With declining manufacturing sentiment and recent downward revisions to our US and euro area GDP forecasts, we have revised down our world real GDP growth forecast for 2019. A US-China trade agreement will be key to avoiding further growth deterioration. After recent downward revisions to our US and euro area GDP forecasts and against a backdrop of declining global manufacturing sentiment, we have revised our world real GDP growth forecast for 2019 to 3.3% from 3.5% previously.Manufacturing...

Read More »Weekly View – “Draghed” down

The CIO office’s view of the week ahead.ECB chief Mario Draghi confirmed a gloomy outlook on the European economy last week in announcing a monetary policy U-turn of his own. Not only were euro area growth and inflation projections cut, but an interest rate hike was ruled out for 2019. The central bank will also launch a new programme of targeted long-term refinancing operations (TLTRO) – loans to euro area banks – but under less generous terms than had been expected by markets, given that...

Read More »US employment: keeping an eye on the clock

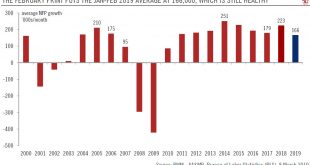

Despite a weaker than expected February employment report, the three-month average remains robust and we would tend to dismiss this weak print as a mere ‘blip’.With only 20,000 job additions, the US employment report for February was weak. However, with the three-month average remaining robust at 186,000, we would tend to dismiss this weak print as a mere ‘blip’. Furthermore, the weak reading is inconsistent with other labour market data and indicators, including recent consumer and business...

Read More »Italy: rough waters could grow calmer

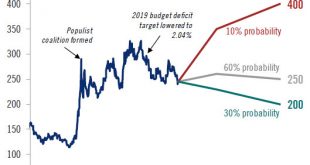

With the country in recession, we remain cautious on Italian sovereign debt. But growing tensions inside the government could have a silver lining.The main leading indicators are pointing towards the recession continuing in Q1 2019 in Italy. We expect growth to move marginally back into the black in Q2 2019, with the Italian economy growing by 0.3% in 2019 overall. Even though we have ruled out a snap 2019 election from our central scenario, the chances of one being called are significant...

Read More »Limited upside for USD/JPY but significant downside

Our baseline scenario suggests limited upside potential for the dollar against the yen, given the current low stock market volatility environment.The Japanese yen has been weak recently, as volatility in the US stock market has receded. Indeed, the sharp increase in US stock market volatility at the end of last year favoured the yen through short-covering and repatriation flows, whereas the subsequent rebound in global risk appetite has penalised the defensive yen (see chart).This recent...

Read More »Promoting Family Businesses

IMD and Pictet join forces to sponsor the 2019 IMD Global Family Business Award.2019 Global Family Business Award – The nomination process is openPictet joined forces with IMD and is now proud to sponsor the 2019 IMD Global Family Business Award, a prestigious annual prize presented to a company that successfully combines family and business interests, tradition and innovation, while at the same time fully assuming its social responsibility.The nomination process for 2019 has been launched,...

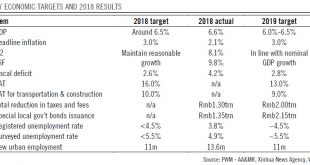

Read More »More fiscal support as expected but no massive stimulus for China

The Chinese government set new economic targets and policy announcements for 2019, broadly in line with what we had been expecting.The new economic targets for 2019 and policy announcements are broadly in line with our expectations. They generally reflect Chinese policymakers’ intention to support growth in the face of economic headwinds but to avoid massive stimulus.The target for real GDP growth for 2019 was lowered to a range between 6.0% and 6.5%, from “around 6.5%” in 2018 and 2017,...

Read More »House View, March 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAt current valuations, we remain prudent about global equities’ further potential, waiting for further clarity on economic and corporate growth before moving from our present neutral stance.At the same time, we remain confident that the central banks will continue to support markets. In Europe, fiscal policy is expected to give a marginal boost to growth.Although central bank dovishness...

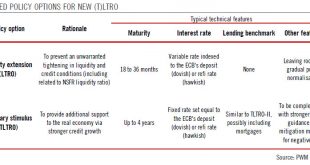

Read More »ECB: to LTRO, or not LTRO, what is the question?

The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs.Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions.We expect the ECB to send out a strong signal at its March meeting that it...

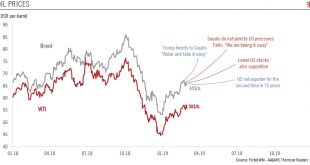

Read More »Oil market update

Brent price finds support between USD60 and USD70Increased pressure from President Trump on the Saudis to halt oil production cuts last week had only a temporary impact. Brent prices are currently being underpinned by several factors, including hopes of a US-China trade deal and OPEC+ production cuts, in particular. The Saudis have been aggressively cutting their production recently. With output of 10.1m barrels/day (mbd) in February, they are already below their 10.3mbd agreed target. In so...

Read More » Perspectives Pictet

Perspectives Pictet