Near-term recession risks remain limited, and a dovish Fed offers supportWe are reducing our 2019 US growth forecast to 2.2%, from 2.4% previously, mostly to account for the partial government shutdown. New York Fed president John Williams has stated that the impact of the shutdown could reach 1% of Q1 GDP.Despite the lower forecast, we remain confident about the underlying fundamentals of the US economy and still regard near-term recession risks as limited. Furthermore, US GDP tends to be weak in the first quarter regardless, because of statistical “seasonal adjustments”. On average, US Q1 growth has been only 1.6% quarter-on-quarter in recent years, versus 2.1% in Q2, 2.0% in Q3 and 2.1% in Q4. We estimate that US growth in Q1 2019 will be close to the historical average, although the

Topics:

Thomas Costerg considers the following as important: FED, Fed policy, Macroview, US economic growth

This could be interesting, too:

investrends.ch writes Trump deutet Powell-Nachfolge bis Jahresende an

investrends.ch writes Jerome Powell schürt Hoffnungen auf tiefere Zinsen

investrends.ch writes Jerome Powell: «Es gibt keinen risikolosen Weg»

investrends.ch writes Fed senkt Leitzins wie erwartet

Near-term recession risks remain limited, and a dovish Fed offers support

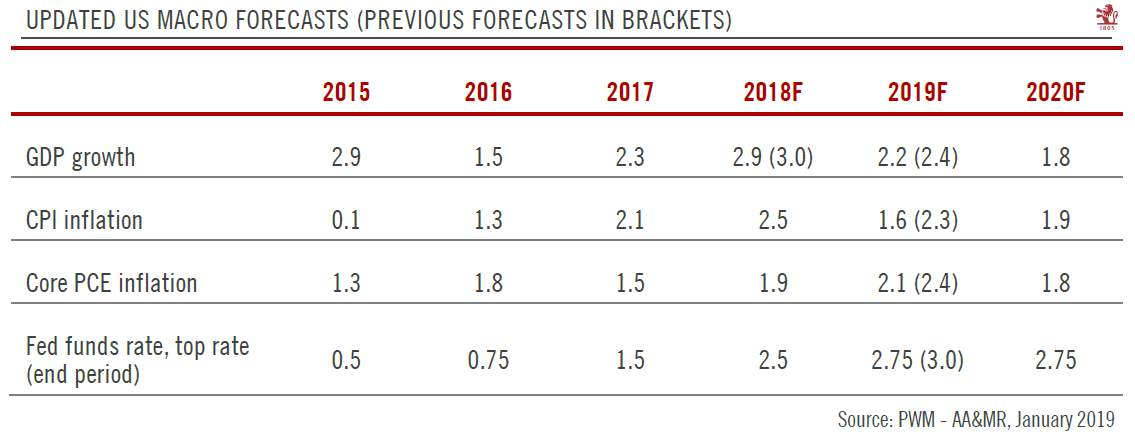

We are reducing our 2019 US growth forecast to 2.2%, from 2.4% previously, mostly to account for the partial government shutdown. New York Fed president John Williams has stated that the impact of the shutdown could reach 1% of Q1 GDP.

Despite the lower forecast, we remain confident about the underlying fundamentals of the US economy and still regard near-term recession risks as limited. Furthermore, US GDP tends to be weak in the first quarter regardless, because of statistical “seasonal adjustments”. On average, US Q1 growth has been only 1.6% quarter-on-quarter in recent years, versus 2.1% in Q2, 2.0% in Q3 and 2.1% in Q4. We estimate that US growth in Q1 2019 will be close to the historical average, although the weak figure this year will be due to the shutdown rather than adverse weather conditions. However, the back pay that federal employees receive when government reopens will likely lead to a rebound in household consumption.

Key for us is that business investment signals, while weaker than last year, remain relatively robust. The US consumer is still healthy, and the housing sector is likely to stabilise. There could also be some sort of a deal with China before the 1 March deadline for the expiry of the US moratorium on higher tariffs on Chinese goods. Included in the deal would be China’s promise to import more US oil, agricultural and manufactured products. All eyes are on Chinese Premier Liu He’s upcoming US visit to glean more clarity on that front.

We remain optimistic that business investment, while likely slowing after an exceptional 2018, will buttress 2019 GDP growth. We believe business investment is likely to grow about 3% this year (versus circa 7% in 2018). However, much could depend on how the domestic energy sector fares. The recovery in oil prices in recent weeks could, if sustained, help support oil-related investment.

The Federal Reserve (Fed) is helping to sustain the growth cycle. The dovish turn in its rhetoric since December has helped to pacify financial markets and make them more liquid. We now foresee only one rate hike this year ( in June). instead of the two we previously expected. Indeed, there is the possibility of no rate hike at all. The Fed could communicate about its balance sheet plans – a key focus for markets – in the second half of this year.