Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAfter a bruising 2018, we expect further volatility ahead. But the recent sell-off in equities, particularly in the US, may have been excessive with regard to still-decent fundamentals. We will continue to use spikes in volatility for tactical advantage, believing they offer opportunities.We are cautious on corporate credit overall as leverage, increasing rates and slowing growth make the climate challenging. We are neutral on US Treasuries overall, with their relatively high couponproviding some protection against the further, limited rises in US rates we expect.We continue to see alternatives as a way to boost the relatively uninspiring prospects for traditional portfolios. Private

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAfter a bruising 2018, we expect further volatility ahead. But the recent sell-off in equities, particularly in the US, may have been excessive with regard to still-decent fundamentals. We will continue to use spikes in volatility for tactical advantage, believing they offer opportunities.We are cautious on corporate credit overall as leverage, increasing rates and slowing growth make the climate challenging. We are neutral on US Treasuries overall, with their relatively high couponproviding some protection against the further, limited rises in US rates we expect.We continue to see alternatives as a way to boost the relatively uninspiring prospects for traditional portfolios. Private

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

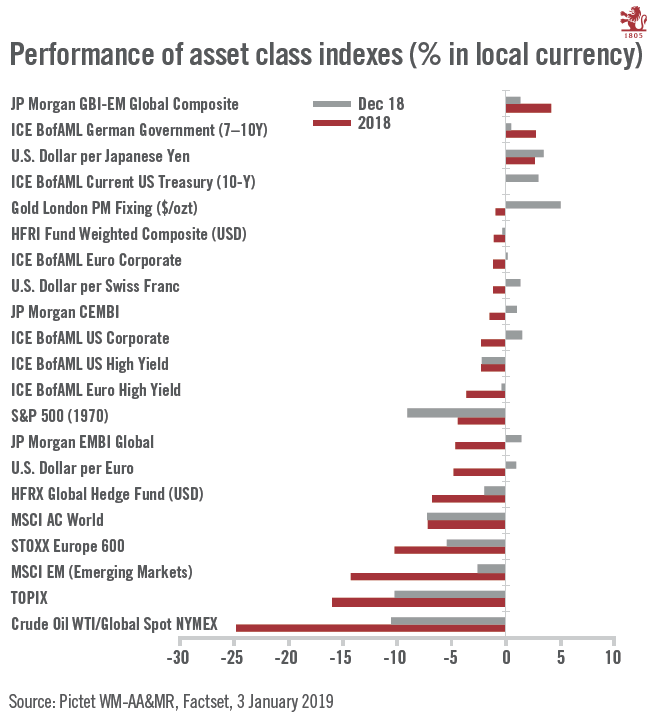

Pictet Wealth Management's latest positioning across asset classes and investment themes.

- After a bruising 2018, we expect further volatility ahead. But the recent sell-off in equities, particularly in the US, may have been excessive with regard to still-decent fundamentals. We will continue to use spikes in volatility for tactical advantage, believing they offer opportunities.

- We are cautious on corporate credit overall as leverage, increasing rates and slowing growth make the climate challenging. We are neutral on US Treasuries overall, with their relatively high couponproviding some protection against the further, limited rises in US rates we expect.

- We continue to see alternatives as a way to boost the relatively uninspiring prospects for traditional portfolios. Private equity should keep its illiquidity premium over public equities, and we are exploring private equity real estate.

Commodities

- At USD51 for end 2019, our model points to the equilibrium oil price remaining close to current levels and therefore to limited potential for further downward momentum, as long as the US dollar stabillises and world GDP grows by around 3.5%.

Currencies

- The structural Swiss current account surplus and the external environment should continue to put upward pressure on the Swiss franc. We believe it could trade at around CHF1.15 to the euro on average in 2019. Dollar strength against the euro could abate progressively in 2019, if the growth gap diminishes and the ECB embarks on gradual policy normalisation.

Equities

- The new lows and abrupt rebounds in December on major stock indices reinforce our neutral stance on equities. Earnings growth expectations have been steadily lowered over the past quarter.

- Uncertainty is keeping volatility high and weighing on valuations in global equity markets. But emerging markets proved more resilient than their developed market equivalents, helped by a weakening US dollar.

- Macro issues aside, the oil & gas industry is in a period of transition as alternative sources of energy continue to rise. The major oil companies have to decide how to further adapt their business in a world that will ultimately consume less of their products. The oil services industry has to fight to maintain its relevance from an equity investment standpoint.

- Treasury yields fell in the final weeks of 2018, and we expect the US yield curve to flatten in 2019, as the Fed stops its hiking cycle after two additional rate increases due to weakening US growth. Renewed steepening could depend on confirmation that robust economic growth continues and fears of accelerating inflation.

Alternatives

- Investors have continued to pour money into private equity funds in the search of yield. This wall of capital has intensified competition for buyout deals. Our private equity strategy is focusing more intently than ever on manager selection.