The balance of risks to growth in the region is still tilted to the downside.The big question about the euro area economy is when the bottom of the slowdown will be reached. A rebound was already expected in Q4 2018, but at the start of this year there are still few signs of recovery. Flash composite PMI numbers for the region declined by 0.4 points to 50.7 in January, the weakest level since July 2013. New orders and new export orders remained weak and below the economic expansion threshold level of 50. French services PMI numbers fell further in January to 47.5 from 49.0 in December. On the other hand, the manufacturing PMI rose to 51.2 in January following its prior plunge. The German flash composite PMI rose to 52.1 in January on the back of strong services performance, but the

Topics:

Nadia Gharbi considers the following as important: euro area economic activity, euro area growth forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The balance of risks to growth in the region is still tilted to the downside.

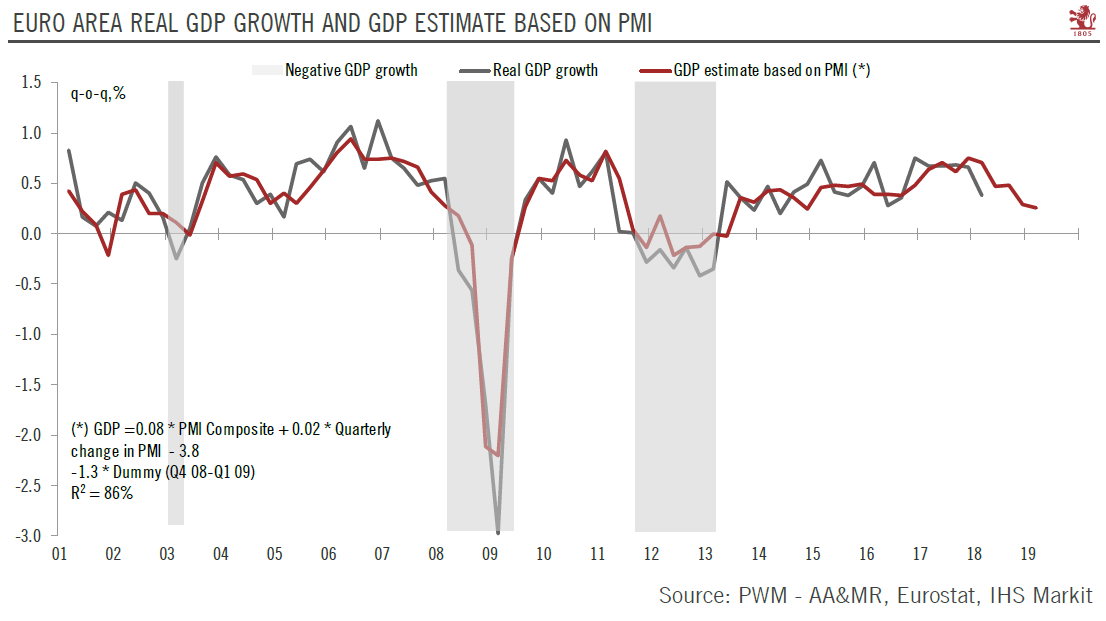

The big question about the euro area economy is when the bottom of the slowdown will be reached. A rebound was already expected in Q4 2018, but at the start of this year there are still few signs of recovery. Flash composite PMI numbers for the region declined by 0.4 points to 50.7 in January, the weakest level since July 2013. New orders and new export orders remained weak and below the economic expansion threshold level of 50. French services PMI numbers fell further in January to 47.5 from 49.0 in December. On the other hand, the manufacturing PMI rose to 51.2 in January following its prior plunge. The German flash composite PMI rose to 52.1 in January on the back of strong services performance, but the manufacturing sector showed continued weakness, falling to 49.9 from 51.5 in December.

We expect confidence to be partially restored in H1 2019, as some idiosyncratic factors should abate in our view. Such idiosyncratic factors include uncertainty over Italy’s budget draft, which eroded business and consumer confidence; new emissions standards, which contributed to a depression in car sales, especially in Germany and the “yellow vest” protests in France, which have had a dampening effect on commercial activity in December. We have revised our annual real GDP growth forecast for the euro area down to 1.4% from 1.6% in 2019, as well as our country forecasts for France and Germany on the back of weaker data published at the end of last year.

The euro area economy will likely slow in 2019, with real GDP growth of 1.4%, compared with close to 2% in previous years. Growth will still rely mainly on domestic demand, which remains healthy, while deteriorating foreign demand will pose the main downside risk. Other significant risks to growth in the region include the threat of auto tariffs, a disorderly Brexit, escalated trade tensions, an economic slowdown in China and political uncertainty (notably in France and Italy).