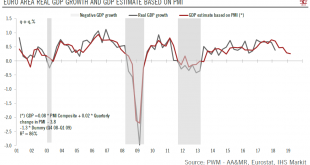

The balance of risks to growth in the region is still tilted to the downside.The big question about the euro area economy is when the bottom of the slowdown will be reached. A rebound was already expected in Q4 2018, but at the start of this year there are still few signs of recovery. Flash composite PMI numbers for the region declined by 0.4 points to 50.7 in January, the weakest level since July 2013. New orders and new export orders remained weak and below the economic expansion threshold...

Read More »US macro and Federal reserve forecast update

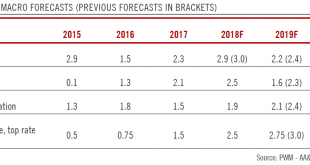

Near-term recession risks remain limited, and a dovish Fed offers supportWe are reducing our 2019 US growth forecast to 2.2%, from 2.4% previously, mostly to account for the partial government shutdown. New York Fed president John Williams has stated that the impact of the shutdown could reach 1% of Q1 GDP.Despite the lower forecast, we remain confident about the underlying fundamentals of the US economy and still regard near-term recession risks as limited. Furthermore, US GDP tends to be...

Read More »Emerging market fixed income outlook

Selectiveness will be key to navigating between 2019 tailwinds and headwinds.Overall, we think there are reasons for investors to be more optimistic on emerging market (EM) debt in 2019. A Fed pause, a limited rise in US Treasury yields, a weaker US dollar and an eventual US-China trade truce could all be tailwinds for EM debt after poor returns in 2018.Furthermore, monetary and fiscal stimulus should help put a floor on the recent Chinese growth slowdown. Along with some policy relaxation...

Read More »Weekly View – Still ‘closed’ for business

The CIO office’s view of the week ahead.The US government shutdown marched into its fifth week, making it the longest in US history, with 800,000 ‘nonessential’ federal workers and even more contractors affected. While it is concerning that there seems to be no end in sight, there are also some potential positive effects that could play out in the economy. Any damage to economic growth is likely to be minimal and confined to the period of the shutdown. Once it ends, there will be a fresh...

Read More »European Central Bank likely to stick to script

The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have deteriorated further, notably in France and Germany. While risks have...

Read More »The “Three Amigos”

[embedded content] 2018 was a difficult year for markets and according to César Pérez Ruiz, Pictet Wealth Management’s Head of Investments and CIO, 2019 will be a year in which the “three amigos” will have to coexist. The bull will appear in economic deceleration, the bear in a democratic recession and the kangaroo across market dynamics.

Read More »Brexit update – PM May seeks new direction

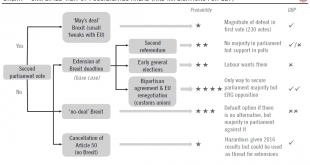

Theresa May reaches out to find all-party agreement on Brexit.This week, the British Parliament rejected Theresa May’s divorce deal en masse. At the same time, she has kept enough support to stay in power, as a motion of no confidence was rejected.How the Brexit process unfolds from now remains highly uncertain. The recent turn of events means there is an increasing probability of the UK seeking an extension of the 29 March deadline (now our base case) as May reaches out to opposition...

Read More »Outlook for euro periphery bonds

Economic fundamentals should come back into focus, but politics still a factor.After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political equilibrium remains fragile, with a risk of snap elections in 2019.With the end...

Read More »How mobile technology is changing the way we shop

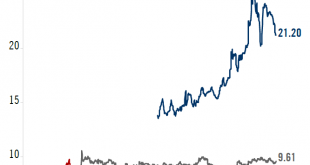

As is evident when travelling on public transport, people spend a lot of their idle time on mobile phones. But according to Stephan Schambach, the serial entrepreneur behind several major innovations in e-commerce, retailers have been slow to recognise that the future of their industry lies in mobile technology. Customers will increasingly demand the online experience available in other consumer industries such as travel and tourism, and the retail brands that are first to provide it will...

Read More »Weekly View – CIO view: May’s ‘TINA’ vote

The CIO office’s view of the week ahead.Economic data came in weaker than expected last week, especially in China and Europe, and we can anticipate messy forthcoming US data, given the ongoing US government shutdown. In China, manufacturing survey readings dropped into contraction territory, which together with hard data points toward continued growth deceleration in China’s imports and exports. At the same time, Germany, Europe’s manufacturing powerhouse, saw a continued fall in industrial...

Read More » Perspectives Pictet

Perspectives Pictet