Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March.The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support.The problem is that there remains no majority for any alternative. If there is no plan voted by parliament before the 29 March deadline, the default option remains a ‘hard Brexit’— in other words, a disruptive crashing out from the EU. The margin of defeat for the divorce deal on 15 January will be crucial. A narrow loss could increase the chance that the deal is submitted to parliament again after a few tweaks,

Topics:

Thomas Costerg considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Claudio Grass writes Year in review: A tectonic shift has only just begun

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March.

The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support.

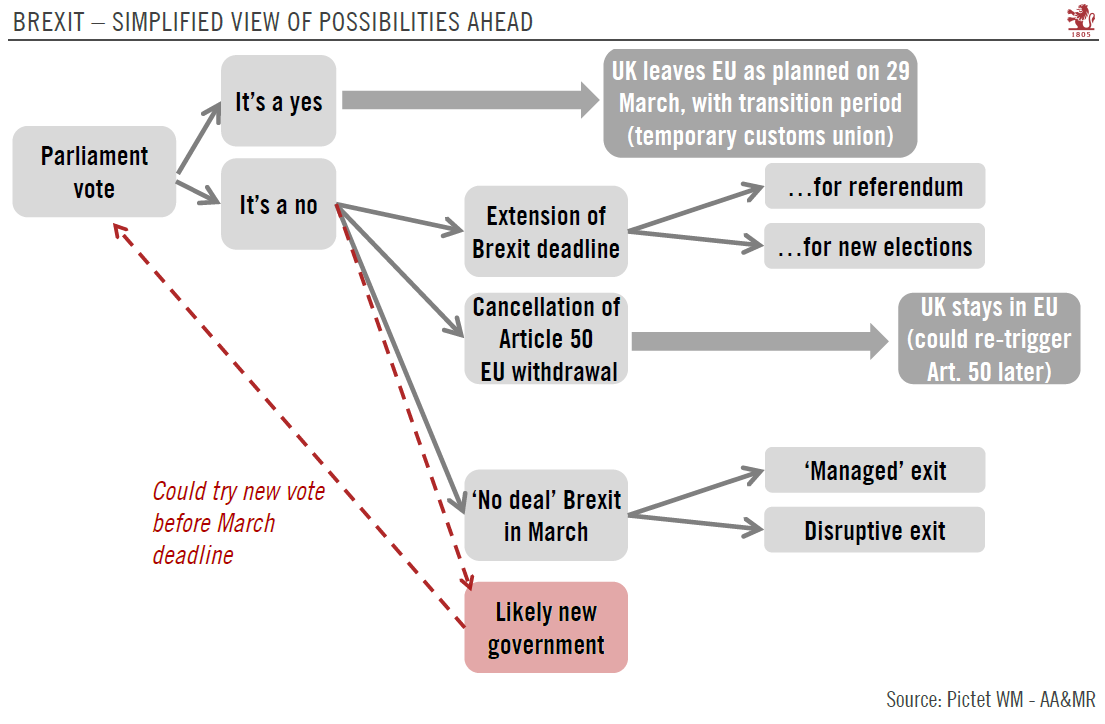

The problem is that there remains no majority for any alternative. If there is no plan voted by parliament before the 29 March deadline, the default option remains a ‘hard Brexit’— in other words, a disruptive crashing out from the EU. The margin of defeat for the divorce deal on 15 January will be crucial. A narrow loss could increase the chance that the deal is submitted to parliament again after a few tweaks, assuming European officials are willing to co-operate.

While public appetite for a new Brexit referendum seems to be growing, the possibility of a fresh general election is probably higher. Either would likely lead to an extension of the 29 March deadline.

A major development in recent days has been a Commons vote requiring Theresa May to come up with a ‘plan B’ within three days if next week’s vote fails. There is hope among Remainers (who, on paper, form a majority in the House of Commons) that parliament, by asserting its powers, can avoid a hard Brexit. So, while it is true that there could be a no-deal Brexit on 29 March if the current logjam persists, the overwhelming majority of the British Parliament that is opposed to such an outcome are strongly mobilised and we still expect that considerable efforts will be employed to break the current impasse.

Although requiring the approval of other EU countries, it is also increasingly possible that the 29 March deadline will be extended, probably beyond the European Parliament elections in May, particularly if new elections or a fresh referendum are called in the UK.

To sum up, a smooth UK exit from the EU remains our base case scenario, but there is huge uncertainty, and domestic political shenanigans could still put the UK on track for an accidental hard Brexit.

Our base case scenario is for sterling to appreciate towards USD1.35 over a six-month time horizon. A short extension of the March deadline, while it would avoid a near-term ‘accident’ (crashing out), would still prolong uncertainty and therefore would limit sterling’s upside potential. A longer extension would be less detrimental and would likely lead to a rebound in sterling relative to the US dollar (although less strong than the one we would expect were Theresa May’s divorce deal to go through).