The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have deteriorated further, notably in France and Germany. While risks have clearly shifted to the downside, the ECB might refrain from admitting this and emphasise the fact that some one-off factors are painting an overly dark picture of the current cyclical position. Thus, the ECB will likely acknowledge the deterioration in data, but wait for further evidence (data) before

Topics:

Nadia Gharbi considers the following as important: ECB, ECB meeting, Europe chart of the week, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

The ECB is comfortable with current market expectations for rate hikes.

At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have deteriorated further, notably in France and Germany. While risks have clearly shifted to the downside, the ECB might refrain from admitting this and emphasise the fact that some one-off factors are painting an overly dark picture of the current cyclical position. Thus, the ECB will likely acknowledge the deterioration in data, but wait for further evidence (data) before making any significant changes to its communication. Hence, we believe the ECB will keep its forward guidance unchanged, and maintain the position that key ECB interest rates will likely remain at their current level “at least through the summer of 2019”. The ECB may allude to the next staff forecasts (7 March) as a key to any reformulation of its monetary stance.

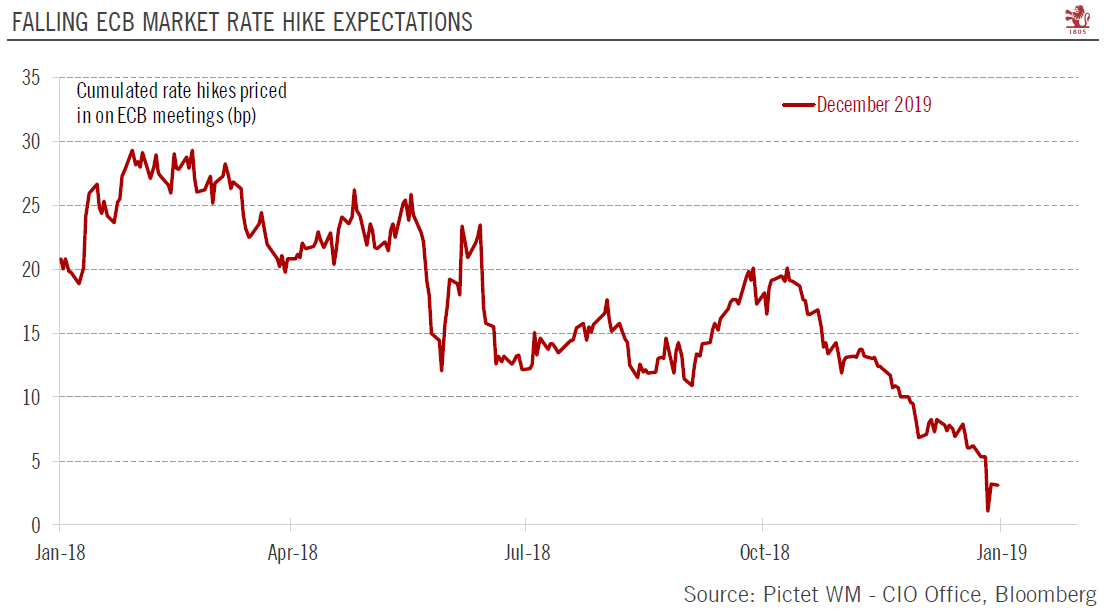

Given that net asset purchases have ended, the focus has shifted progressively to interest rates. Our call remains that the ECB will deliver the first deposit rate hike in the H2 2019, but this has been increasingly challenged by recent data flows. The risk is now tilted towards no rates hike at all in 2019.The latest ECB meeting minutes mentioned that “both the expected time-period before a first increase in the key ECB interest rates and the expected reinvestment horizon had increased in response to the recent weaker than expected data. This appeared to be in line with the state-contingent elements of the Governing Council’s forward guidance on both instruments and contributed to preserving the financial conditions necessary for sustained inflation convergence.” In other words, the ECB was clearly pleased with market-based expectations for the first rate hike (pushed out to 2020) and is likely to endorse (again) the market’s (dovish) expectations at its next meeting.

The deterioration in data makes communication trickier for the ECB. In the end, core inflation developments will probably be the main determinant of the timing for the beginning and subsequent pace of interest rate normalisation. Notably, core inflation data in the first months of the year will determine whether the first-rate hike will arrive in H2 2019 as the forward guidance implies. Despite the downward revision to the path in core inflation in December, the Council appears confident that it will meet the target, notably based on labour market developments. Wording around inflation is unlikely to change next week.

We think Mr Draghi will likely hint again that there has been some discussion about an extension of the liquidity facility for banks, but we believe a decision on the TLTROs will only come at a later stage.