With declining manufacturing sentiment and recent downward revisions to our US and euro area GDP forecasts, we have revised down our world real GDP growth forecast for 2019. A US-China trade agreement will be key to avoiding further growth deterioration. After recent downward revisions to our US and euro area GDP forecasts and against a backdrop of declining global manufacturing sentiment, we have revised our world real GDP growth forecast for 2019 to 3.3% from 3.5% previously.Manufacturing sentiment in all regions deteriorated in February, with the exception of emerging economies, where sentiment recorded a small rebound. Deterioration in sentiment is progressively translating into a marked downturn in hard data. International trade contracted for the second month in a row at the end

Topics:

Jean-Pierre Durante considers the following as important: Global PMI, Macroview, manufacturing, World economy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: A Most Unusual Economy

Jeffrey P. Snider writes Demand Down, Supply Down, Ugly Up

Jeffrey P. Snider writes It’s Inventory PLUS Demand

Jeffrey P. Snider writes ADP Front-Runs BLS and President Phillips

With declining manufacturing sentiment and recent downward revisions to our US and euro area GDP forecasts, we have revised down our world real GDP growth forecast for 2019. A US-China trade agreement will be key to avoiding further growth deterioration.

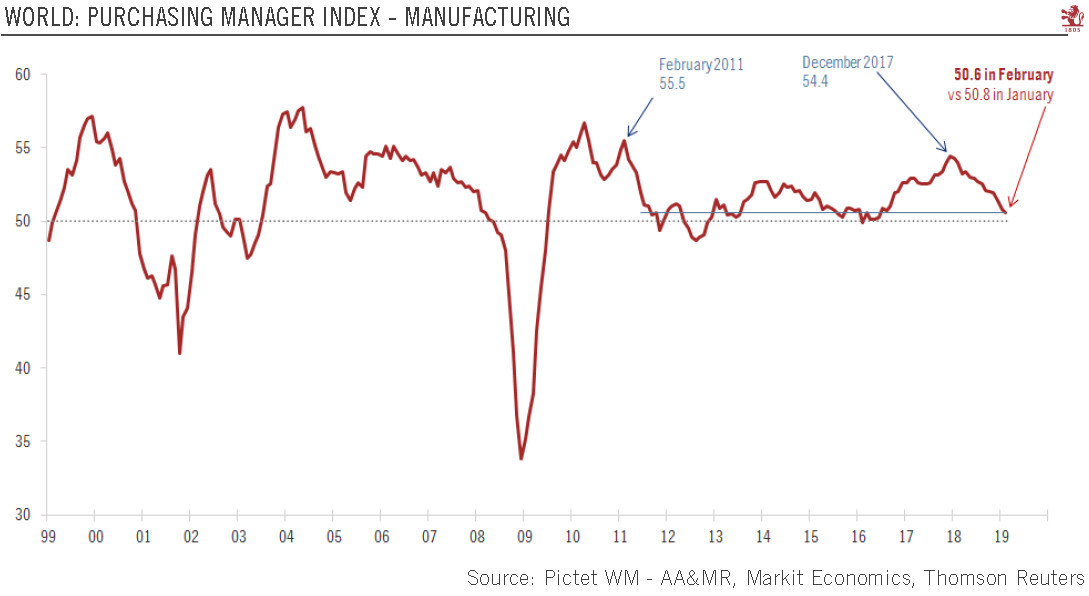

After recent downward revisions to our US and euro area GDP forecasts and against a backdrop of declining global manufacturing sentiment, we have revised our world real GDP growth forecast for 2019 to 3.3% from 3.5% previously.

Manufacturing sentiment in all regions deteriorated in February, with the exception of emerging economies, where sentiment recorded a small rebound. Deterioration in sentiment is progressively translating into a marked downturn in hard data. International trade contracted for the second month in a row at the end of 2018, caused by a collapse in Asian trade. It is difficult not to see this as a direct consequence of the US-China trade dispute.

However, some rosy touches remain in this bleak picture. Our international trade leading indicator continues to point to slow but positive growth in the months ahead. Early releases of trade data of the leading exporting economies tend to confirm a rebound after the recent contraction. Moreover, global financial conditions have been relaxed after the contraction recorded at the end of last year. Their close relationship with the PMI and the world GDP suggests a rebound in sentiment in the following months and that a global recession could be avoided this year.

All in all, it appears of paramount importance to see some progress in trade negotiations in order to spurn the risk of a global recession.