We expect German growth to pick up somewhat in the second half of the year, although we expect fiscal stimulus to remain limited.Germany’s economy weakened significantly in the second half of 2018. External headwinds remain strong and, in an environment where monetary-policy ammunition remains limited, all eyes have shifted towards German fiscal policy, especially as the country has generated significant budget surpluses since 2011.Beyond the already implemented 2019 fiscal stimulus, the country has fiscal space amounting to around 1% of GDP, or EUR34bn according to various fiscal rules.Material fiscal easing would be a game-changer for us. This would support euro area and German demand growth. However, as things stand, the slowdown has not been severe enough to see the government upping

Topics:

Nadia Gharbi considers the following as important: German elections, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We expect German growth to pick up somewhat in the second half of the year, although we expect fiscal stimulus to remain limited.

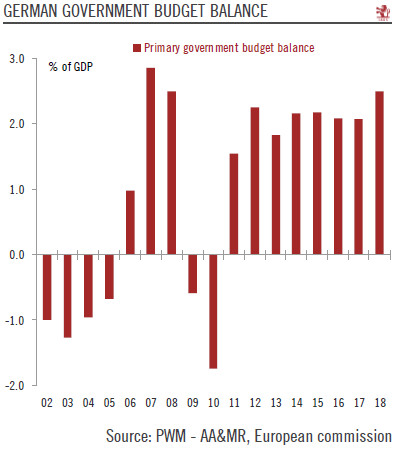

Germany’s economy weakened significantly in the second half of 2018. External headwinds remain strong and, in an environment where monetary-policy ammunition remains limited, all eyes have shifted towards German fiscal policy, especially as the country has generated significant budget surpluses since 2011.

Beyond the already implemented 2019 fiscal stimulus, the country has fiscal space amounting to around 1% of GDP, or EUR34bn according to various fiscal rules.

Material fiscal easing would be a game-changer for us. This would support euro area and German demand growth. However, as things stand, the slowdown has not been severe enough to see the government upping its fiscal stimulus any further. In addition, while a consensus in favour of looser fiscal policy has been emerging, political decision-making among the governing coalition is complicated.

Our view on the German economy is unchanged. Domestic demand remains solid and underpinned by healthy fundamentals. Sustained jobs and wages growth, falling inflation due to lower oil prices and fiscal stimulus are all factors that should help private consumption to remain resilient this year. Fundamentals that have supported growing investment – tight capacity, easy financial conditions and strong cash flows – persist as well. However, deteriorating foreign demand and rising external uncertainties remain the most serious downside risks for an export-orientated economy like Germany’s. We expect growth to remain subdued in H1 2019, before picking up somewhat in H2 2019, as some of the near-term risks come to a head. Nevertheless, the balance of risks to our growth outlook remains angled to the downside. Particularly worrying in the near term for Germany is any potential escalation of trade tensions between the US and Europe.