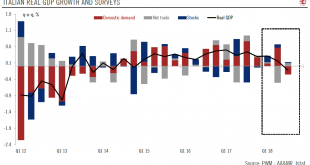

Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy.After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP). To avoid the EDP, Italy had to backtrack on parts its initial plans for fiscal...

Read More »UK Politicians remain stuck in the mire

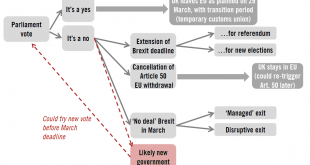

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March.The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support.The problem is that there remains no majority for any alternative. If there is no plan voted by parliament before the...

Read More »Mass customisation of breakfast cereals

When Hubertus Bessau was 16, he knew exactly what he wanted to do – or rather, he knew exactly what he did not want to do. He did not want to work for a large company where it would be hard for him to have any impact on what happened. His ambition was to find a career that he would enjoy and where he could make a difference.He was already earning his own pocket money by designing websites for friends of his parents rather than taking casual jobs like working in a bar as friends did. When he...

Read More »Germany is stagnating

Sagging industrial production and confidence figures point to weak Q4 GDP.German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009.While some idiosyncratic factors were likely at play, such as below-average water levels on the Rhine, which may have had an impact on energy production and chemical...

Read More »Outsized rise in rates charged on US credit cards

The increase in interest rates paid for credit card debt far exceeds the rise in the Fed funds rate, pointing to sizeable divergence in the impact Fed tightening is having on the US economy.The Fed’s interest-rate tightening since Q4 2015 has had divergent repercussions on interest rates paid by ‘end users’ across the US economy.Interest rates on credit card debt have risen particularly sharply since the start of Fed tightening.How monetary policy is transmitted to the ‘real economy’,...

Read More »Euro credit: 2019 outlook

After a negative 2018, developments in Italy and indirect ECB support will help define the road ahead for European corporate bonds.Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell slightly. Looking back, policy makers had a major impact on the performance...

Read More »House View, January 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAfter a bruising 2018, we expect further volatility ahead. But the recent sell-off in equities, particularly in the US, may have been excessive with regard to still-decent fundamentals. We will continue to use spikes in volatility for tactical advantage, believing they offer opportunities.We are cautious on corporate credit overall as leverage, increasing rates and slowing growth make the...

Read More »People’s Bank cuts banks’ reserve requirements, more policy easing ahead

While the latest move will inject liquidity into the Chinese banking system, more direct stimulus can be expected in a bid to lift China’s slowing economy.The People’s Bank of China (PBoC) announced a further reduction in banks’ required reserve ratios (RRR) on Friday by 1 percentage point. According to the central bank, this round of RRR cuts will inject roughly Rmb800 billion of net liquidity into the banking sector.In our view, this move was partly motivated by the economy’s seasonal...

Read More »Fed’s New Year Resolution: Listen to markets

Hints that Fed balance-sheet reduction could in question.Fed Chairman Jerome Powell made dovish remarks at a conference on Friday to the effect that the Fed would be ‘patient’ about further rate increases after having delivered four rate hikes in 2018.Crucially, Powell mentioned possible tweaks to the Fed’s preset plans for balance sheet shrinkage to calm financial markets concerns, after downplaying the balance sheet aspects at the December post-policy meeting press conference.This...

Read More »Weekly View – A kangaroo market week

The CIO office’s view of the week ahead.The first week of the year delivered a series of conflicting signals and a complementary dose of volatility in markets. After 20 days of daily moves of over +/-2% in the S&P 500 in 2018, out of last week’s three trading days of 2019 alone, two were marked by daily moves of over +/-2%. In data, the December US ISM manufacturing index showed its weakest reading in two years, as businesses continue to worry about trade tensions. However, this was...

Read More » Perspectives Pictet

Perspectives Pictet