Selectiveness will be key to navigating between 2019 tailwinds and headwinds.Overall, we think there are reasons for investors to be more optimistic on emerging market (EM) debt in 2019. A Fed pause, a limited rise in US Treasury yields, a weaker US dollar and an eventual US-China trade truce could all be tailwinds for EM debt after poor returns in 2018.Furthermore, monetary and fiscal stimulus should help put a floor on the recent Chinese growth slowdown. Along with some policy relaxation (tax cuts, reductions in banks’ reserve requirements, support for infrastructure investment, relaxation of property market restrictions), this could support Chinese credit, and lead to Chinese growth rebound in H2. Furthermore, an eventual trade truce with the US could boost business and investor

Topics:

Perspectives Pictet considers the following as important: Emerging market credit spreads, fixed income, fixed income forecasts, Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Selectiveness will be key to navigating between 2019 tailwinds and headwinds.

Overall, we think there are reasons for investors to be more optimistic on emerging market (EM) debt in 2019. A Fed pause, a limited rise in US Treasury yields, a weaker US dollar and an eventual US-China trade truce could all be tailwinds for EM debt after poor returns in 2018.

Furthermore, monetary and fiscal stimulus should help put a floor on the recent Chinese growth slowdown. Along with some policy relaxation (tax cuts, reductions in banks’ reserve requirements, support for infrastructure investment, relaxation of property market restrictions), this could support Chinese credit, and lead to Chinese growth rebound in H2. Furthermore, an eventual trade truce with the US could boost business and investor sentiment towards China.

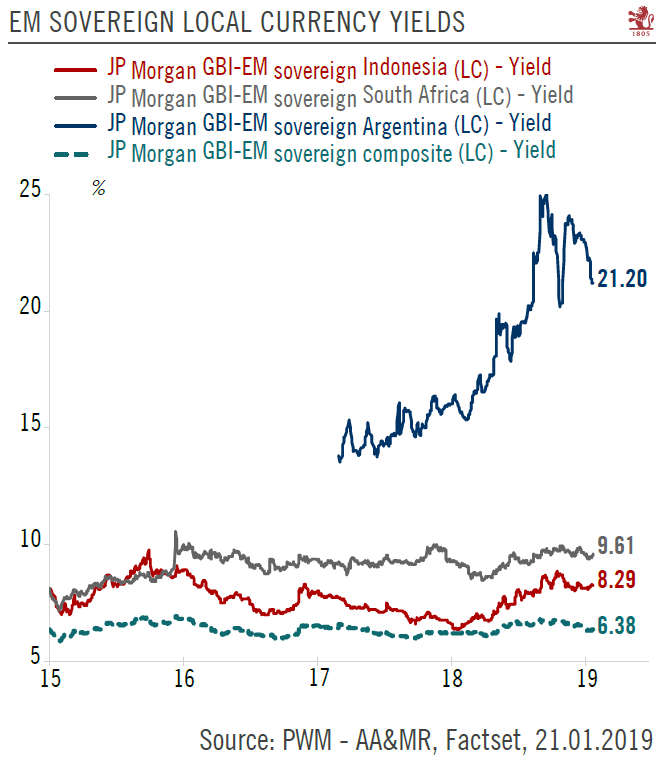

However, elections this year in India, Indonesia, South Africa and Argentina could still rattle bond investors should the winners prove less market friendly than the incumbents. Moreover, political and geopolitical uncertainties still remain high in key EM countries. The new populist presidents of Brazil and Mexico will have to prove they can reform their economies and implement their agendas while retaining investor confidence. Russia, despite remaining an attractive destination for fixed-income investors, is at the mercy of further US sanctions.

These tail- and headwinds, along with the global growth slowdown that has recently pushed the oil price lower mean that selectiveness will be key to navigating the complex EM debt universe in 2019.

The fate of EM is tightly linked to the oil price. EMs are divided between oil importers (for example, China, India, Indonesia and Turkey), which have benefitted from the recent slide in oil prices, and oil exporters (for example, Brazil, Mexico and the Gulf countries), which thrive when the oil price rises. This highlights the importance of selectiveness in navigating the complex EM debt space in 2019.

Pictet Wealth Management is neutral on EM debt in general and looking for opportunities in sovereign local currency debt and corporate hard currency debt. To this end, we take into account individual country stories and favour a defensive approach through the selection of quality names.