We expect the Federal Open Market Committee meeting this week to confirm the Fed’s pivot towards dovishness.We believe the Fed will wear its ‘central banker to the world’ hat during the Federal Open Market Committee meeting on March 19-20. Expressions of continued confidence in the US economy may prove secondary to concerns about Europe (including Brexit ) and China, meaning we expect the Fed to send a dovish message.Meanwhile, the Fed is gradually moving the goalposts on inflation even as core inflation is close to 2% y-o-y, its official target. We think we could see signs that 2.5% is the new target on inflation. In fact, ‘average inflation targeting’ has been making its way into Fed thinking as it signals a bit of overheating would be welcome given past inflation undershoots.While the

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We expect the Federal Open Market Committee meeting this week to confirm the Fed’s pivot towards dovishness.

We believe the Fed will wear its ‘central banker to the world’ hat during the Federal Open Market Committee meeting on March 19-20. Expressions of continued confidence in the US economy may prove secondary to concerns about Europe (including Brexit ) and China, meaning we expect the Fed to send a dovish message.

Meanwhile, the Fed is gradually moving the goalposts on inflation even as core inflation is close to 2% y-o-y, its official target. We think we could see signs that 2.5% is the new target on inflation. In fact, ‘average inflation targeting’ has been making its way into Fed thinking as it signals a bit of overheating would be welcome given past inflation undershoots.

While the Fed may further signal its intention to stay put for a while on rates, the focus of the FOMC meeting will be on the Fed’s balance sheet. We expect an official confirmation of the end of balance sheet reduction in the second half of the year (likely in Q3).

There is the risk of a communication mistake. The Fed will officially wrap its decisions on the end of the balance sheet reduction in technical details (banks’ post-financial crisis needs for higher excess reserves) but this could become mingled with its more bearish global outlook.

The risk is therefore that the Fed accidently sends the message that it is very worried about the US and global outlook, and that its next move, therefore, will likely be a rate cut.

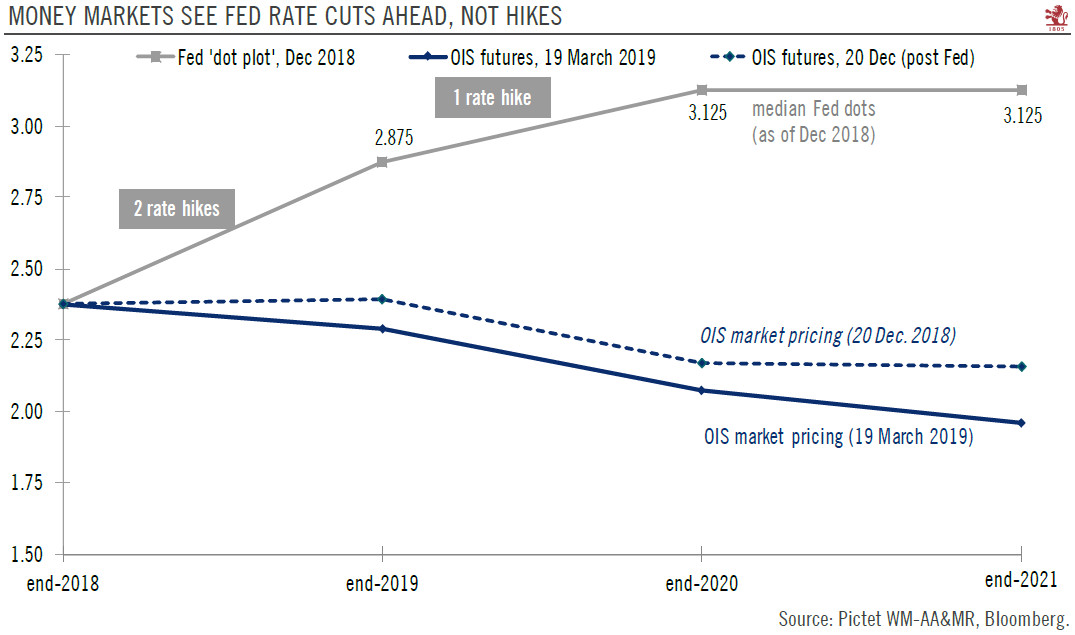

We are reviewing our forecast of one more rate hike in June (the final one in the current rate-hiking cycle that began in late 2015). While we think some regional Fed presidents still want to hike rates, the persistent (if not dogmatic) dovishness of several Washington DC-based governors, the fear of going above the ‘neutral’ rate of interest, and the paralysing fear of pushing the US into recession, could mean there is no rate hike at all this year or next.

More generally, we see the Fed now in a ‘debt dominance’ monetary regime (a continuation of the quantitative easing (QE) regime), characterised by the impossibility of central banks to normalise policy because of the sheer amount of debt in the system. The monetary regime is important for investors, as it is what ultimately drives risk premia, especially for risky assets. We think the Fed’s dovish turn in early 2019 reflects its slow acceptance of this state of affairs. Monetary policy is therefore likely to stay accommodative and market friendly for a while, in our view.