growth unchanged at 3.6%As global growth probably slowed to 3.2% in the second half of 2018, a 3.3% growth estimate for 2019...

Read More »Getting ready for tiering

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.Despite nearly four years of asset purchases and five years of negative rates,...

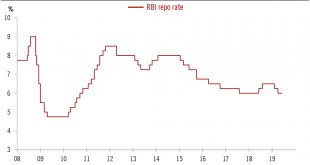

Read More »India: RBI cuts interest rate again

As widely expected, the Reserve Bank of India announced a cut to its policy interest rate last week. We expect that monetary policy will likely stay accommodative in order to support growth going forward.The Reserve Bank of India (RBI) cut its policy interest rate (RBI repo rate) by 25 basis points (bps) last week, bringing it down to 6.0%. This was the RBI’s second interest rate cut this year under its new governor Shaktikanta Das. With this move, the RBI has fully reversed last year’s rate...

Read More »Weekly View – Flextension?

The CIO office’s view of the week ahead.Risk assets were positive across the board last week, with volatility falling back into low territory. The rally was driven by encouraging signs from the world’s two biggest economies. In China, a turn in economic indicators has started to show through with manufacturing purchasing manager indices (PMI) moving back into expansion territory in March. At the same time, the US has returned to a ‘Goldilocks’ environment, with Friday’s solid employment...

Read More » Perspectives Pictet

Perspectives Pictet