In a context of financial and demographic pressure, the pension reform in Brazil may be the single most important source of long-term fiscal savings for the country, and necessary to restore fiscal balance.The sharp deterioration of Brazil’s public debt in recent years, triggered by a deep recession in 2014-2016, now requires the imminent restoration of fiscal balance in order to bring public finances back onto a more sustainable path.In this regard, pension reform is widely seen as the single largest source of long-term fiscal savings, given the generosity of Brazil’s current pension system and outsized related spending compared to its demographics.An ambitious draft reform was sent by the Bolsonaro administration to Congress at the end of February as a basis for parliamentary

Topics:

Team Asset Allocation and Macro Research considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In a context of financial and demographic pressure, the pension reform in Brazil may be the single most important source of long-term fiscal savings for the country, and necessary to restore fiscal balance.

The sharp deterioration of Brazil’s public debt in recent years, triggered by a deep recession in 2014-2016, now requires the imminent restoration of fiscal balance in order to bring public finances back onto a more sustainable path.

In this regard, pension reform is widely seen as the single largest source of long-term fiscal savings, given the generosity of Brazil’s current pension system and outsized related spending compared to its demographics.

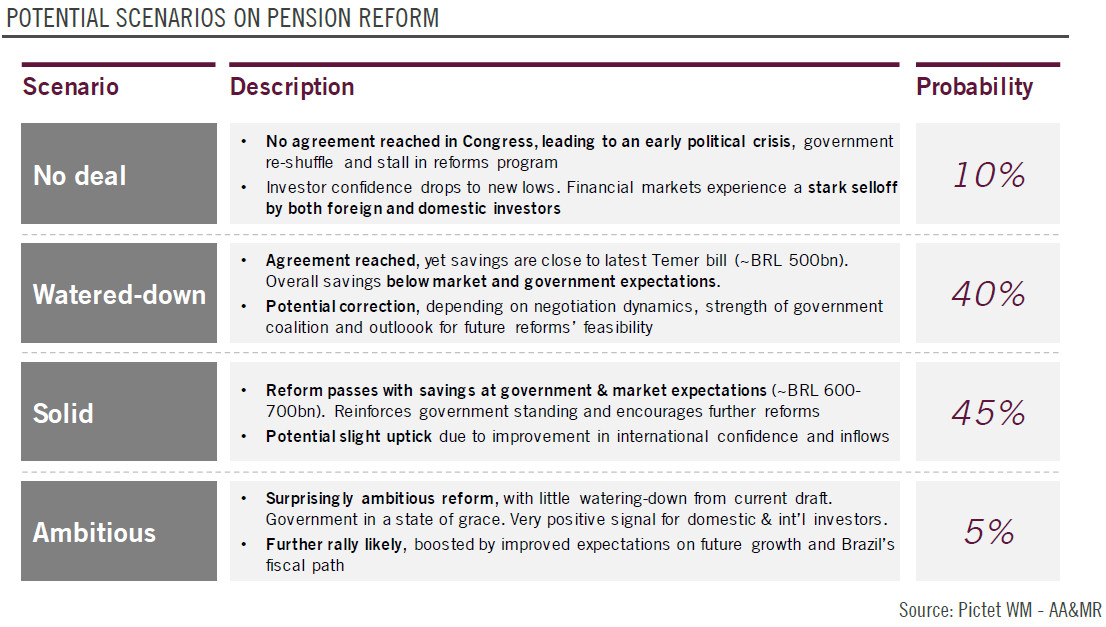

An ambitious draft reform was sent by the Bolsonaro administration to Congress at the end of February as a basis for parliamentary discussions. Although there is wide consensus within Congress around the urgent need for a reform, the balance of power indicates that garnering sufficient support will necessitate significant political coordination.

The link between Brazil’s public finances and financial markets, both fixed income and equities, is evident. Recent movements seem to indicate a rather optimistic mood, with expected fiscal savings potentially in the higher range of what is reasonably achievable.

Should the government fail to deliver on its promise of a solid reform, we believe there is a risk of correction as market participants reprice expectations. The dynamics of discussions to come, including presidential involvement and ability to navigate cross currents in Congress and public opinion will be key.