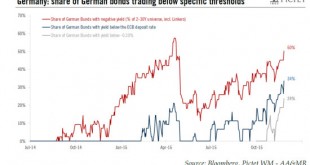

Among its various options, we believe that the ECB would have to cut the deposit rate by at least 20bp to surprise the market. We have laid out our baseline scenario for this week’s ECB policy meeting, including a 10bp deposit rate cut, a 6-month QE extension and a possible broadening of the scope of asset purchases. Recent ECB rhetoric suggests that risks are tilted towards a more aggressive policy package. It would not be the first time that Mario Draghi over-delivers, although this time...

Read More »Japan: a year of normalisation – still appealing, but risk-reward is not as good as before

Our 2016 scenario reaffirmed our preference for developed equities over emerging equities. Overall our total return expectation in Japan is similar to expectations in the US and Europe in a 7%-10% range. A number of concerns hang over the outlook for Japanese equities in 2016. The first phase of Abenomics had only mixed success, and plans for the second phase are still vague. Although there are some encouraging signs, the economy’s trajectory remains weak. Earnings have been resilient,...

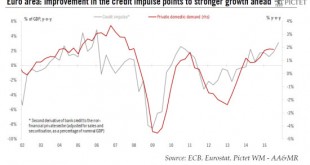

Read More »Euro area: strong rebound in bank credit flows in October, with more to come

Further loosening of broad monetary and financial conditions likely, adding to upside risks to the outlook for growth. We were looking for a rebound in euro area bank credit flows in October following a large and unexpected decline in September, largely due to a collapse in lending to non-financial corporations in the Netherlands. In the end, bank lending to the non-financial private sector did recover quite strongly in October and we continue to believe that the credit cycle has legs, in...

Read More »The Millennials: Decoding the New Generation

[embedded content] Published: Wednesday November 25 2015 Millennials are increasingly driving spending growth in the US. Marianne Johnson, Financial Analyst at Pictet Wealth Management, explains the particular characteristics of this key demographic, and the implications of the generational handover for companies and investors.

Read More »Business surveys in the euro area: solid growth in services sector

November’s upside surprises in surveys (PMI and IFO in particular) are unlikely to dissuade ECB policymakers that more needs to be done at their December 3 meeting. November’s euro area business surveys highlighted that the recovery continues to be largely led by domestic strength. In terms of countries, German surveys (PMI, IFO) surprised on the upside, whereas in France, surveys (PMI, INSEE) were less upbeat than in the previous month, partly reflecting the loss of confidence after the...

Read More »The Millennials: Decoding the New Generation

Millennials are increasingly driving spending growth in the US. Marianne Johnson, Financial Analyst at Pictet Wealth Management, explains the particular characteristics of this key demographic, and the implications of the generational handover for companies and investors.

Read More »2016 macroeconomic and strategic alternative scenarios

Macroview Last week, on November 18th, we published our key takeaways for our 2016 macroeconomic and strategic scenario. In the following post, we feature the conditions under which two alternative scenarios for 2016 , one positive and one negative, could materialize. Please see our “Macroeconomic and Strategic Scenario for 2016: Key takeaways” post for a detailed overview. Upside risks for a positive alternative scenario Greater acceleration of economic growth in Europe, driven by...

Read More »Secular outlook for the global economy and financial markets: key takeaways

Macroview There is an ongoing debate about whether the world is facing secular stagnation and deflation. In the inflation/deflation debate, we are in the deflationist camp. If economic mechanisms are left unchecked, deflationary forces will rise. DM central banks will struggle to hit their 2% inflation targets. The inflation targeting monetary policy style of the 1990s and early 2000s was followed by the quantitative easing (QE) style after the 2008-11 US subprime and euro area debt...

Read More »US monetary policy: a December hike remains the most likely scenario

The minutes of October’s FOMC meeting confirmed that a December hike is firmly on the table. Although monetary conditions have tightened noticeably so far in November, the most likely scenario remains that the Fed will hike rates in December. Conditions for a hike “could well be met” in December The FOMC statement published after the 27-28 October meeting has sounded more hawkish than expected, as it put a December hike more firmly on the table. The minutes of this same meeting,...

Read More »Macroeconomic and Strategic Scenario for 2016: Key takeaways

Macroview In 2016, we forecast global economic growth of 3.3%, slightly better than in 2015. This will be a ‘goldilocks’ environment (not too hot, not too cold), that allows continued supportive monetary policy. Macroeconomy US real GDP growth will be above potential at 2.5% (against potential growth of 1.8%), but with an absence of momentum. Growth will be driven by domestic demand. Euro area growth will accelerate modestly, to 1.8%, from an estimated 1.5% in 2015. Domestic demand is...

Read More » Perspectives Pictet

Perspectives Pictet